"Content, Content, Content"

Today’s write-up will focus on two key takeaways from Disney’s Q1 FY22 financial results: (1) management sees the light in the DTC business and is moving quickly to ensure its services are in a position to win in the market; and (2) stellar results at the domestic Parks are an important reminder that The Walt Disney Company will be much more than a DTC powerhouse.

Disney DTC: Integration

In response to the Q4 FY21 results, I wrote the following:

“Over the course of the past 6-12 months, Disney has faced some lingering questions from the investment community about its strategic decision-making… and I’ve come to believe that this skepticism is warranted. For that reason, I believe the appropriate decision is for management to seriously consider whether it’s time to pursue a different approach.”

That comment was focused on the company’s U.S. DTC strategy:

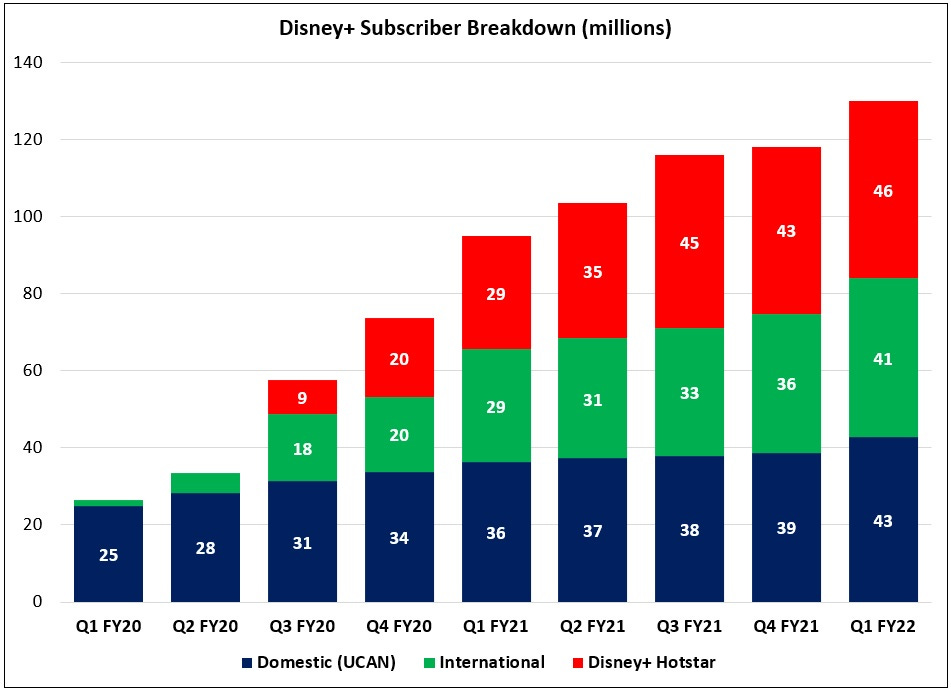

“I think the time has come for a change: Disney needs to collapse Disney+ and Hulu into a single app… As we saw with Hamilton, Disney+ has the ability to attract millions of new subscribers who may be outside of the Marvel / Star Wars / kids demo; the question is how they can convince these subs to keep using and paying for the service (‘One month later, almost 30% of users who signed up to watch Hamilton had cancelled Disney+’). I believe the consolidation of Disney’s U.S. SVOD services is the answer to this problem.”

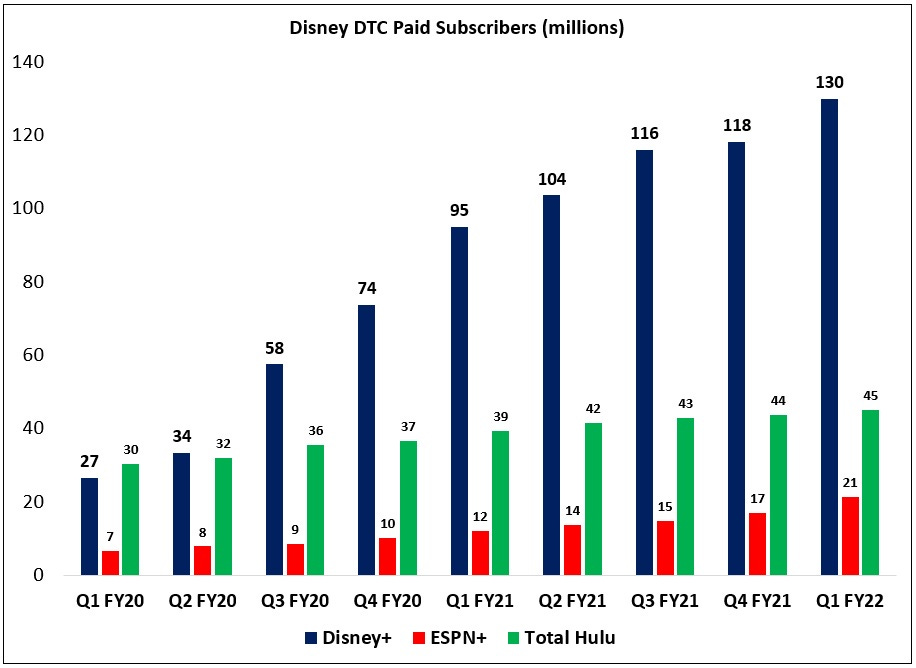

While the company’s DTC results were actually quite strong in Q1, with Disney+ reporting a sequential increase of nearly 12 million subscribers, it’s becoming apparent that management agrees with the logic for making some strategic changes (the opportunity to take the next step from a bundled approach to a single offering). Over the past few years, Disney+, Hulu, and ESPN+ worked well as standalone services - but adoption and engagement across the company’s U.S. DTC services will benefit greatly from this change. (That said, while I’m convinced this will happen, it will take some time; the biggest remaining hurdle is Comcast’s 33% stake in Hulu).

This comment on the call, from CEO Bob Chapek, was revealing: