Dollar Tree's Red Dot Dilemma

"It was a necessary evil..."

Note: Access all prior Dollar Tree research on the TSOH website

From “Dollar Tree: Raising The Bar” (October 2025):

“Management must remain relentlessly focused on serving the low opening price point, a key point of differentiation relative to many retail competitors. With ~85% of SKU’s still at or below $2, I’m confident this distinction remains intact; it’s critical, in my view, to hold this line in the years ahead, keeping a large majority of the SKU’s at or below $2. Multi-price is a lever to be pulled rarely, and when there is a compelling incremental reason to do so.”

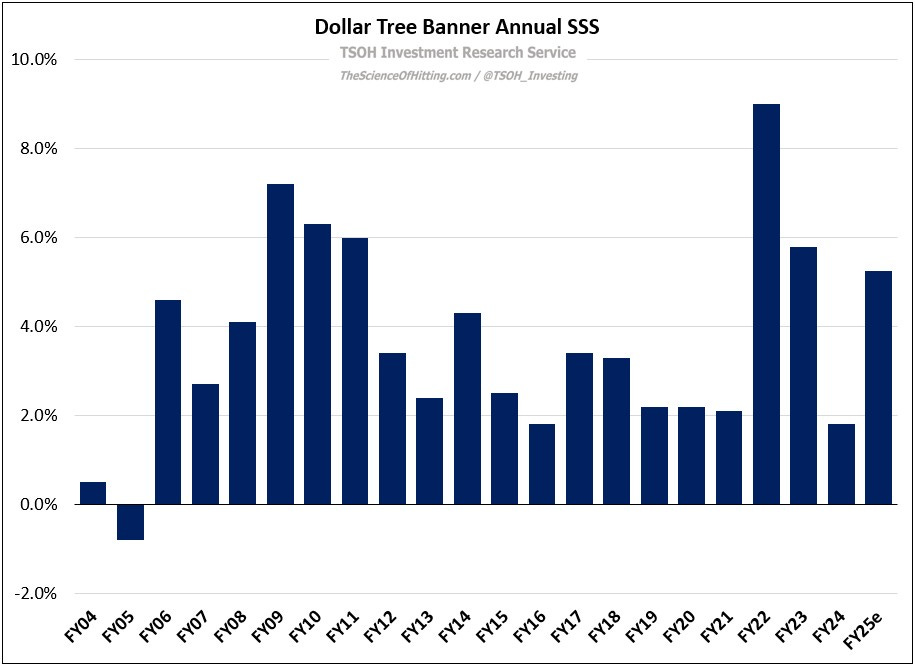

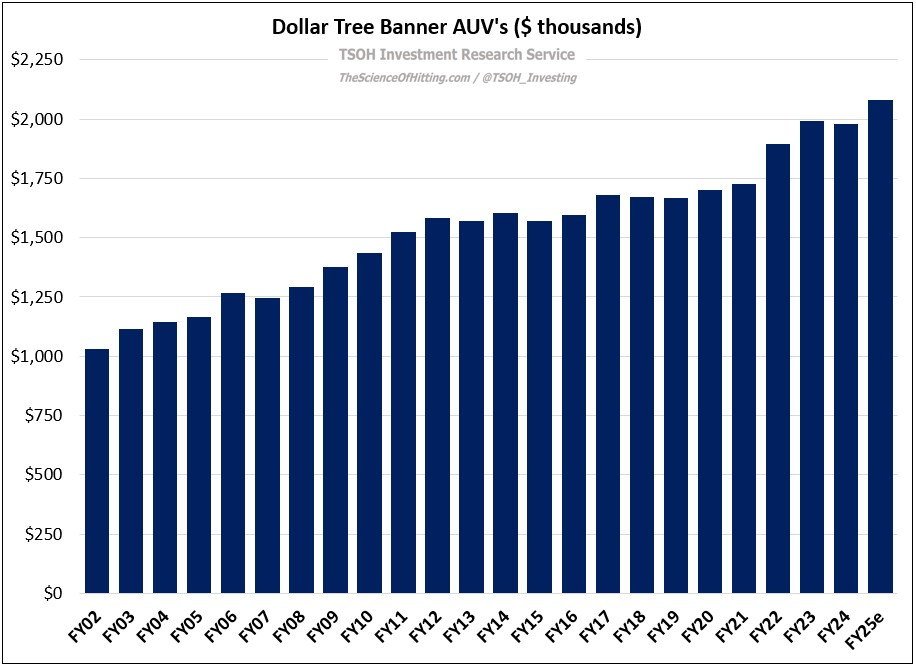

Using same store sales (SSS) as a proxy for customer adoption, we can see that Dollar Tree’s strategic evolution remains on track: FY25e comps / SSS growth is now expected to be north of 5.0%, compared to the initial 3.0% - 5.0% guidance provided in March. As a result, average unit volumes (AUVs) across the banner rose by >20% over the past five years to ~$2.1 million.

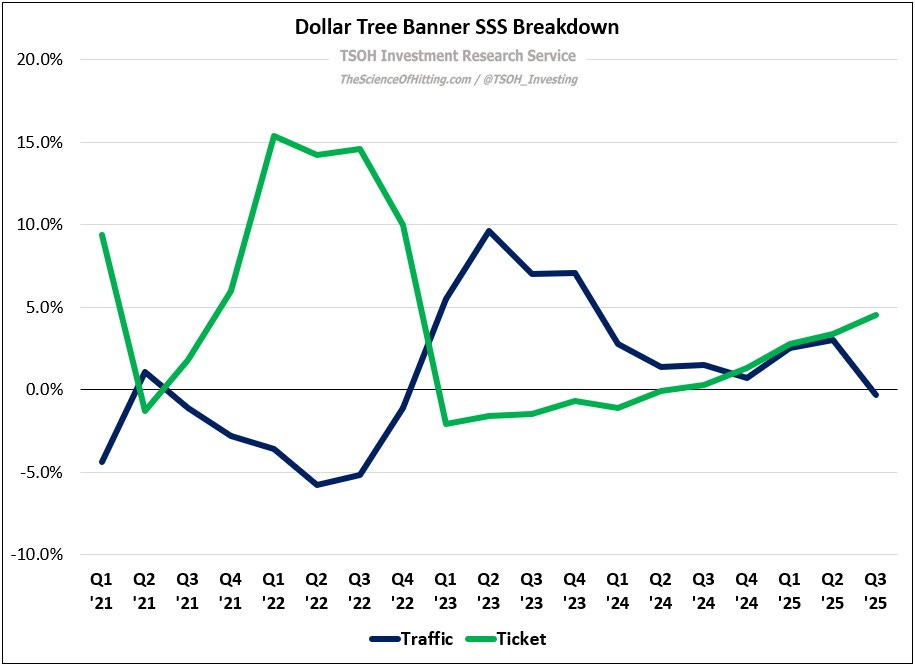

As we zoom in on the recent results, one notable change in Q3 FY25 was the traffic / ticket comp mix: as you can see below, the entirety of DLTR’s SSS growth in the quarter was attributable to higher ticket, with the contribution from traffic at -0.3%, the worst result they’ve reported in nearly three years.

That brings us to the title of today’s post, which speaks to some of the important near term questions faced by Dollar Tree - the answers to which are critical to the long-term success of the retailer’s multi-price strategy.