In Zuck We Trust?

Meta Q4 FY25 Update

From “Meta: The Decisive Period” (August 2025):

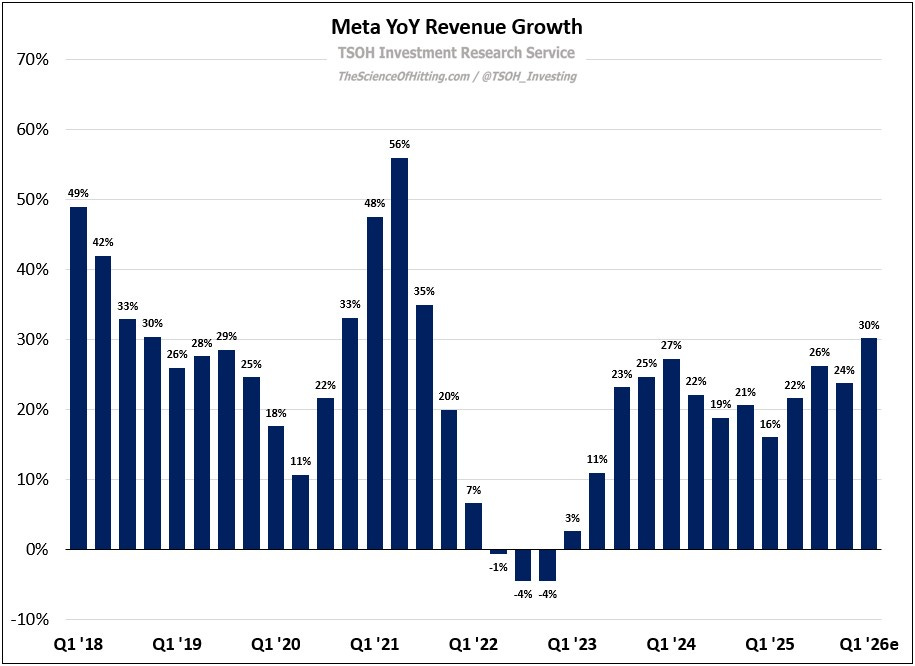

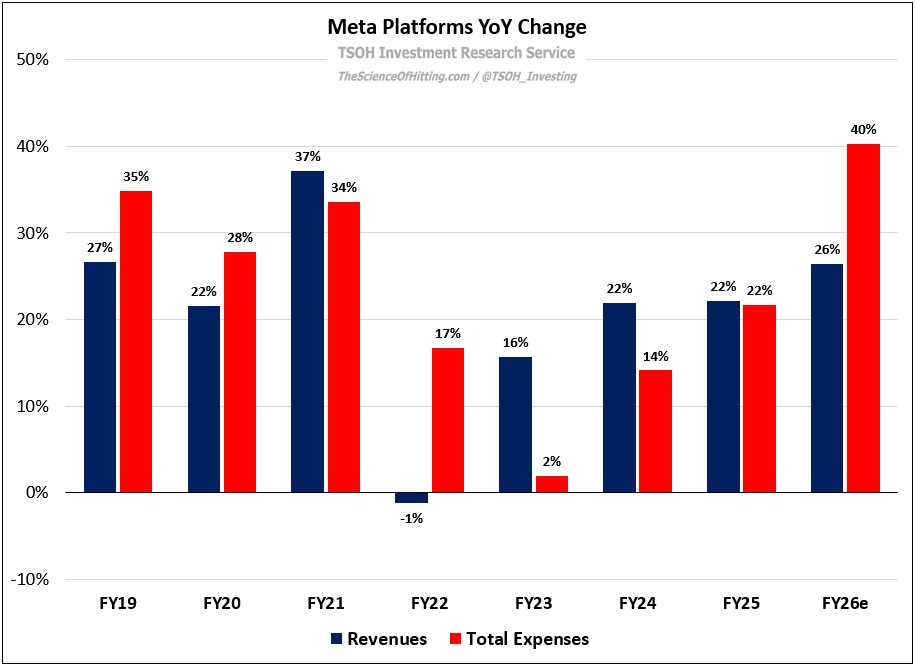

“This input - explosive CapEx growth - is just one part of the story. As we look at the output - Meta’s recent financial results - we can clearly see the first phase of this CapEx ramp has been a home run. As I wrote in November 2022, when Meta’s FOA CapEx ramp was well underway, we could roughly gauge what was required to generate a sufficient ROI (“at least 500 basis points of FOA revenue growth above baseline expectations”). While it’s tricky to pinpoint what ‘baseline expectations’ should be, the number I had in my head was roughly 10% YoY revenue growth; as shown below, the top-line growth rates Meta has reported as of late have cleared that bar by a wide margin, coming in at +20% or better in eight of the past nine quarters.”

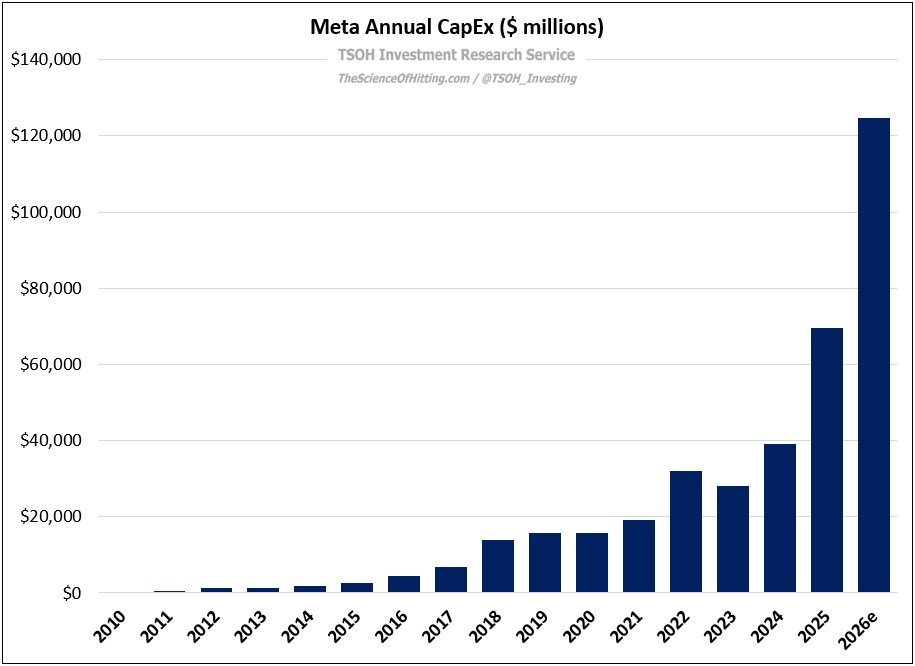

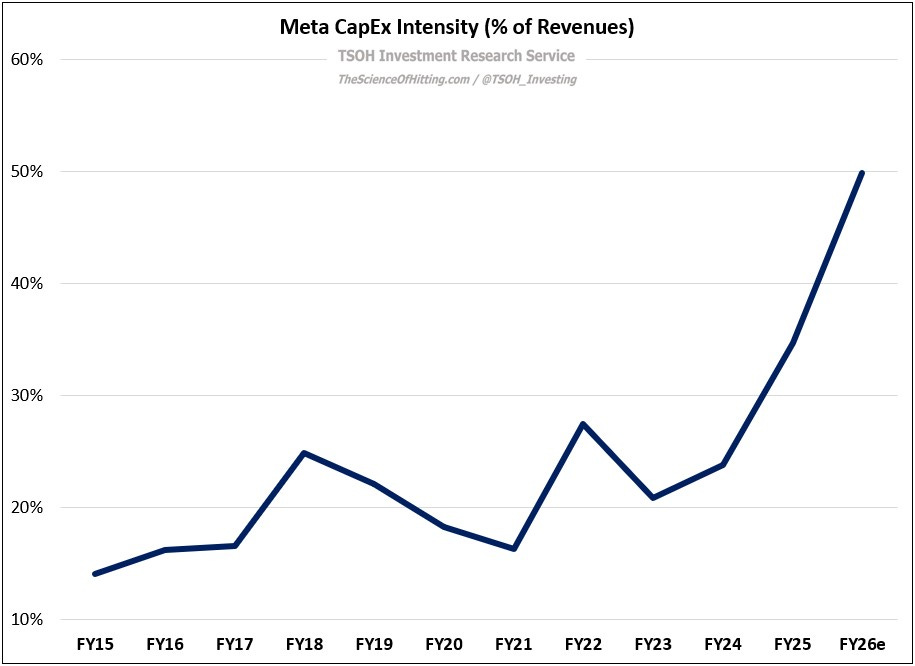

While the initial CapEx ramp referenced in 2022 has clearly worked, Meta has moved to a second investment phase, the scale and duration of which requires an even higher level of trust. With Meta’s latest results, each of these variables – the level of CapEx / expense growth and the corresponding reacceleration in revenue growth – have climbed further into what once seemed unimaginable territory. First is FY26e CapEx: as opposed to the consensus analyst estimates in early 2024 - just 24 months ago - for the coming fiscal year of less than $50 billion, the midpoint of management’s guidance is ~$125 billion, or CapEx intensity of ~50% (on FY26e revenues).

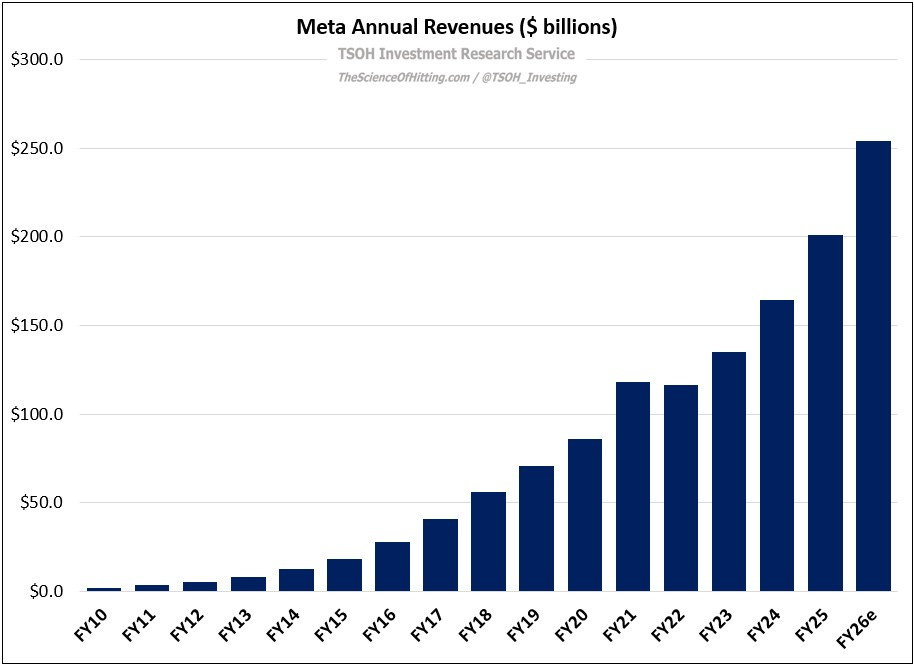

While those figures are staggering, they are one side of the equation. One variable to measure them relative to is revenues – and as you can see below, Meta management expects an equally astounding top-line acceleration in Q1 FY26, with revenues increasing ~30% YoY (+26% CC) at the midpoint - the highest quarterly YoY revenue growth rate from Meta in more than four years.

In addition, the following commentary provides further encouragement as it relates to FY26e revenue growth: “We expect FY26 total expenses to be in the range of $162 billion to $169 billion [implying 40% YoY expense growth]. Despite the meaningful step up in infrastructure investment, we expect to deliver operating income that is above our 2025 operating income.”

The low end of those expectations - for minimal EBIT growth in FY26e – implies at least mid-20’s (%) revenue growth, to >$250 billion. As we think about how Meta was perceived by the investment community just a few years ago – Facebook was well past its prime, TikTok was disrupting Instagram, and Apple’s policy changes (ATT) would structurally impair targeting and attribution for monetization – it is pretty astounding that Meta has delivered ~22% annualized revenue growth over the past four years (FY22 – FY26e).

With that said, the FY26e figures still imply a substantial growth gap between revenues and expenses, the result of which will be ~600 basis points of EBIT margin compression, to ~35%; as a result, I expect mid-single digit EBIT growth in FY26, substantially lagging revenue growth. This, in my mind, provides the framing for understanding why the stock has been so volatile: while it’s not too revealing to say the near term financials will be driven by these two variables, expectations have been all over the map in recent years.

What explains the significant volatility of each variable?