"Complexity As A Moat"

An update on Portillo's (PTLO)

From “Portillo’s: A Growth Story” (March 2024):

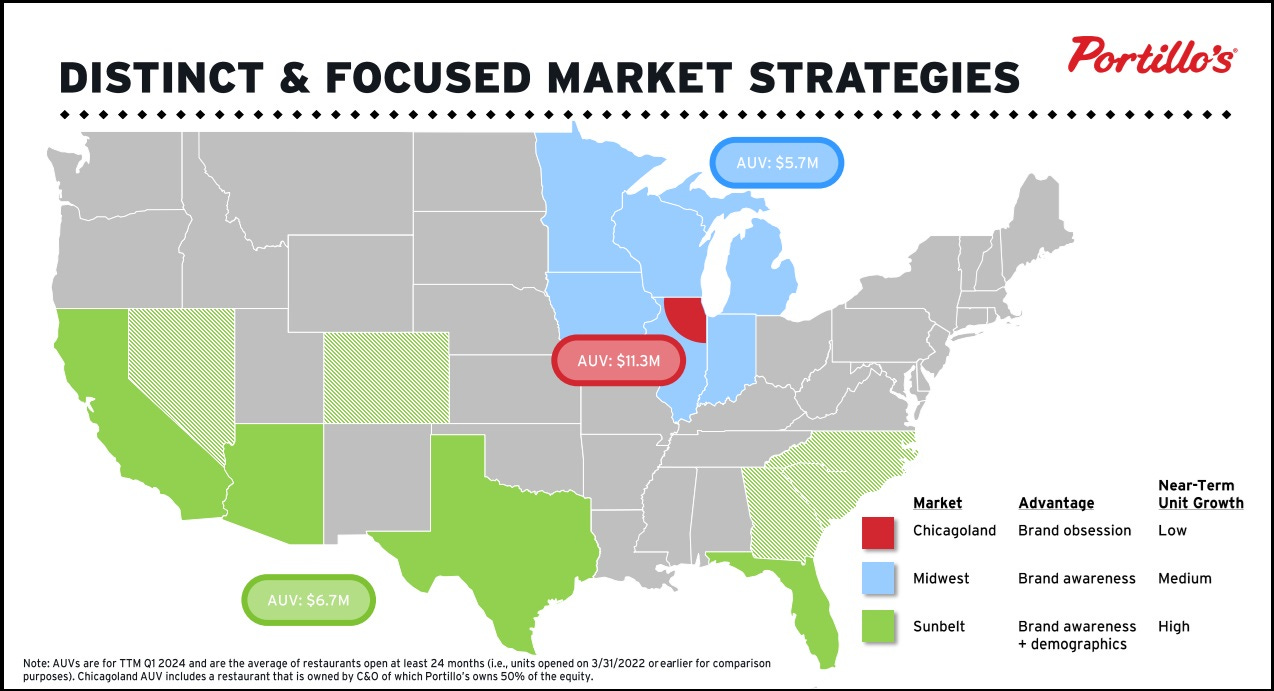

“The challenge for present management is how to evolve that way of thinking [complexity as a moat] to meet their financial objectives while retaining what makes Portillo’s special… Portillo’s success in Chicagoland is undeniable, but the ‘Cheese Sauce Spill’ [Midwest] markets tell a different story. An optimistic interpretation is that this wasn’t indicative of a limited ability for the brand to travel; instead, it reflected growing pains for an organization that needed time to learn how to successfully grow outside its home market. Portillo’s paid their dues over the past decade, and they’ll reap the rewards as they expand through the Sunbelt… Over time, if I decide to invest in Portillo’s, it will likely happen because I’ve seen clear evidence to support that theory.”

Six months in, Portillo’s has hit some bumps in the road. Their recent lackluster results have attracted the attention of an activist investor, Glenn Welling of Engaged Capital, who has built a ~10% stake in the company. (Reporting from CNBC suggests that Welling, who recently engaged in an activist campaign at Shake Shack, is focused on build costs / unit economics and the real estate strategy; I discussed the latter point in the initiation.) Finally, it was announced on May 29th that COO Derrick Pratt was leaving the company, with his departure treated as a “qualifying termination”.