CAVA: Running The Playbook

From “CAVA: The Next Chipotle?”: “The main takeaway is that the unit economics at the CAVA-bannered locations have been attractive (at a minimum, comparable to Chipotle’s results in the early-2000’s). I think we have clear line of sight for a significant improvement in operating efficiency over time on below the line expenses… There’s a scenario where today’s valuation [~$40 per share] ultimately proves reasonable, or even attractive.”

When that write-up was published in July 2023, I think it’s fair to say the consensus view in the value investor community was quite negative on the prospects for CAVA’s stock. It was viewed as a high-flyer IPO that had a low probability of long-term success. Given that it has more than doubled since that time, it’s probably safe to assume that those beliefs have not changed.

As I noted at that time, I looked at CAVA because I wanted to avoid reflexively responding to a new idea without doing the work. As I found, that can be a revealing exercise - particularly on the names that everybody “knows” are overvalued from the headline valuation. My goal was to try and correct some of the mistakes I made as a young investor - for example, overlooking a company like Netflix due to its valuation without truly doing the research.

Along that same line of thinking, today’s write-up will bring us up to date on CAVA. As I wrote with the stock at ~$40 per share, there was no question in my mind that there was a scenario where the valuation proved reasonable, or even attractive. With it at ~$90 per share, does that conclusion still hold?

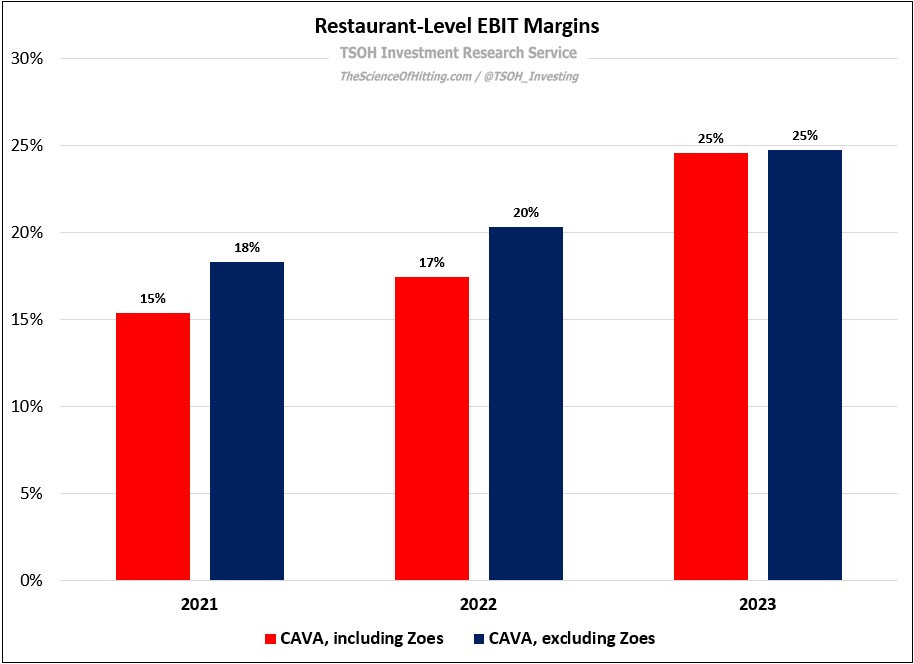

First, let’s update on the unit economics, a major focus of the initial write-up (in particular, comparing the results with Chipotle’s in the early 2000’s). As you can see below, CAVA has benefited from two key developments: the Zoes Kitchen conversions, which were completed in late 2023, and ongoing improvements at the namesake banner. As a result, overall restaurant-level (RL) profit margins improved ~1,000 basis points over the past two years.

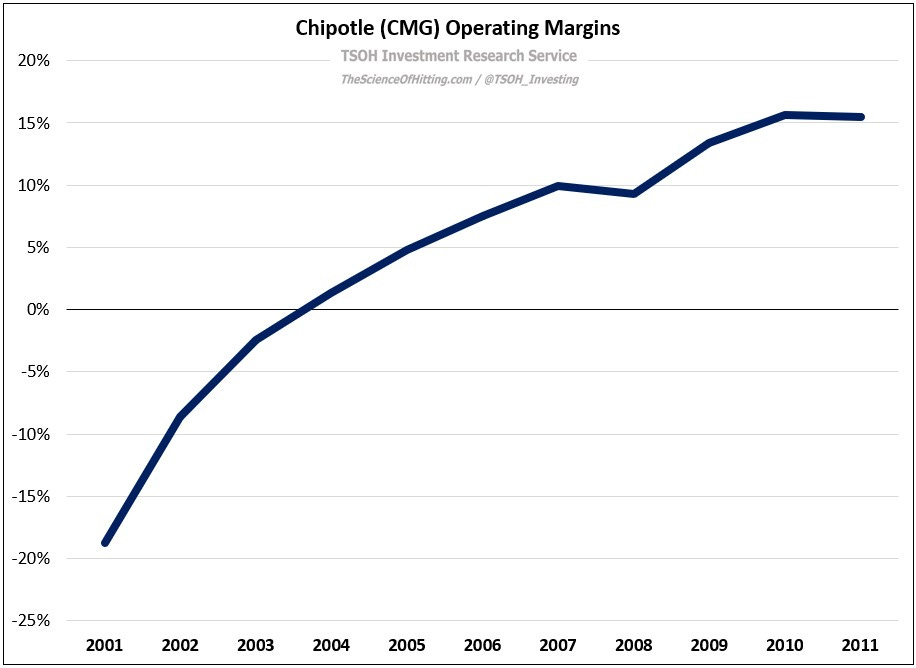

At ~25%, CAVA’s RL margins are meaningfully higher than the ~15% RL margins Chipotle generated in 2003 (when it had ~300 units). Where CAVA continues to lag is “below the line” expenses (G&A, D&A, and preopening), which were ~23% of sales in FY23, compared to ~16% at Chipotle in 2003.

In total, the two companies are at a comparable position on their margin profile at a similar point in their lifecycle / growth phase. As we look forward, I believe that CAVA remains well placed to replicate the OpEx leverage and EBIT margin lift that Chipotle saw when its unit count increased from 177 in 2001 to 1,230 in 2011. (For example, as a result of scale efficiencies gained from the centralized production of dips and spreads at the Verona facility.)