"I'll Never Sell A Share"

From the 2001 Berkshire Hathaway shareholder meeting:

Charlie Munger: “Earlier this morning, I was autographing books when a very good-looking woman came up to me and said she wanted to thank me. I said, ‘For what?’ And she said, ‘You told me to buy this pantyhose I’m wearing from Costco.’ I’d evidently made some previous comment about how amazing it was that Costco could get Hanes to allow a co-branded pantyhose in Costco stores. That wouldn’t have happened 20 years ago.”

Warren Buffett: “She must have been pretty desperate if she was consulting with you on where to buy pantyhose.”

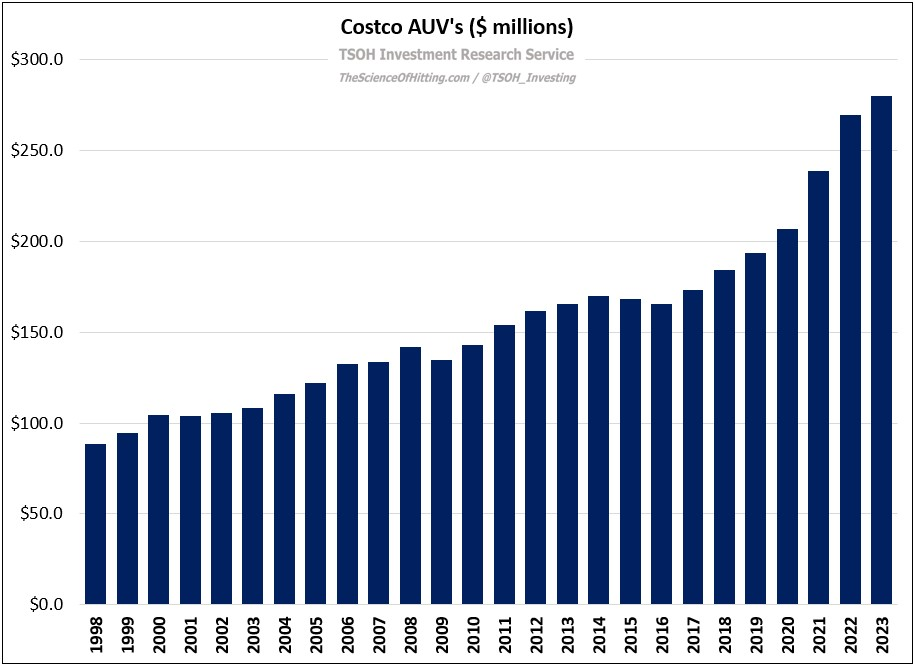

When Buffett and Munger made those comments, Costco was a chain of ~350 warehouses with average unit volumes (AUV’s) of ~$100 million per year. Today (as of YE FY23), Costco is a chain of 861 warehouses (with ~70% in the United States) that generate AUV’s of ~$280 million per year.

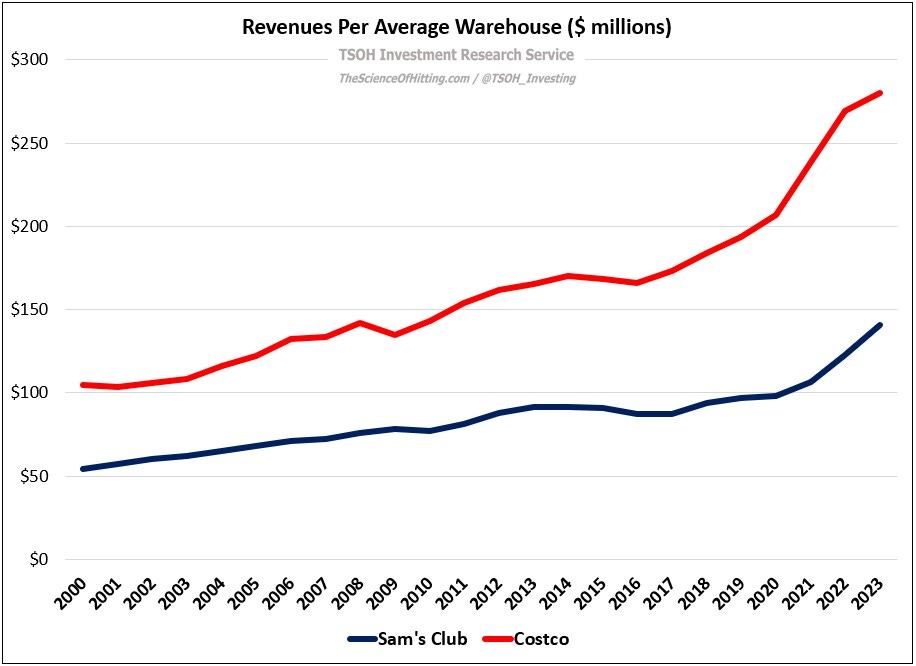

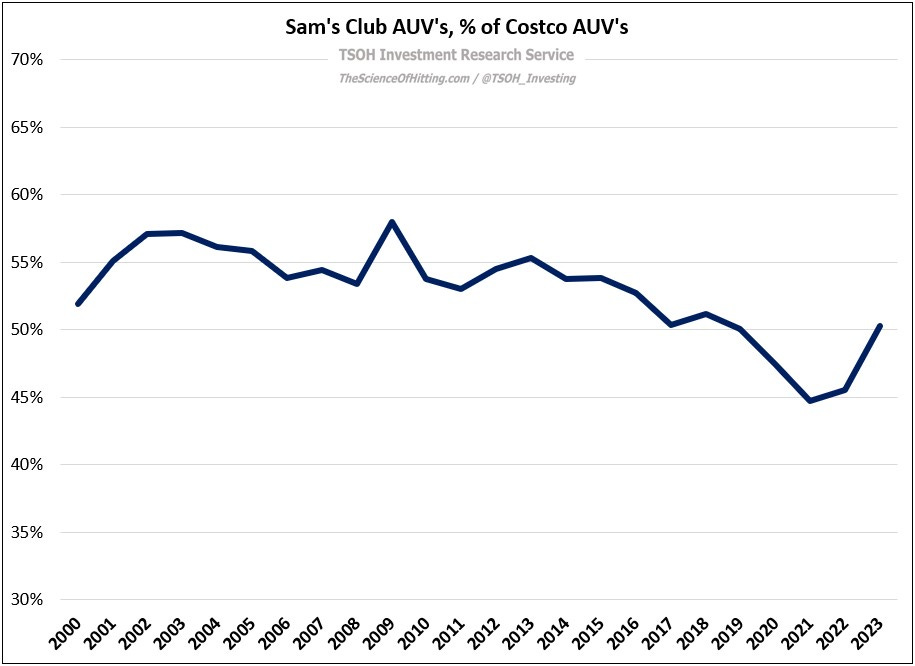

In terms of competition, Costco continues to be in a class of its own. While management gave some deserved credit to Sam’s Club on its Q4 FY23 call (“We've seen improvements in parts of what they do… they are tough competitors and so are we.”), the reality is that a large gap remains between the two companies on warehouse productivity: as you can see below, the average Costco generates annual AUV’s that are ~2x higher than the average Sam’s. (At ~133,000 square feet, the average Sam’s is ~10% smaller than the average Costco.) The second chart shows the average AUV’s for Sam’s as a percentage of average AUV’s for Costco; that metric has fluctuated between 45% - 60% for the past 25 years, with a recovery for Sam’s in FY22 and FY23 following a decade of underperformance.)

What makes Costco special? This comment, from CEO Craig Jelinek’s 2022 shareholder letter, succinctly captures the company’s vision (simple but not easy): “Through the years, Costco’s mission has stayed the same: providing our members with quality goods and services at the lowest prices. We follow our Code of Ethics of obeying the law, taking care of our members and employees, respecting our suppliers, and rewarding our shareholders. By staying true to our culture, Costco has continued to succeed, despite the challenging business environment.”

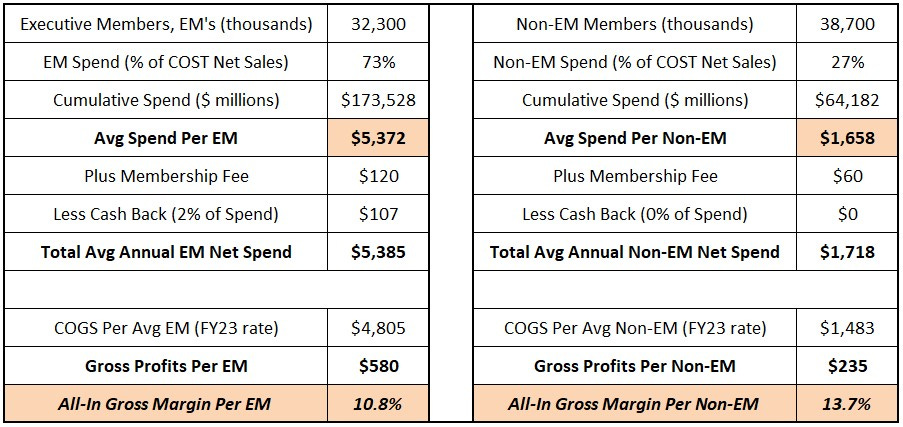

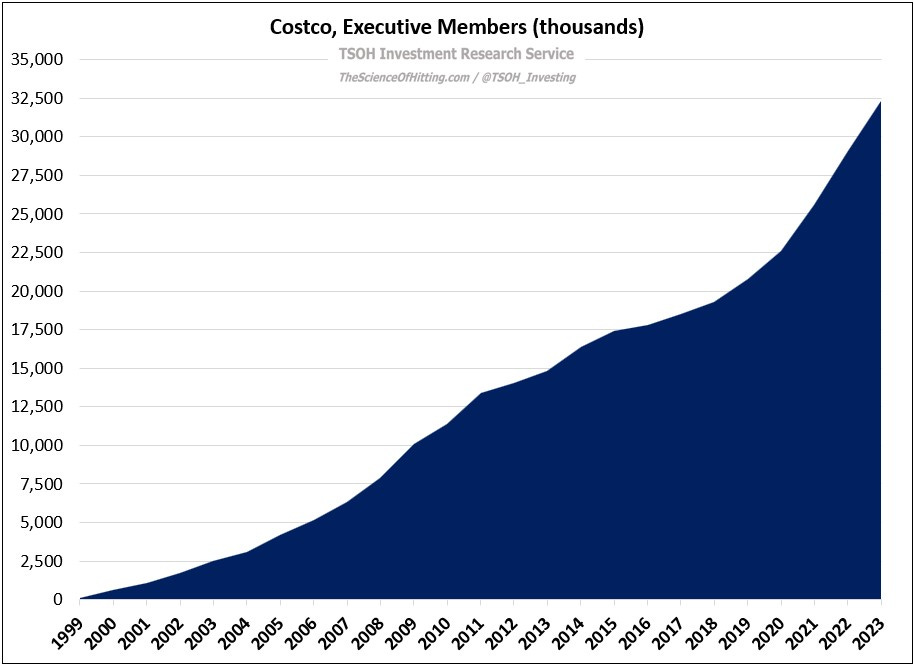

As we think about the business strategies that support this vision, the company’s executive membership (EM) program is a noteworthy example (first discussed in “The Costco Snowball”). Based on disclosures from the Q4 FY23 call (“executive members now represent ~73% of worldwide sales”), we can estimate the average EM spent ~$5,400 at Costco last year – roughly 3x higher than the average non-EM (~$1,700). After accounting for the 2% reward EM’s receive on eligible purchases, the all-in gross margin that Costco generates from the average EM is approximately 10.8% - 300 basis points lower than the rate for non-EM’s. (For EM customers who spend more than the average, the effective gross margin “paid” to Costco is even lower; rewards are capped at $1,000 a year, or $50,000 of annual spend.)

This is a virtuous cycle that encourages EM adoption and higher customer spending, which has worked wonders since its introduction in 1998: Costco ended FY23 with 32.3 million EM’s, a ~3x increase since 2010 (45% of all paid cardholders, up from 36% in 2010). As CFO Richard Galanti noted on the Q4 FY23 call, ““A regular member, over the first few years, will buy more every year. An EM starts at a higher lever and will buy more every year from that higher level.”

Expansion