BF.B: "Continued Headwinds"

Note: A reminder that I’m hosting an AlphaSense expert webinar on Tuesday at noon ET with Jon Bratta, the former VP of Emerging Brands at Monster.

Sign-up today to receive an email notification when the webinar is available.

From “Brown-Forman: The American Spirit” (January 2025): “I would argue that the ‘portfolio of brands’ strategy will be more difficult to succeed at, particularly if it relies upon acquiring up and coming brands at prices that reflect their potential. Given that Brown-Forman has previously been in the sights of acquirers, I do wonder if this choice is partly reflective of the desires of the company’s controlling shareholders. This came to mind as I read the following comment from Whiting’s first shareholder letter in 2019: ‘We are committed to the long‑term independence of Brown‑Forman as a leader in the spirits industry.’ If that’s a key objective, I can appreciate why size / diversification would be desired. How it then ranks on their list of priorities - for example, relative to per share value creation - is interesting to consider.”

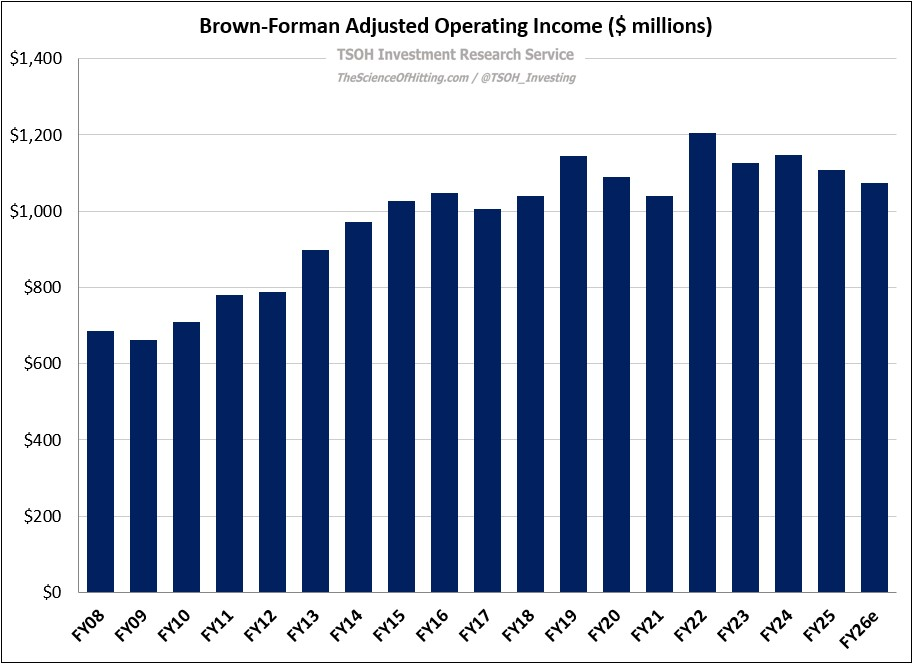

FY25 was a difficult year for Brown-Forman, concluding with a 3% YoY organic revenue decline in the fourth quarter; those challenges are expected to continue, with initial guidance calling for revenues and operating income to both decline low-single digits in FY26. As shown below, this implies FY26e EBIT that’s comparable to the result that BF reported a decade ago (in FY16).