Markel: "Below Our Expectations"

An update on Markel's 2023 results

From “A Long-Term Mentality” (April 2023): “I’m not intimately familiar with all the risks incurred across Markel’s insurance businesses (that applies at Berkshire too). Given the nature of what they do, particularly in long-tail lines and ILS, that’s a bit uncomfortable to admit… On the other hand, I’ve closely examined Markel’s track record over the past three decades and watched management’s words and actions in real time over an extended period (~10 years); in terms of the results they’ve achieved and deserved confidence (trust) in management, including the willingness to be open and honest with owners when things don’t go as planned, I think Markel scores very highly.”

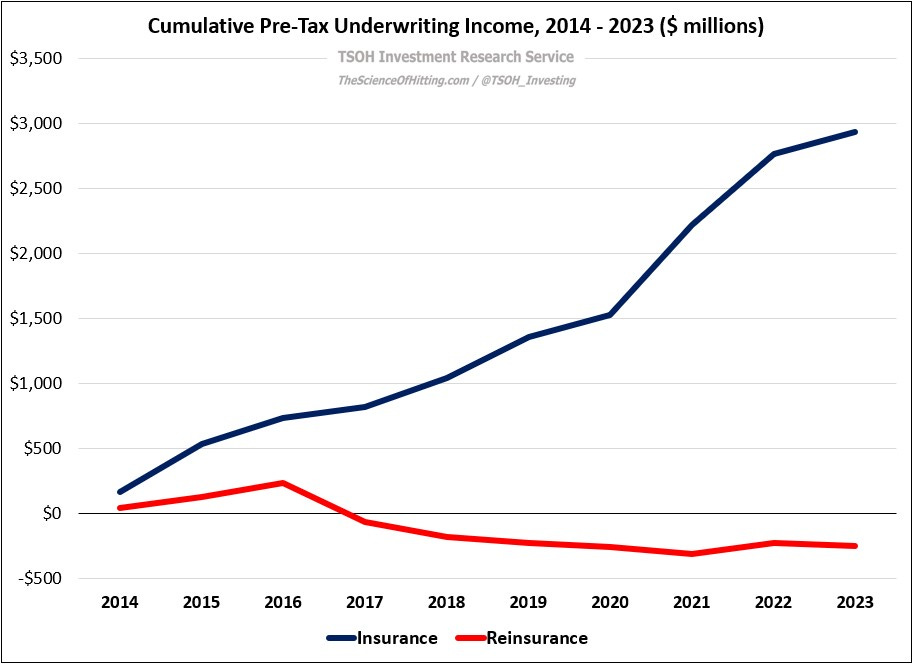

Well, the company’s 2023 Insurance results gave us an opportunity to test that conclusion (specifically, when things don’t go as planned). As CEO Tom Gayner wrote in the 2023 shareholder letter, “We fell short of our goals in Insurance… We share your disappointment in those results.” As discussed previously, results in Markel’s Reinsurance segment have underwhelmed since the Alterra deal: over the past decade, it has reported a cumulative underwriting loss of ~$250 million. That has been more than offset by the (much) larger Insurance segment, which reported ~$2.9 billion of cumulative underwriting income over the same ten-year period (~93% combined ratio).

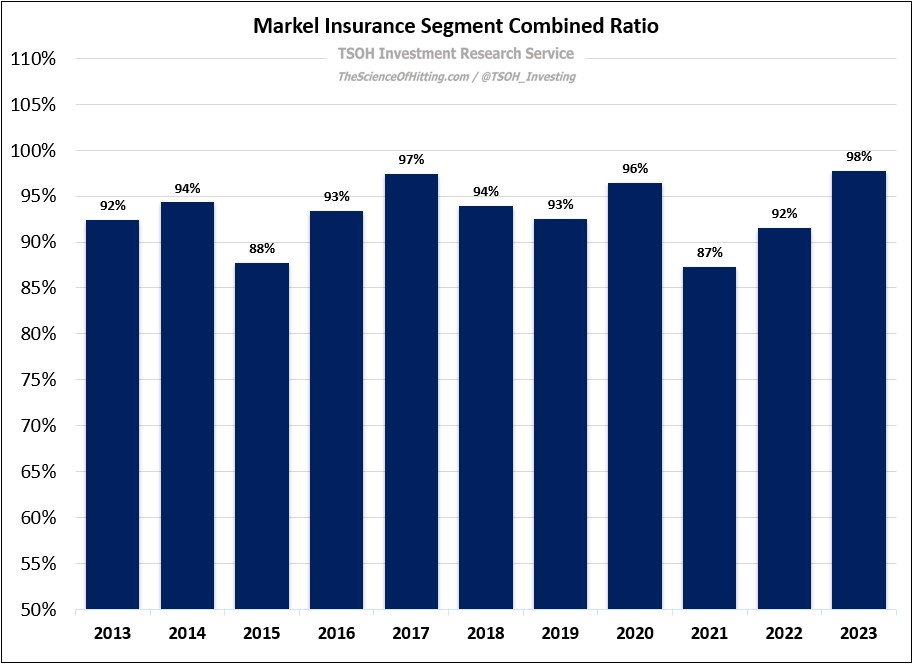

Unfortunately, as Insurance loss trends deteriorated over the past 18 months, management concluded further action was necessary (“to put prior year development trends behind us”). This led to a ~105% combined ratio for the Insurance segment in the fourth quarter and ~98% for the year; as you can see below, that led to the worst result for the segment in the past decade.

As outlined in the shareholder letter, this included missteps in collateralized IP insurance (“we can and should have done better”), as well as broader industry developments that they failed to sufficiently anticipate / adjust to. (“We fell short in predicting the scale and extent of social inflation in certain pockets of our insurance operations… adverse development on our general liability and professional liability lines totaled $331 million, or five points.”)