"In A Transitional Period"

An update on Home Depot (HD) and Floor & Decor (FND)

From “A Unique Environment” (February 2023):

“Home Depot’s (HD’s) business experienced significant tailwinds over the past three years; the lingering question is whether those gains will prove to be sustainable. The Q4 results and the 2023 guidance show that this question remains unanswered. With a significant decline in existing U.S. home sales (“NAR’s measure of housing affordability fell to its lowest level since 1985”), along with a potential lag from the home improvements / remodels completed from 2020 – 2022, it seems reasonable to assume that a more difficult year or two lies ahead. The FY23 guidance accounts for that reality, but I do wonder if the assumptions are still a bit optimistic…”

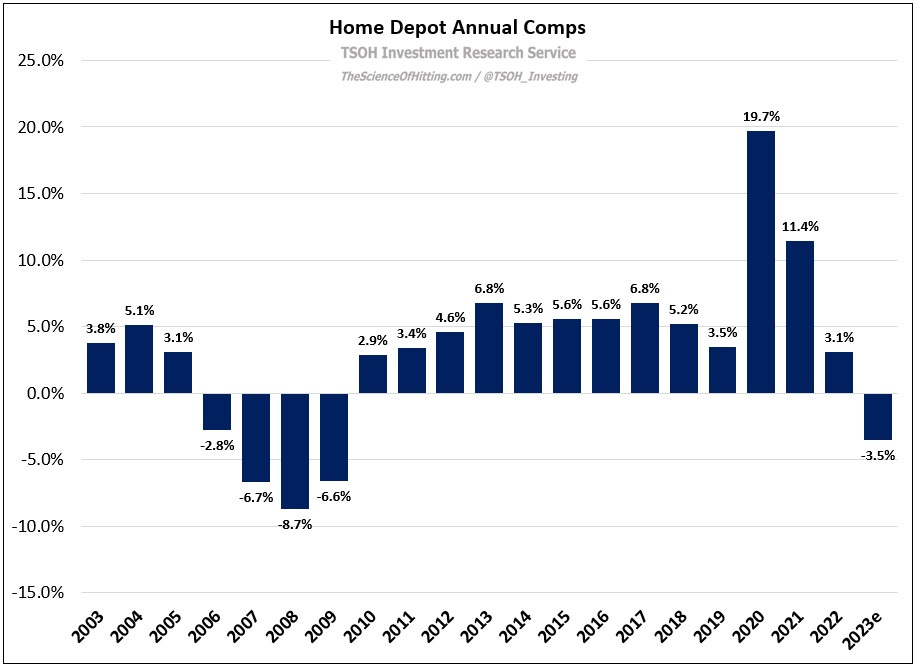

The first three months of the year are behind us, and those questions have grown louder. With Q1 comps down 4.5%, Home Depot management was forced to cut FY23 guidance: as opposed to a prior belief that comps would be “approximately flat”, they now expect a decline of 2% - 5%. As you can see, this would mark the first year of declining comps at HD since 2009.

On the call, HD management said the following (CFO Richard McPhail): “We expected 2023 to be a year of moderation in the home improvement market, driven by monetary policy actions to dampen overall consumer demand. In our view, we are in a transitional period in the consumer economy.”

Demand moderation is materializing in two key areas: major home remodels / renovations and large ticket discretionary purchases like grills, patio furniture, etc., which are clearly being impacted by the pull forward of purchases over the past three years (for a clear example of this, look at the revenue trends for Traeger from slide 11 of their Q1 FY23 report; as you’ll see, their grill revenues in Q1 FY23 were ~50% lower than in Q1 FY21). This comment from HD management sums it up well: “We've seen demand soften across parts of the business, including flooring, kitchen, and bath. Softer demand may reflect consumers moving from larger to smaller projects… A newer dynamic this quarter was a more cautious consumer, given broader macro concerns, including credit availability… Pros and consumers are taking on smaller, less discretionary projects.” (Note that Home Depot’s flooring comps have come in below the company average in each of the past five quarters.)

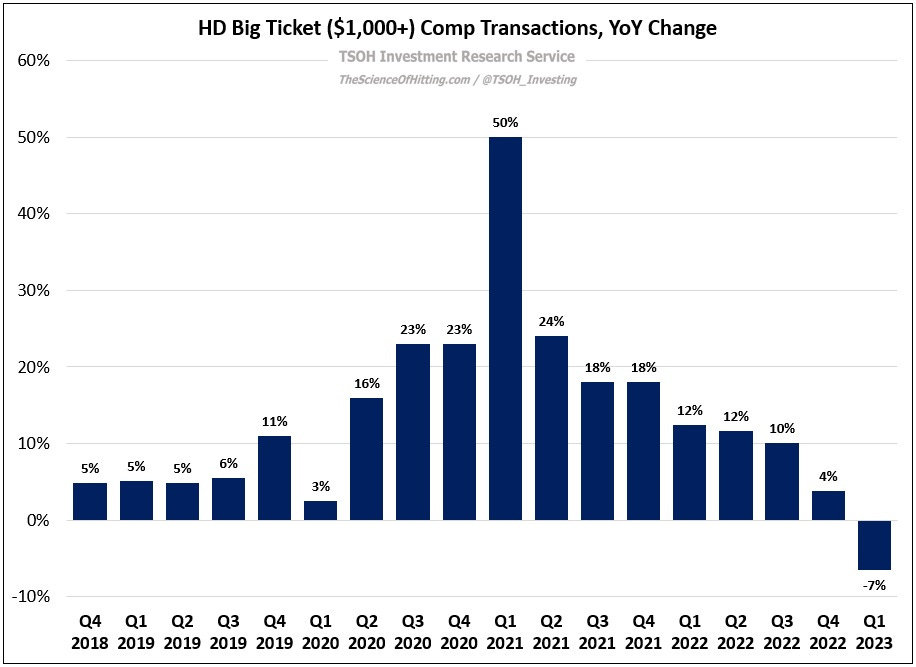

This is most evident when looking at the large ticket ($1,000+) transaction comps, which declined by 7% YoY in Q1 - a significant change in trend from the results reported over the past 24 - 36 months. As a reminder, I estimate these transactions account for ~25% of Home Depot’s sales. (June 2021: “Large transactions, while they benefit from the purchase of a $2,000 or $3,000 refrigerator, are still very much driven by the project business… These are [project driven] tickets with 50, 60, or 70+ units in the basket.”)

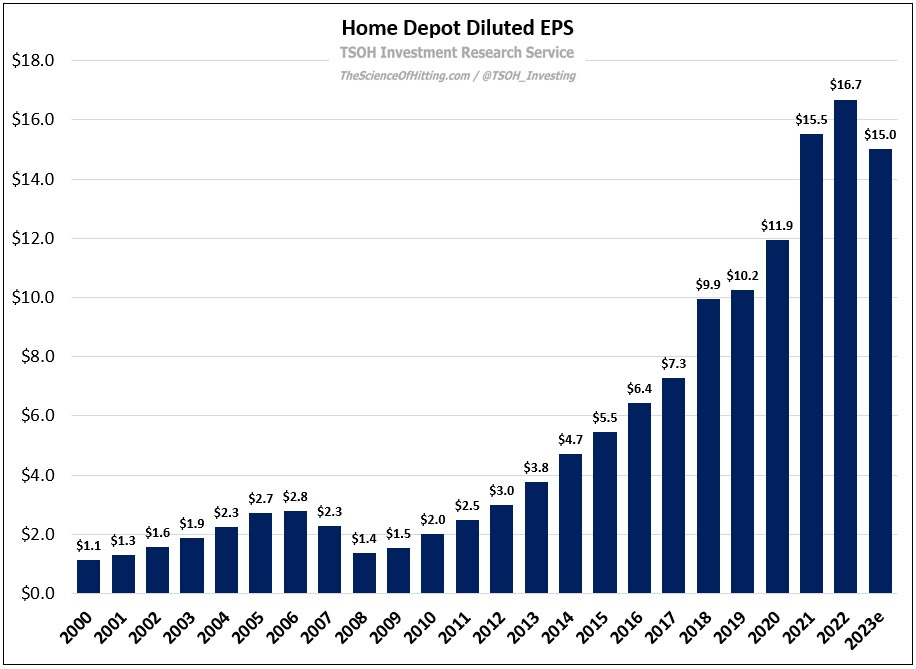

Top-line pressures have a material impact on the bottom line (a natural outcome from sales deleverage, but also as a result of the incremental wage investments). For the year, management expects EPS to decline by roughly 10%, to ~$15.0 per share (from 2019 – 2023e, that’s a four-year EPS CAGR of +10%). Revisiting the discussion about the dividend from February, the payout ratio is likely to be at ~55% in 2023. As I said then, the 10% increase in the face of potential short-term headwinds struck me as a curious decision (and out of line with the idea of “wanting to increase our dividend every year as we grow earnings”). If nothing else, it’s becoming clear that the aggressive growth of the past decade, with the per share dividend up >5x from 2013 – 2023e, is behind us; future increases to the per share dividend should roughly mirror the pace of HD’s EPS growth (i..e, high-single digits).

Floor & Decor