Match: Feeling The Heat

In “Match Group: Disappointing Execution”, I wrote the following:

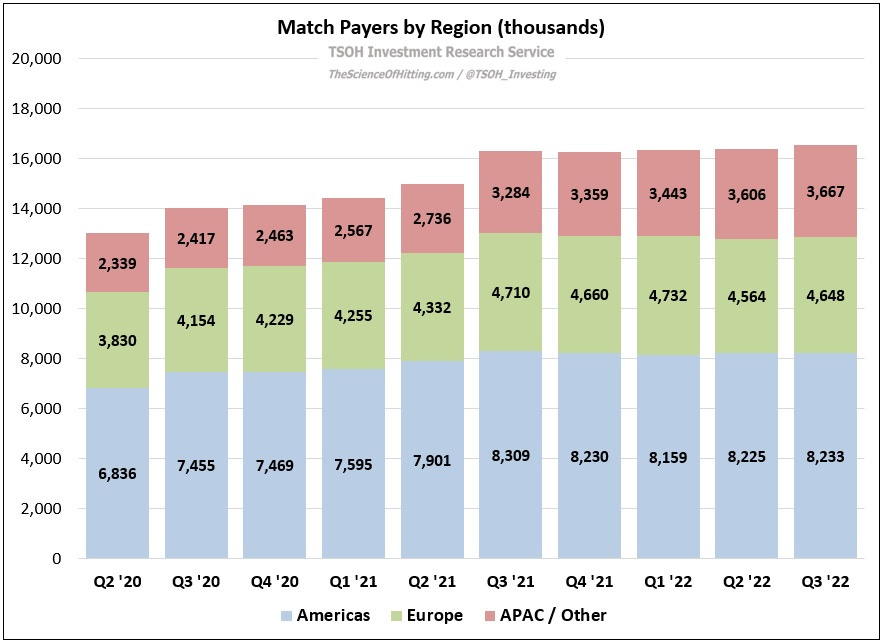

“Digging in on Payers, we can see that Match has a bit of a problem on their hands. As shown below, Payers growth in the most recent quarter was largely attributable to APAC / Other (+32% YoY), with Americas and Europe growing +4% and +5%, respectively, versus Q2 FY21… The growth in APAC / Other has been greatly helped by the Hyperconnect acquisition, which closed in June 2021… The relatively easy comparison in APAC / Other (before Hyperconnect closed) will fall off next quarter; based on the recent trajectory, Payer growth in the region will likely decelerate from the low-30’s in Q2 FY22 to the mid-teens in Q3 FY22. That development, in combination with the relatively weak Americas and Europe results, will pressure overall Payers growth (likely falling into the low-to-mid single digits).”

The following chart (updated to include the Q3 FY22 results) shows that Match came in at the low end of that range: consolidated Payers were +2% YoY, with ~12% growth in APAC / Other largely offset by YoY declines in the Americas and Europe. Since early 2015, Match had delivered double digit Payers growth (YoY %) in every quarter; that streak has now been broken.

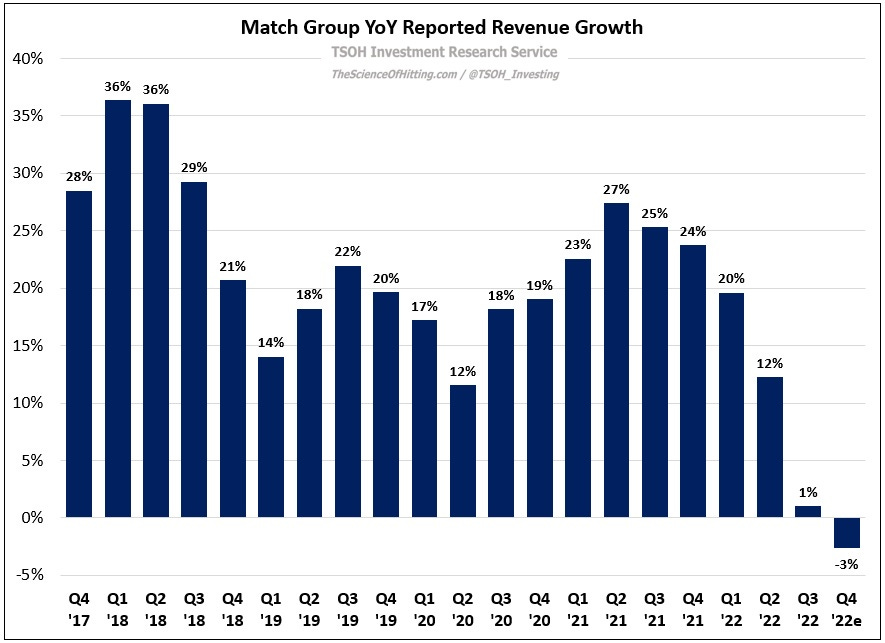

In Q3, revenues were $810 million, a 1% YoY increase (+10% in constant currencies); in Q4, management expects revenues to decline low-single digits (on a constant currency basis, revenues are expected to grow mid-single digits). As you can see below, this is a result that stands in stark contrast to the financial performance that Match Group had grown accustomed to.

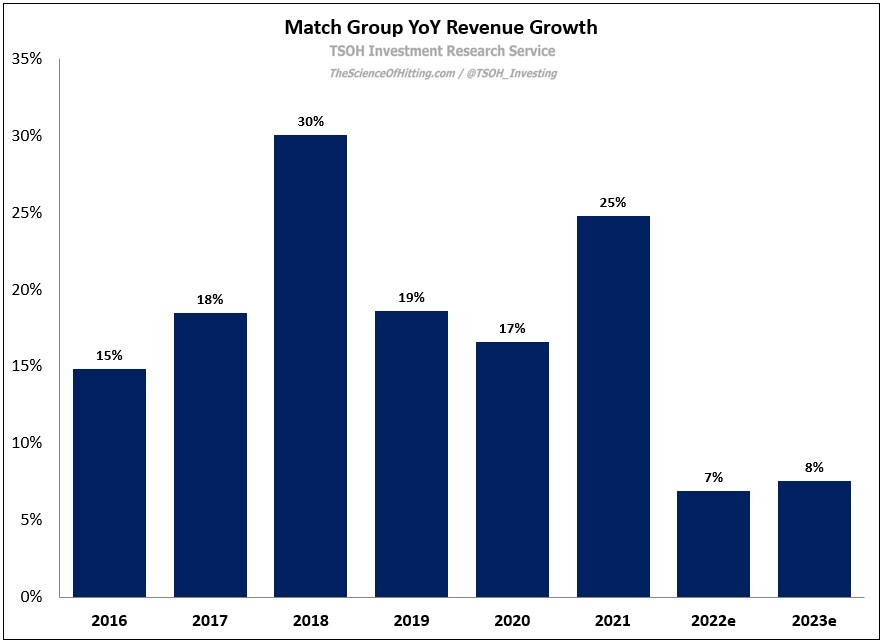

For FY22, Match is on pace for revenues of ~$3.19 billion, a mid-single digit increase versus FY21 (to put that number into context, the trailing five-year revenue CAGR through FY21 was +22% p.a.). In addition, in the Q3 FY22 letter, management gave early guidance for the coming fiscal year: “In the current economic environment, visibility into 2023 performance is challenging. That said, we’re focused on delivering 5% - 10% revenue growth for the full year [inclusive of a three point FX headwind]. We expect YoY revenue growth to accelerate gradually as the year progresses…”

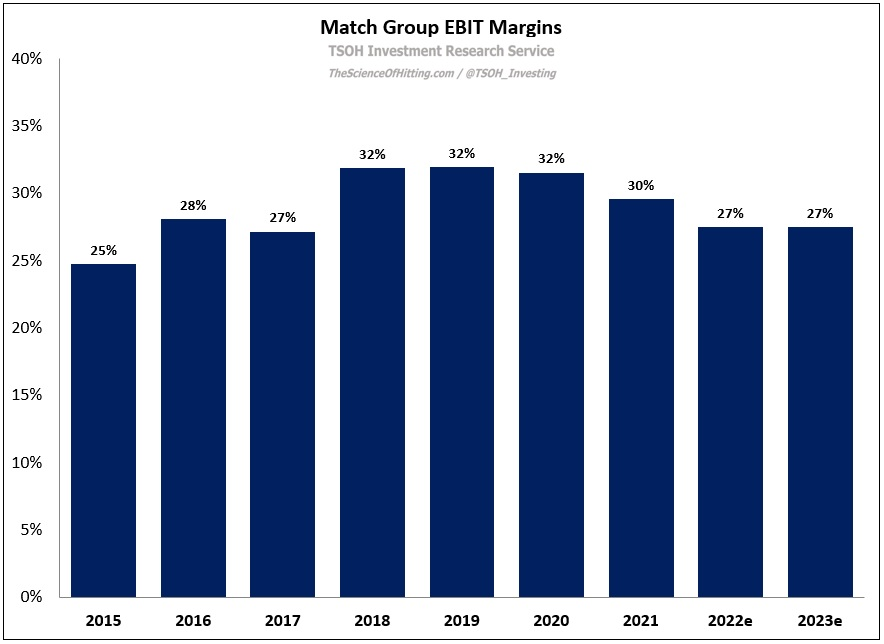

For a company that has typically reported mid-teens revenue growth (at a minimum), 2022 and 2023 mark a material change in the trend; the expense structure has been slow to adjust to this new reality, with operating margins coming under pressure as well as of late (EBIT margins contracted ~500 basis points over the past two years, from ~32% in 2020 to ~27% in 2022e).

The combination of slowing revenue growth and margin compression has stalled earnings growth. This underwhelming performance hasn’t gone unnoticed by Mr. Market: at Wednesday’s close (~$51 per share), the stock price has declined by roughly 70% from its October 2021 highs.

The question, as always, is whether the market is correctly anticipating ongoing challenges at the business or if it has over extrapolated based on recent results. If it’s the latter, this may be an opportune time for a long-term investor to initiate a position in the global leader in online dating.