DLTR: "We Know How To Fix It"

From “Value Creation Lever?” (September 2022):

“I’d love to own the Dollar Tree banner at the right price, especially given the early success of the strategic shift. That said, even if the right price was offered - you can reasonably argue we’re already there - how does that thinking change given the inclusion of Family Dollar? (Which, in my opinion, remains a long way from living up to my definition of a high-quality business.)

The answer that I’ve come to, for now, is to keep being patient. If the Dollar Tree banner continues to meet / exceed my expectations (a path to Dollarama) and if the valuation looks attractive, I may convince myself that some wiggle room is justified, particularly given that Family Dollar likely accounts for ~10% of the company’s overall value. I’m not 100% set on that conclusion, but it’s something I’m more open to than 12-18 months ago.”

I’ve had a lingering interest in Dollar Tree for the past five-plus years, and it continues to this day. The story for the namesake banner is compelling: I’d argue it holds an attractive spot in U.S. retail, with a defensible model and differentiated position. In addition, the company is in the early stages of repositioning the business, with a successful outcome offering significant upside potential (in terms of banner profitability). On the other hand, as we approach the eight year anniversary of the Family Dollar acquisition, it remains a weight around DLTR’s neck. The question, as I discussed in September, is whether there’s a point where the price offered for the core banner makes this a cost worth bearing (particularly if you think FDO has any chance of being fixed). Now, we have some interesting developments worth thinking about; specifically, with the hiring of Richard Dreiling in January, is there reason to be more optimistic about Family Dollar’s future? If so, the opportunity is clear: if the cards fall favorably, Dollar Tree will be a great investment from today’s valuation. That brings us to the focus of today’s post: first, what is the state of affairs at the core banner?; and second, is there reason to believe FDO is finally positioned for improved results?

Dollar Tree

In November 2021, Dollar Tree management made a major change to the banner’s core business model: after 35 years of selling “everything-for-$1”, they announced that the starting price point for the majority of their SKU’s / assortment would be increased to $1.25. This followed another notable change, first implemented in 2019, to explore a multi-price strategy called Dollar Tree Plus (DT+). As I wrote at that time, assessing the logic of that decision required an appreciation of Dollar Tree’s customer value proposition:

“In my mind, the key thing to recognize is that the Dollar Tree concept has a relatively unique merchandise mix. As noted in the annual report, >50% its sales are in the Variety category (toys, stationery, party goods, arts and crafts, etc.) and Seasonal category. A large percentage of Dollar Tree’s business is from products like helium balloons, greeting cards, party supplies, and so on (with two-year stacked comps in the discretionary business recently running at +10%); the reason why I think this is important is because I do not get the sense that these are product categories where customers will flee Dollar Tree because of the higher price point.”

We now have some evidence to test my prior assumptions (the reported financials). My read on the early results for Dollar Tree? So far, so good.

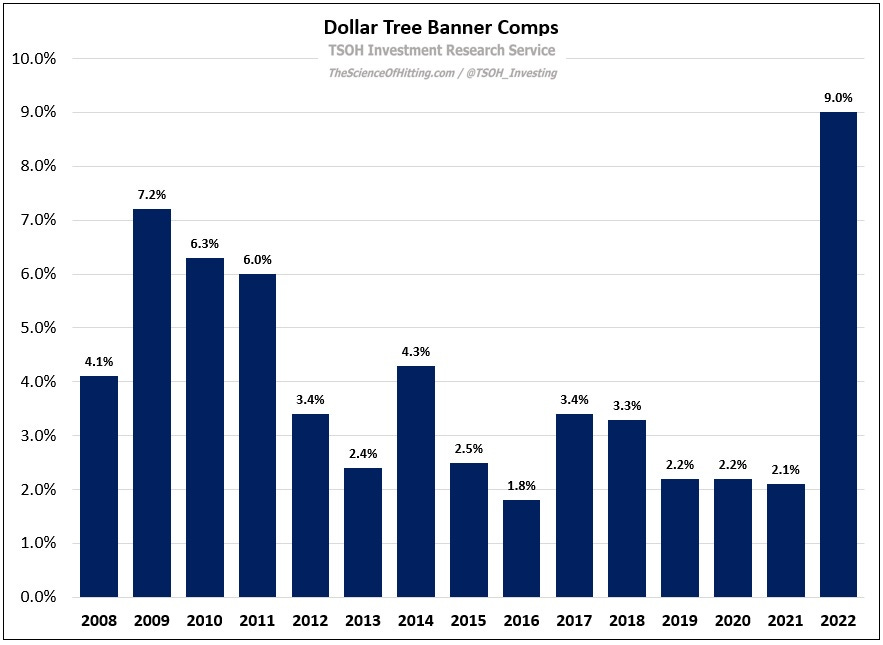

As you can see below, Dollar Tree banner comps increased by 9% in 2022, the strongest print for Dollar Tree in more than 15 years (which includes the financial crisis, a period when its customer value proposition shined).

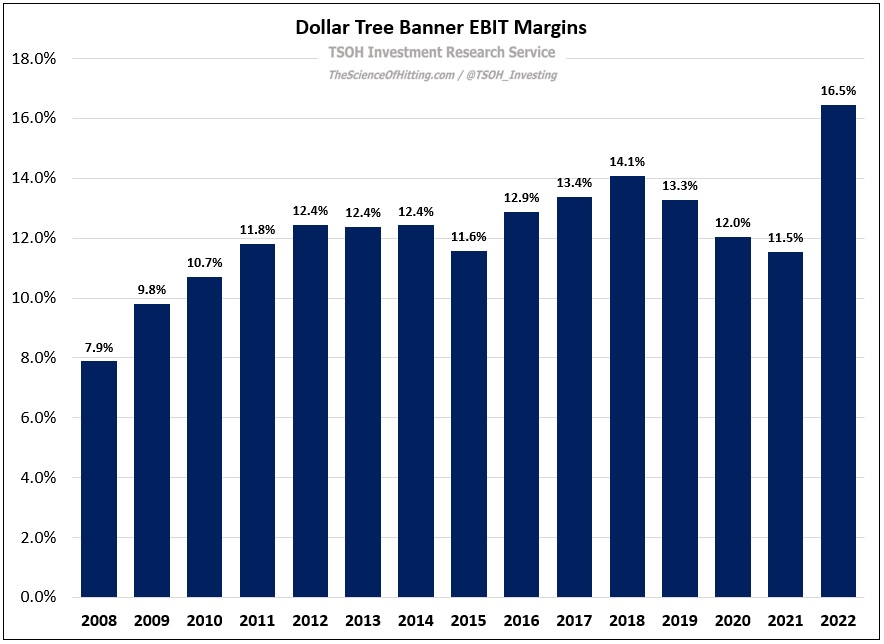

As disclosed in the 10-K, the +9% comp reflects a 13% increase in average ticket, offset by a 4% decline in traffic (the number of transactions). That strikes me as a reasonable / acceptable outcome, particularly when you consider the bottom line impact: as shown below, banner EBIT margins in 2022 were 16.5% - up >400 basis points from the 2019 – 2021 average.

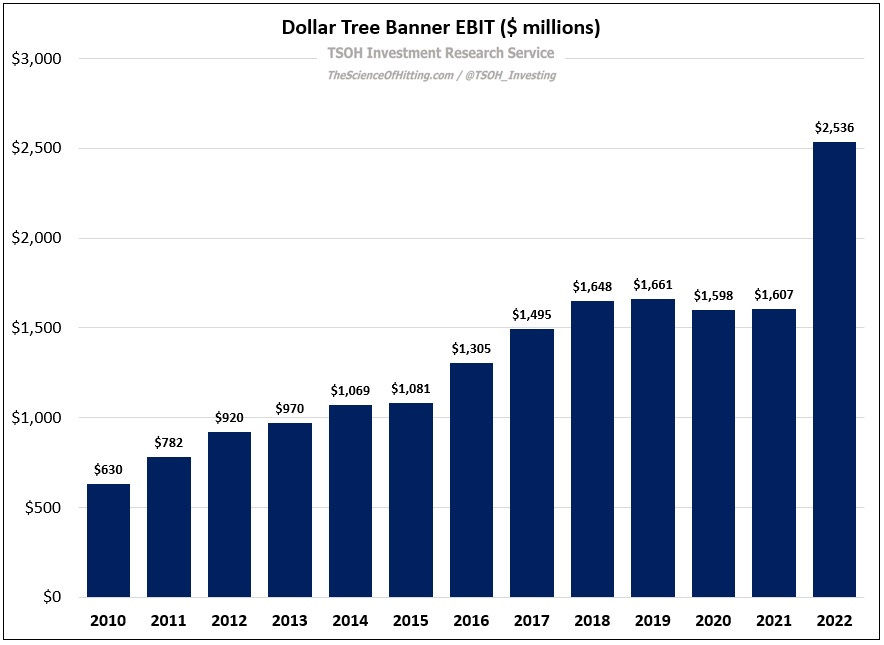

The combination of unit growth (+1% to 8,134 stores), strong comps, and significant margin expansion has led to a major increase in profitability: in 2022, the Dollar Tree banner generated $2.54 billion of operating income – up nearly 60% from 2021. (If we allocate corporate costs on a percentage of revenues basis, banner pre-tax income in 2022 was $2.2 billion; to put that in context, at $149 per share, DLTR has an enterprise value of ~$35 billion.)

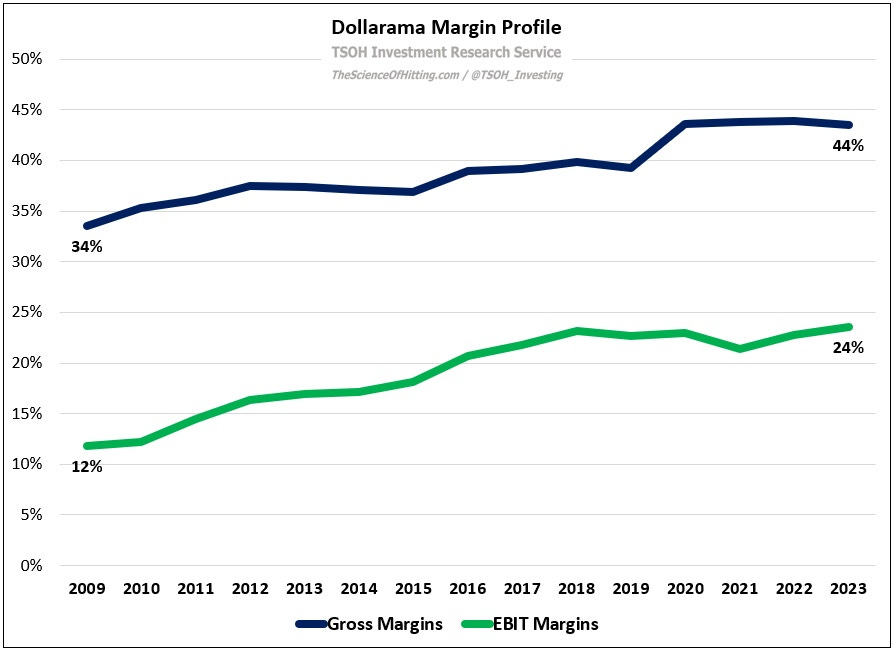

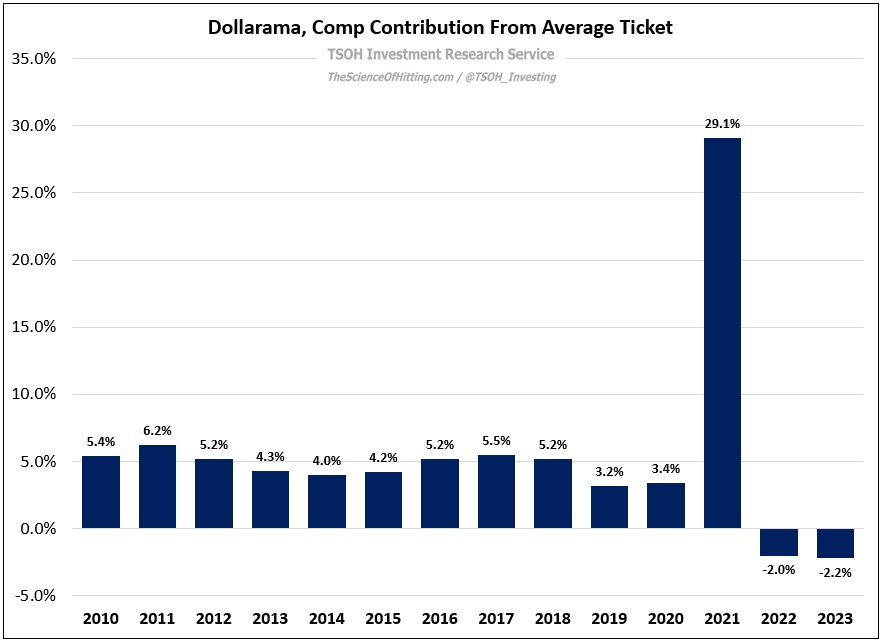

A big question here is determining the sustainability of this improvement: was 2022 the beginning of a longer term trend, a la Dollarama, or a one-time adjustment? (I would highly recommend revisiting the Dollarama case study; it is critical to understanding how I’m thinking about Dollar Tree.) Honestly, I’m a bit torn on that question. What gives me some optimism is the product mix discussed earlier; as someone who has frequented Dollar Tree stores over the years, I can confidently tell you that they sell certain products that, even at $1.25, are an attractive value relative to what you’d likely pay at your average drug store or regional grocer - and in the categories where there are clearer substitutes, I think they can strike the balance between an improved offering and slightly higher profit dollars (or, on a unit basis, pennies). Said differently, I believe the thought process shared in December 2021, which has since been proven justified by the (early) financial results, still rings true.

This comment, from Dollar Tree’s Q4 FY22 call, was noteworthy:

“The Dollar Tree merchant team successfully managed through the transition to the $1.25 price point… Traffic is positive, and we are confident it will be a contributor to comps in 2023. In 2022, we added $3 and $5+ merchandise into more than 1,800 Dollar Tree stores; we plan to add another 1,800 stores in 2023… Separately, we have been aggressively expanding our $3, $4, $5 frozen and refrigerated products, going from zero stores to 3,500 stores in 2022. This consists of three cooler doors, one at each price point with an attractive selection of proteins, pizza, ice cream, and more, which the customers are responding positively to…With the $1.25 transition behind us, it's time for Dollar Tree merchants to get more creative than ever before. They have continued to raise the bar on delighting customers and driving sales.”

Family Dollar

The problem for DLTR has been, and continues to be, Family Dollar.

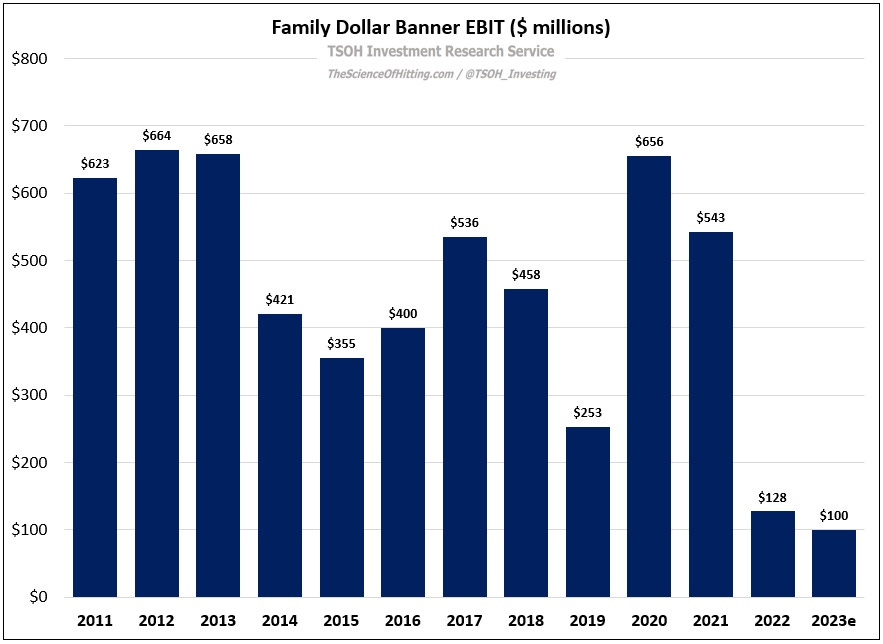

In 2022, Family Dollar generated $128 million in operating income – it’s worst result in more than a decade. In addition, based on management’s commentary on the Q4 call, the banner will likely deliver a roughly similar level of profitability in 2023. As a reminder, the price tag on this deal back in 2015 was nearly $9 billion; needless to say, this has not gone according to plan. (DLTR took ~$3 billion of impairment charges on FDO in 2018 / 2019.)

This comment, from Dreiling on the company’s Q4 call, neatly summarizes the significance of the problem: “At Family Dollar, it's clear that we’re at least a decade behind…” So, that’s the problem (and it’s a big one). The question is if they can find an answer; what is the FDO turnaround plan?