GEICO: "Major Repolishing"

Today’s post is sponsored by AlphaSense, the leading market intelligence and search platform that helps investors to make more thoughtful decisions. As I discussed a few weeks ago, AlphaSense is a key part of my investment research process, particularly for document search and expert transcripts (a library of 150,000+ proprietary expert transcripts that is growing by 6,000 per month). In addition, AlphaSense has generative AI search features (think of it as a comparable tool to ChatGPT) with access to millions of critical source documents - SEC filings, call transcripts, broker research, trade journals, and expert interviews. In summary, AlphaSense is a research tool that has made my daily workflow more efficient. To see if it can do the same for yourself and for your firm, sign up for a free trial today at www.alpha-sense.com/TSOH/.

From “GEICO: The Gecko Stumbles” (March 2023): “Progressive has ran laps around GEICO over the past few years… GEICO was mistaken to dismiss the role of telematics / usage-based insurance (UBI)… GEICO’s performance in recent years shows that even a well-positioned business requires adept managerial decision-making to live up to its full potential.”

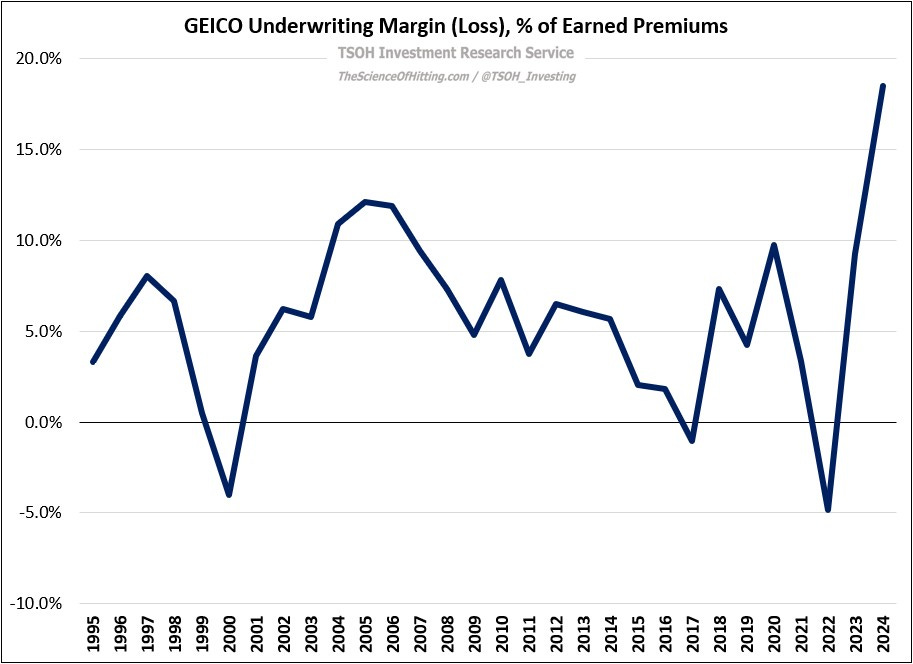

Much has happened at GEICO over the past few years. On one hand, underwriting results have greatly improved, as evidenced by a ~19% underwriting margin in 2024 - GEICO’s most profitable year in decades.

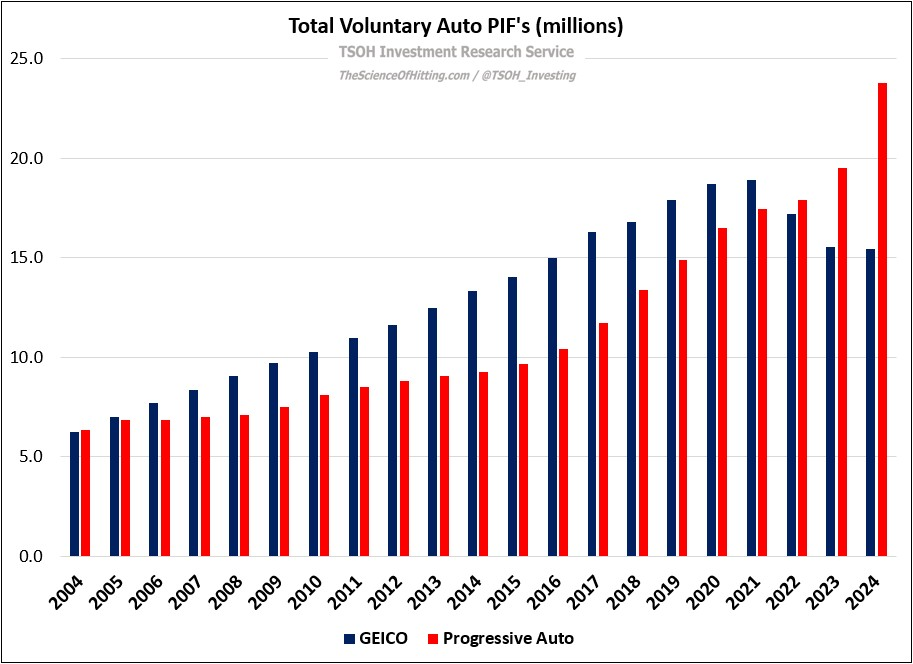

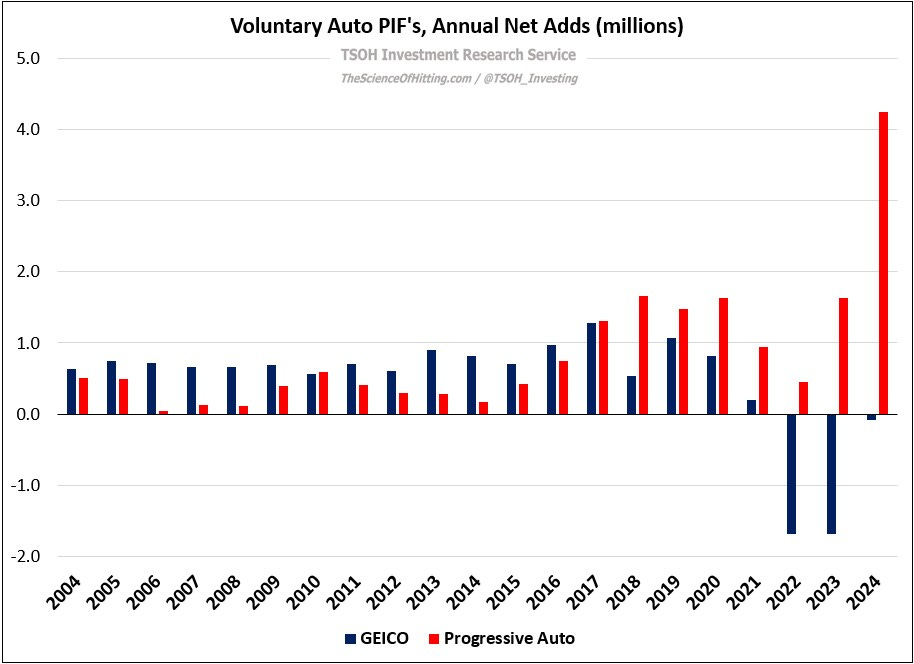

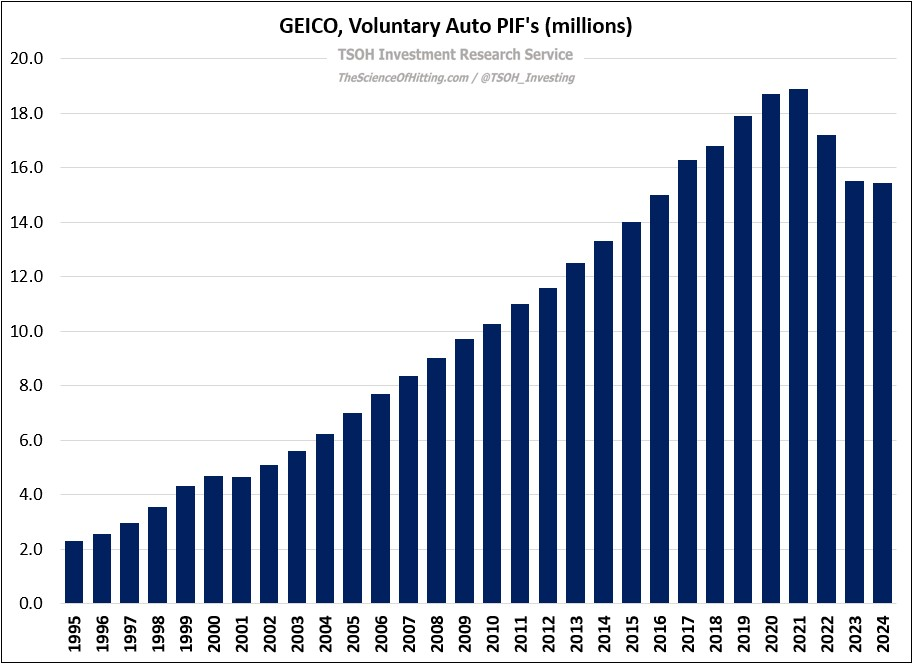

On the other hand, GEICO continues to lag its most formidable competitor, Progressive, by a huge margin on other metrics, most notably policies-in-force (PIF) growth: as you can see below, Progressive’s auto insurance customer base is now >50% larger than GEICO’s. That outcome reflects the addition of ~9.0 million net Progressive auto PIF’s over the past five years, versus the loss of ~2.5 million net GEICO auto PIF’s over the same period. In summary, GEICO first needed to address its pricing / underwriting issues; now, they need to return to PIF / market share growth. (As outlined in PGR’s 10-K, Direct Auto applications from new customers increased 51% in FY24.)

As Warren Buffett noted in the 2024 shareholder letter, while there has been meaningful improvement at GEICO, there is more left to do: “In five years, Todd Combs has reshaped GEICO in a major way, increasing efficiency and bringing underwriting practices up to date. GEICO was a long-held gem that needed major repolishing, and Todd has worked tirelessly in getting the job done. Though not yet complete, the 2024 improvement was spectacular.”

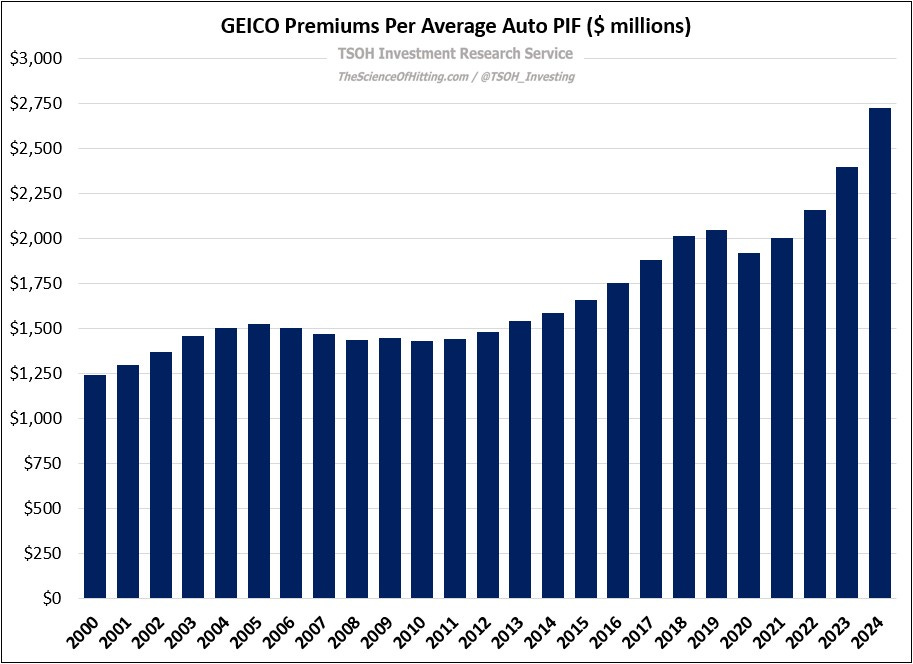

As we review the meaningful improvement in underwriting results, note that pricing has played a significant role: premiums per average policy were +11% in 2022, +17% in 2023, and +8% in 2024. In total, annual premiums per average auto PIF was ~$2,700 in 2024 – a nearly 40% increase compared to ~$2,000 per auto PIF average in 2021 (one favorable thing about short-tail lines is you have some ability to quickly recognize and adjust to mispricing).

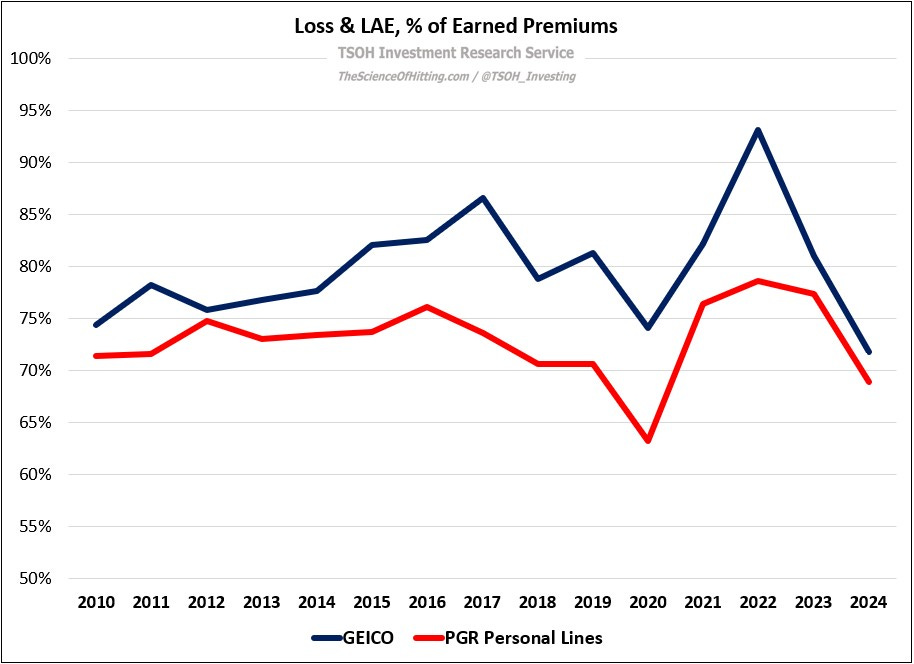

Higher average pricing and lower claims frequencies led to a ~72% loss & LAE expense ratio in 2024 – ~1,000 basis points lower than the average over the prior decade, and meaningfully closing the gap relative to PGR.

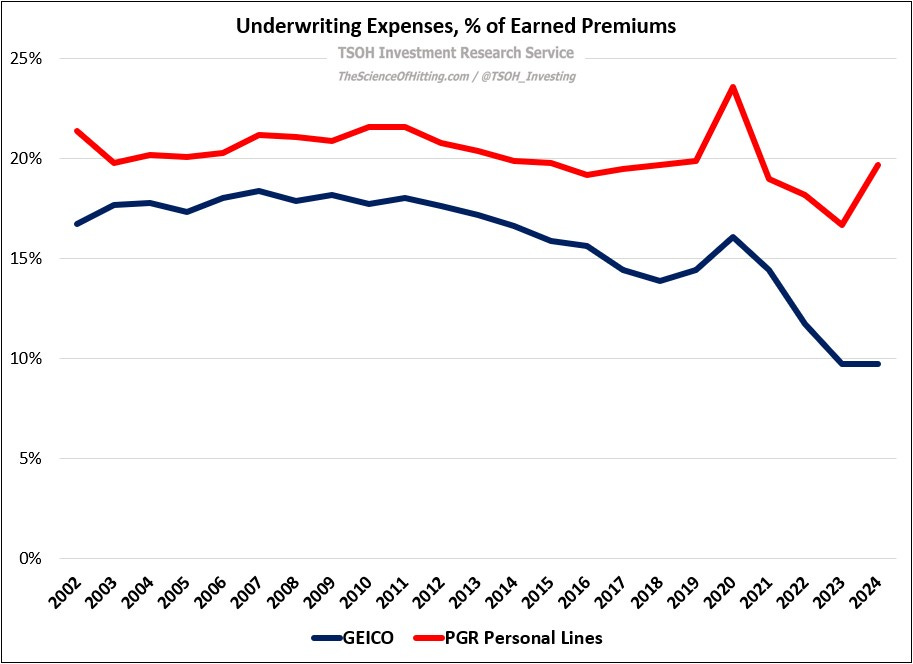

In total, GEICO’s combined ratio outperformed Progressive’s Personal Lines unit by about seven points in 2024, at ~82% and ~89%, respectively. That said, Progressive’s underwriting expenses are inclusive of outsized growth investments: as outlined in the 10-K, total advertising costs in 2024 were ~$4.0 billion, or ~120% higher than the 2022 / 2023 average. As shown above, the logic of that decision has been supported by, and is reflected in, their astounding volume growth (>4 million net auto PIF’s added in 2024).

While the relative results are still quite discouraging, PIF trends did improve at GEICO in 2024 (albeit from some dark days in 2022 and 2023): as noted in the annual report (page 57), the rate of PIF declines slowed throughout 1H FY24 (but still at -4.3% YoY in Q2 FY24), with a return to PIF growth in the back half of the year driven by increased new business and stable retention rates. With GEICO’s advertising expenses growing YoY throughout 2024, following “significantly reduced advertising expenditures” in 2022 and 2023, that’s a clear sign of management’s desire to return to growth – and while the last few years have been a major step in the wrong direction for GEICO, you can see below that the yearend 2024 base (~15.4 million voluntary auto PIF’s) is ~7x larger than their auto volumes at the time of the acquisition.

GEICO’s underwriting expenses were -6% YoY in 1H FY24, yet came in at +8% for the year; that change in trend is indicative of an advertising expense step-up in 2H FY24. While the GEICO model is partly fueled by best-in-class expense ratios, that is balanced against the short-term cost of advertising and acquiring new business. For GEICO, I think the desired outcome over the next few years is for underwriting expenses (as a percentage of premiums) to increase, i.e. for management to see compelling evidence to justify outsized advertising expenses / customer acquisition costs to accelerate PIF growth.

Other notable changes have occurred under the surface at GEICO. As mentioned earlier, Todd Combs became CEO at the beginning of 2020; he replaced Bill Roberts, Tony Nicely’s long-time partner, who only held the top job for ~18 months. Combs has an interesting background given that he worked at Progressive earlier in his career; as he recounted on the “Art of Investing” podcast, he told Buffett at their first meeting (in 2010) that he believed GEICO had a long-term problem / disadvantage relative to PGR:

“Warren asked, ‘Is Progressive better than GEICO?’ I said yes. He pushed back a little, and I said, ‘GEICO is better at marketing and branding, but Progressive is a data company, and data will win in the long run.’”

As Buffett discussed during an early 2020 CNBC interview (at 01:02:46), “Todd understands insurance very well at the operating level… I hope that he isn’t at GEICO very long… He has not made a permanent career shift [but] I don’t know how long he’ll be there. Progressive has done a better job of correlating risk with rate; that’s what we’re focused on… We have room for improvement… Todd’s job is to work himself out of the job very quickly.”

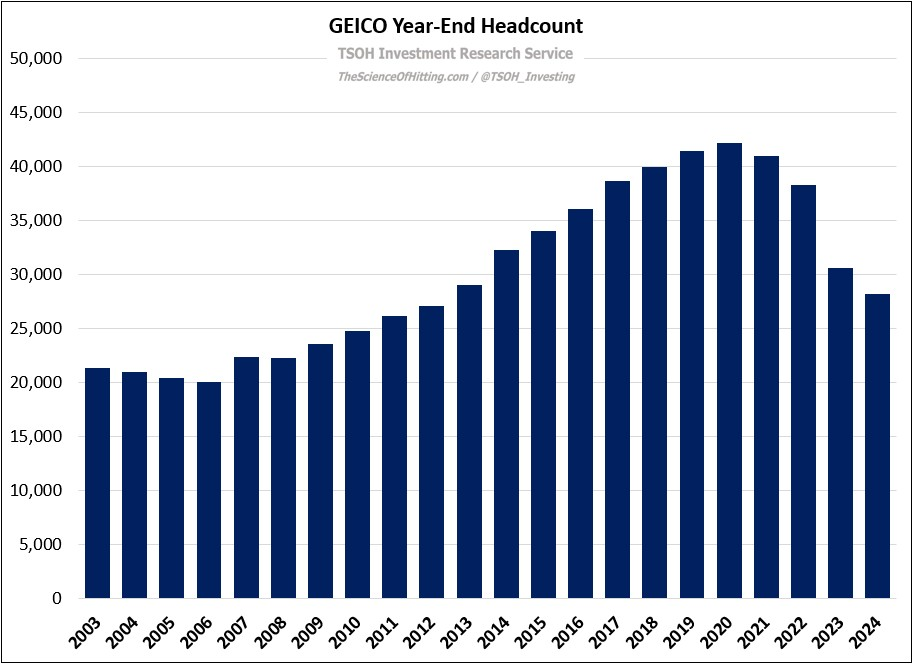

Five years later, and with Buffett noting in the 2024 letter that the job is “not yet complete”, I think we can fairly say that he may not have fully appreciated, or at least communicated, the nature of the challenge that GEICO faced in 2020 (which mirrors his underappreciation of these challenges ten years earlier). Suffice to say that GEICO’s underwhelming financial results for much of the past five years, including a nearly 20% cumulative decline in the PIF base since the end of 2021, has made the reality of the situation abundantly clear. I think that is also apparent in one other notable change at GEICO during Combs’ tenure: as of the end of 2024, GEICO has ~28,000 employees – a roughly one-third reduction from peak levels at the end of 2020 (by comparison, PGR’s headcount has grown by >50% since the end of 2020).

The above suggests that the need for “major repolishing” extended beyond those efforts to match rate to risk; it is reflective of a broader need at GEICO to think about operational improvements (or, as Warren wrote in the 2024 letter, “increased efficiency”). As we think about changes over the past five years, this comment – from Ajit Jain at the 2023 annual meeting – is notable:

“GEICO has certainly taken the bull by the horns and has made rapid strides in terms of trying to bridge the gap in terms of telematics. They have now reached a point where on all new business, close to 90% has a telematics input to the pricing decision. Unfortunately, less than half of that is being taken up by the policyholders… Even though we have made improvements in terms of bridging the gap on telematics, we still haven't started to realize the true benefit - and the real culprit of the bottleneck here is technology. GEICO's technology needs a lot more work than I thought it did. It has more than 600 legacy systems that don't really talk to each other, and we are now trying to compress them to 15 or 16 systems. That is a monumental challenge. And because of that, even though we have made improvements in telematics, we still have a long way to go because of technology. GEICO is still a work in progress… It's important to realize that even if we reach a 96% combined ratio (CR) in 2024, it will come at the expense of having lost policyholders. There is a trade-off between profitability and growth. We're going to emphasize profitability and not growth, and that will come at the expense of [PIF growth]. It will not be until two years from now [in 2025] that we'll be back on track fighting the battles on profitability and PIF growth.”

With the benefit of hindsight, Jain’s assessment of the situation was spot on.

Now that we’re in 2025, it’s time for profitable underwriting and PIF growth.

Conclusion

Two years removed from “The Gecko Stumbles”, two things are evident: (1) GEICO is in a much better position today than it was five years ago, and (2) their underappreciation of the valuable role of telematics in rate setting, which ultimately impacts customer acquisition and retention rates, was a significant misstep by GEICO. What I find most discouraging about this discussion (with the benefit of hindsight) is that Buffett had people like Combs telling him 10+ years ago that the auto insurance business was changing, and that GEICO would be left behind if it didn’t adjust accordingly to UBI. It has taken the better part of a decade to rectify that mistake, and it has proven very costly.

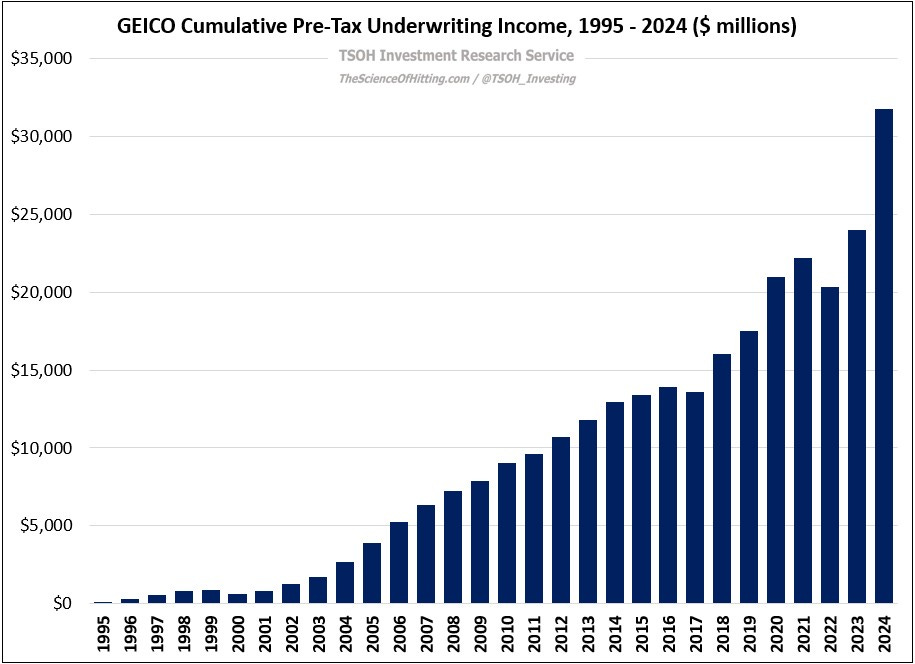

Even with these recent struggles, the long-term outcomes at GEICO remain highly encouraging: over the past 30 years, GEICO has generated ~$32 billion in cumulative underwriting income. That figure is ~7x larger than GEICO’s implied valuation when Berkshire acquired the final ~50% in 1995. As Warren notes, GEICO has been a long-held gem for Berkshire; in 2025 and beyond, I’m optimistic that this repolishing will return it to its prior shine.

I’ll leave the final word to Warren, who said the following 25 years ago (from page 394 of “Buffett And Munger Unscripted”): “Over time, we will be the low-cost producer - that is our goal. We have a lot going in our direction to enable us to do that. The low-cost producer in a huge industry is going to do very well over time… The GEICO equation is fundamentally good… We think we can attract business at a lower cost, and then run it at a lower cost, than most of the competition, if not all… Having the low cost is crucial… We have a very good business model at GEICO… We have a great machine at GEICO.”

NOTE - This is not investment advice. Do your own due diligence.

I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information presented in this report. Assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Projections are based on a number of assumptions, and there is no guarantee that they will be achieved. TSOH Investment Research is not acting as your advisor or in any fiduciary capacity.