BJ's Wholesale: "A Better Business"

An update on BJ and COST

Note: Last week, I moderated a Tegus expert panel call on the U.S. dollar stores, with particular focus on Dollar General. We recorded a few hours after the company reported their (dreadful) Q2 FY24 results, so we had plenty to talk about. The experts offered valuable insights on a number of topics, including the state of the competitive landscape, DG’s operational challenges, and the path to stronger long-term financial performance from small box retailers. Sign-up here to view the panel call on September 12th. As a reminder, I will send a full update on DG and DLTR on Monday, September 9th. That will be followed by a special post on Thursday, September 12th, where I’ll discuss some of my key takeaways from the Tegus panel call.

From “BJ’s Wholesale Club: Transformation?” (December 2023):

“In summary, I think that BJ’s came back to the public markets in 2018 with a lot of room for improvement. Over the next five years, with help from a large pandemic-related tailwind, my read is that management has done a good job; that includes a much stronger balance sheet (~0.7x net leverage, compared to ~3.3x five years ago in Q3 FY18), along with a realistic and sensible approach to long-term warehouse expansion (low single digit annual growth). If they are successful in copying some of the things that Costco excels at, particularly in non-food / general merchandise categories (the treasure hunt experience), there is an opportunity for significant operational improvement and much higher unit volumes (AUV’s). Overall, I think the results suggest that BJ’s business is in a better place today than it was 5-10 years ago.”

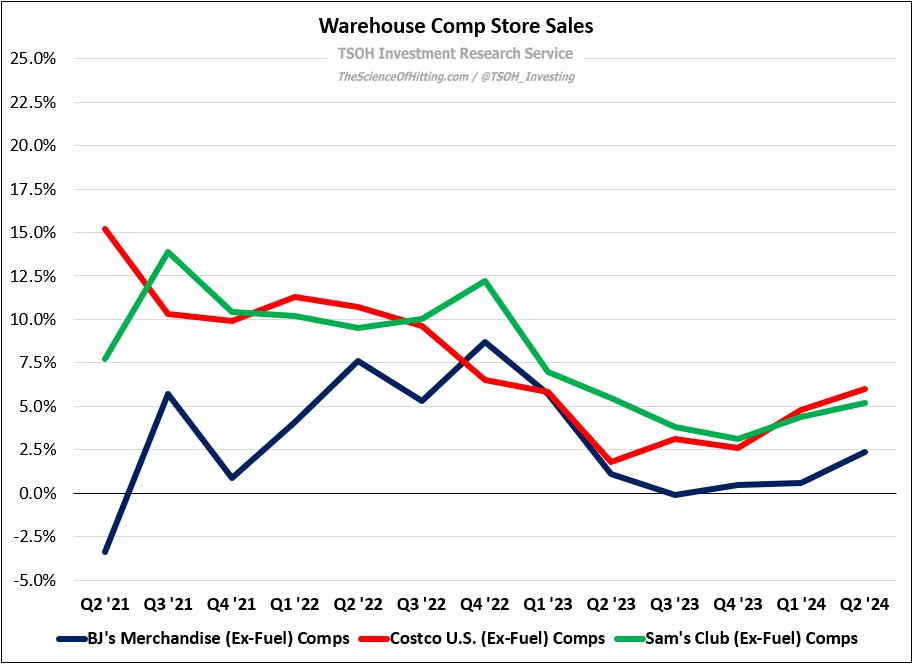

While there continues to be a wide gap between BJ’s merchandise (ex-fuel) comps and those reported at its direct peers (Costco U.S. and Sam’s Club), which is a continuation of the relative comp trends we’ve seen over the past 5-10 years, I think we are seeing some early evidence that BJ’s is positioning itself for a brighter future. Specifically, the company has made progress on driving an improved customer experience within the product categories that drive repeat traffic (grocery), while also revitalizing their general merchandise value proposition (perfecting the treasure hunt experience, where one notable example from the Q2 FY24 results was the high-single digit apparel comp).

One critical category that management has focused on, which CEO Bob Eddy discussed on the company’s Q2 FY24 call, is perishables and produce: