Disney: Breaking The Dam

The interplay between Mr. Market’s views on a company’s long-term prospects / strategic vision and how management chooses to react to that signal can be an interesting dynamic. There are times when management should rightly disregard the short-term worries of the stock market and plow forward. On the other hand, there are also circumstances where Mr. Market’s skepticism should be (or will be) viewed as a sign to management that an alternative approach should be taken into consideration. Over the course of the past 6-12 months, The Walt Disney Company has faced some lingering questions from the investment community about its strategic decision-making… and I’ve come to believe that this skepticism is warranted. For that reason, I believe the appropriate decision is for management to seriously consider whether it’s time to pursue a different approach.

Today’s write-up will focus on four key areas: (1) DTC Entertainment (Disney+ and Hulu); (2) DTC Sports (ESPN+); (3) The Parks business; and (4) The Theatrical business. For additional company-specific commentary, please review my previous Disney articles (April 2021 Portfolio Review, “As Big As Ever”, “The Certainly Know Them Now”, and “The First Inning”).

DTC Entertainment: Results

In November 2019, Disney launched its namesake DTC streaming service.

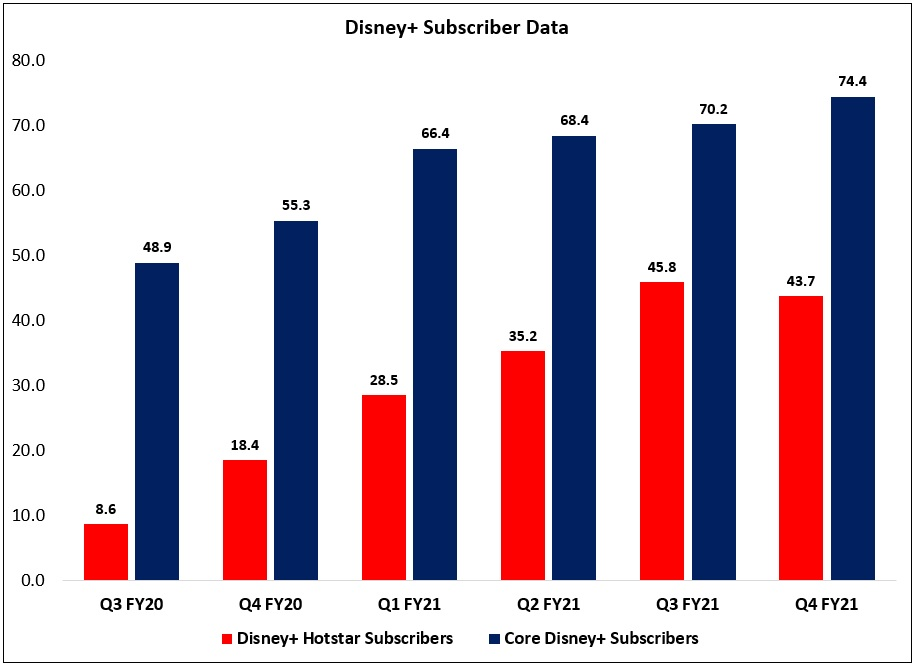

At that time, the company projected Disney+ would have 60 to 90 million paid subs by FY24 (in five years). Shortly after launch, it became apparent that the bar was too low: the service had 10 million paid subs on day one, and 74 million paid subs after its first year. As shown below, Disney+ ended FY21 with 118 million global paid subs, with more than 60% attributable to its core offering (the remainder are Disney+ Hotstar subs located in countries like India and Indonesia, which generate an ARPU of ~$0.70 per month).

The market’s reaction to the Q4 print was effectively a continuation of what we’ve witnessed throughout the first nine months of the fiscal year: despite an objectively astounding overall performance for Disney+ in the two years since it was launched, Mr. Market is asking “what have you done for me lately?”

And to be fair, measured relative to the company’s updated DTC targets, the answer is “not much”. In the past six months, core Disney+ and Disney+ Hotstar each added less than 10 million net subs. As a reminder, management’s goal is 230 million - 260 million total paid Disney+ subscribers globally by the end of FY24 (three years from now). At the midpoint of guidance, and assuming 40% of the mix is attributable to Disney+ Hotstar (roughly comparable to today), that requires 100 million net subs for Disney+ Hotstar and 145 million net subs for core Disney+. From year end FY21, that’s another 56 million Disney+ Hotstar subs (19 million annually) and another 71 million core Disney+ subs (24 million annually). Long story short, the pace of net adds over the past six months – and the results we’re likely to see over the next six months – will not get the job done.

So, given that math, why has management (once again) reiterated its FY24 Disney+ subscriber guide? (And why do I remain confident that they will ultimately meet or exceed these targets?) The answer is two-fold.

First, Disney+ still has a lot of geographic white space. As noted on the call, Disney+ is currently available in about 60 countries (compared to 190 countries for Netflix). Over the next 24 months, the service will be launched in another 100+ countries around the world, opening up a market that is measured in tens of millions (if not hundreds of millions) of households.

Second, Disney is still navigating the impact of the pandemic, which disrupted planned content production. This will take another 2-3 quarters to be addressed, but the company believes that it will have a full slate of new content for subscribers across all of its brands by 2H FY22:

“The dam will break in terms of the content we announced last December; that will be substantial and will lead to a cadence of content throughout Q4 that will look more like what we expect to see from an ongoing standpoint. We're only in year two of Disney+ and the hunger for content for the service is extraordinary. And when you have that happen at the same as a pandemic and you need to shut down production, that's not a good combination. We identified the need for the content a year ago and have prepared a very strong cadence of content, which will hit the pipeline in 2H FY22… In total, we are nearly doubling the original content from our marquee brands - Disney, Marvel, Pixar, Star Wars and National Geographic - coming to Disney+ in FY22… this is the beginning of the surge of new content shared last December.”

In summary, I won’t quibble with Mr. Market’s concerns about the pace of recent Disney+ net adds (with or without Hotstar); relative to prior trends, it has been underwhelming. That said, I also believe that this bout of pessimism will ultimately prove short-sighted. Disney has an unparalleled collection of brands, and demand for content from its core franchises will drive further subscriber growth and ARPU expansion over the long run. I think this quote from Netflix co-CEO Reed Hastings, from the company’s Q2 FY16 shareholder letter, is perfectly applicable to Disney (and note that Netflix’s stock price declined by roughly 35% during the period in question):

“We are growing, but not as fast as we would like or have been. Disrupting a big market can be bumpy, but the opportunity ahead is as big as ever and we continue to improve every aspect of our business."

DTC Entertainment: Strategy

This section gets to the crux of what I mentioned in the introduction: Mr. Market’s skepticism should be viewed as a sign to Disney management that an alternative course should be taken into consideration.

The following chart is from Netflix’s Q3 FY21 shareholder letter:

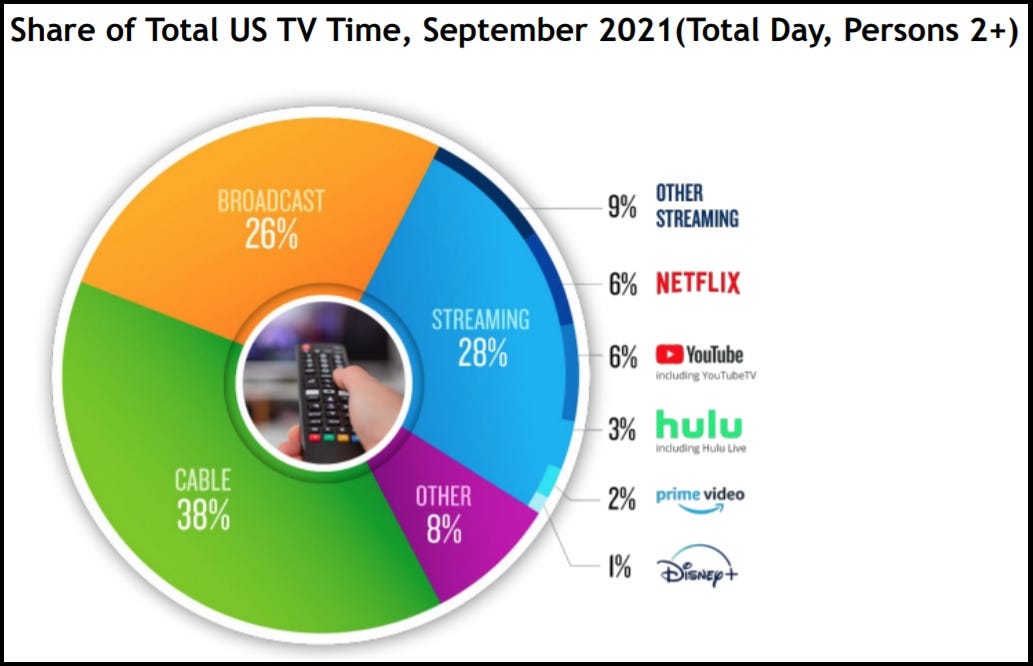

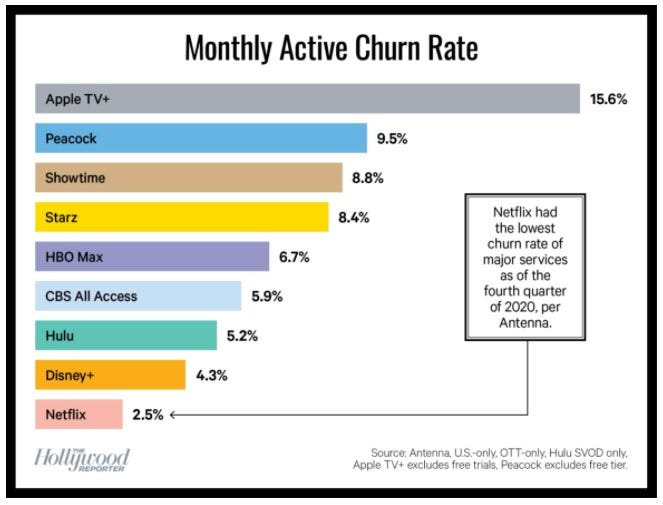

As you can see, Netflix engagement in September 2021 in the U.S. was roughly 6x higher than Disney+. We don’t have granular U.S. subscriber data for either company, but I think we can reasonably guesstimate that the Netflix U.S. sub base is roughly 2x larger than the U.S. Disney+ sub base; that suggests Netflix U.S. per sub consumption is roughly 3x higher than Disney+ (the proper thing to do would be to add Hulu to this discussion, but the inclusion of Hulu Live makes the comparison even messier). The point is that Disney+ is driving much less engagement – in what is presumably its strongest market - than its best-in-class peer. Now, that’s partly due to the nature of the offering (there’s less depth to the library and the target customer is more narrowly defined). But regardless of the reason why, I think this is the reality from a competitive perspective: Netflix has replaced linear TV for millions of U.S. households as the place to start their viewing experience at night (I think Hulu may be perceived similarly, albeit for a smaller audience); it’s where the search for that next TV show or movie begins. Unsurprisingly, this position comes with higher engagement and lower churn; simply put, Disney+ does not hold a similar position in people’s minds (“If you look at some recent comScore data, on connected TV’s in the U.S., Netflix is 26% of time spent [engagement]… Disney+ is 4%”).

I’ve come to believe that this is a fundamental shortcoming of Disney’s DTC strategy that needs to be addressed; consider what investor Dan Loeb said in his letter to Disney CEO Bob Chapek in October 2020: