Beyond The Workshop

An update on Build-A-Bear (BBW)

Note: TSOH Investment Research will be off on Thursday to celebrate Christmas; I hope that everyone has a happy holiday! If you still need to add another present for under the tree, “Buffett And Munger Unscripted” is the perfect gift for family or friends who are interested in business and investing.

From “Build-A-Business” (July 2025):

“In due time, Build-A-Bear faced similar challenges, exacerbated by an underappreciation in the 2000’s of the changes underway in U.S. retail, particularly for the mall-based retailers. Over the past ~15 years, Build-A-Bear management has focused on repositioning the business, with emphasis on international and franchised / partner doors for growth. With all of that said, I think the founding vision of the company was, and still is, a compelling idea: Build-A-Bear is a unique retail concept centered around experience and product customization, with some price flexibility given the infrequency of average customer visits and the nature of the purchase.”

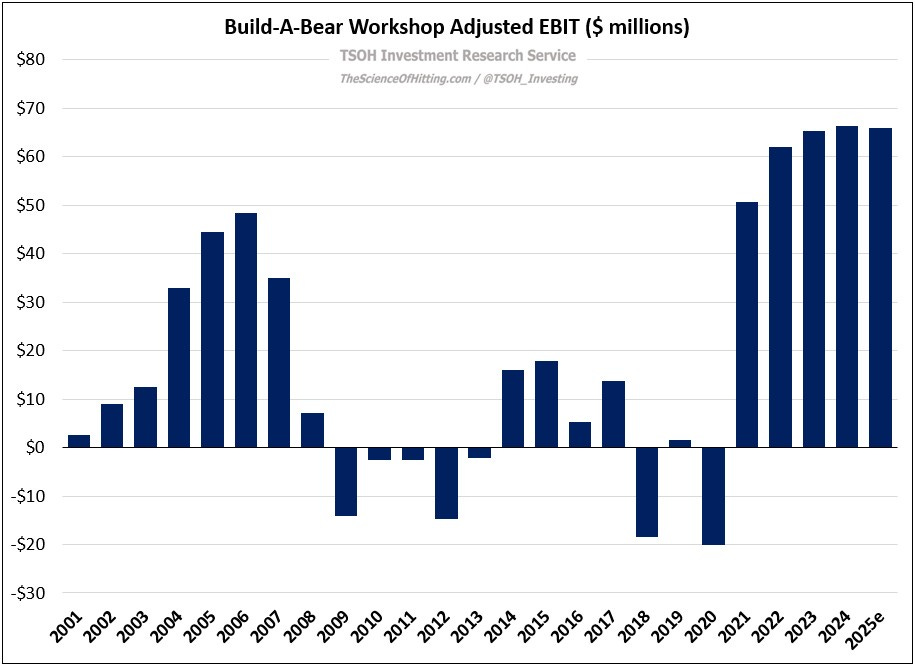

The story told in the Build-A-Bear (BBW) initiation was one of a company truly transformed; that development reflected changes in the strategic vision (international and partner-managed locations), along with an appreciation of its bargaining position relative to key partners (mall landlords) as the world changed over the prior 10+ years, which led to >1,000 basis points of retail gross margin improvement, primarily due to fixed occupancy cost leverage. The result, as you can see below, is a company that has generated ~$200 million of cumulative operating income over the past three years (from FY23 – FY25e) – higher than the company’s cumulative EBIT from FY00 – FY19.

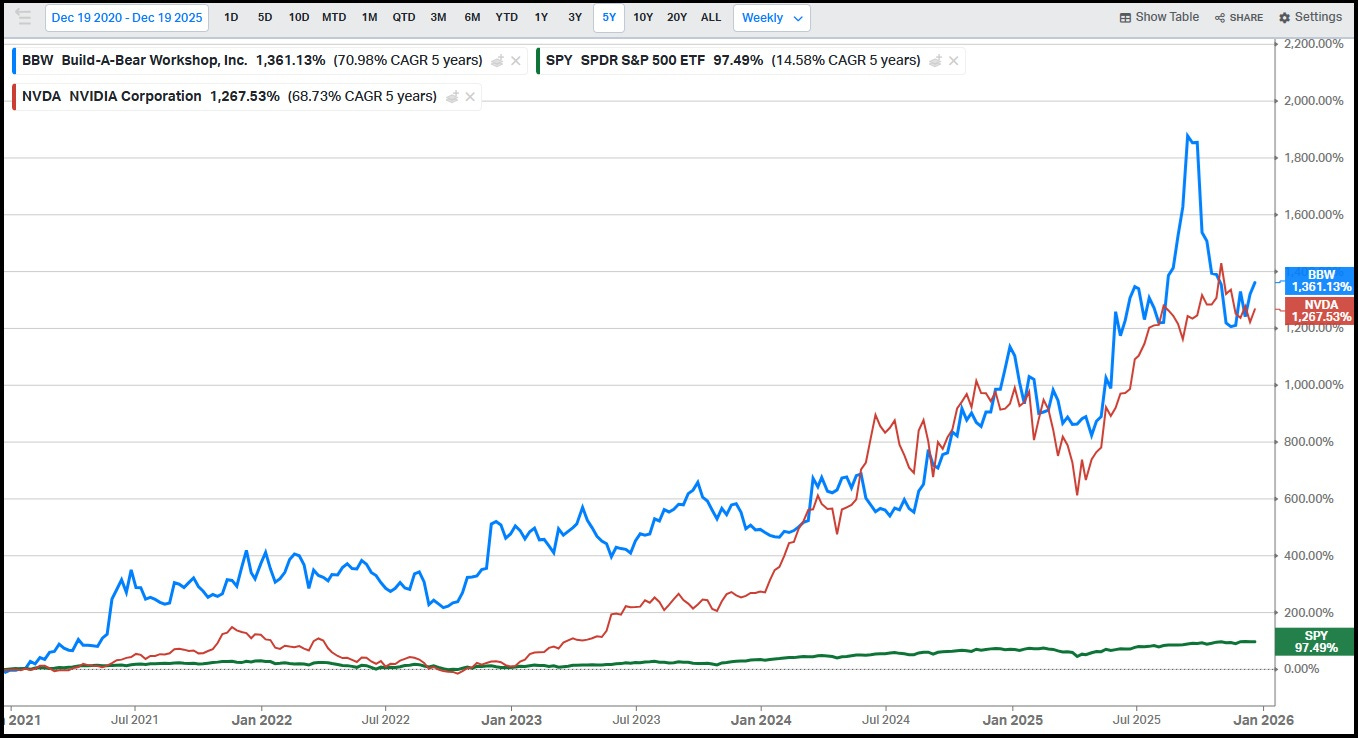

The stock, which fell to ~$1 per share at the pandemic lows, closed on Friday at ~$54 per share. Its price has risen by more than 1,300% over the past five years, a result that has even managed to best NVIDIA - and yet, despite that astounding run, Build-A-Bear currently trades at just ~10x FY25e EV/EBIT.

As I see it, the market’s cautious valuation likely reflects some uncertainty on how the business would perform in a tougher macroeconomic environment, along with some lingering scars among the potential investor base from the painful period witnessed during the late 2000’s and 2010’s. There’s one additional factor that I also suspect has Mr. Market’s attention: competition.

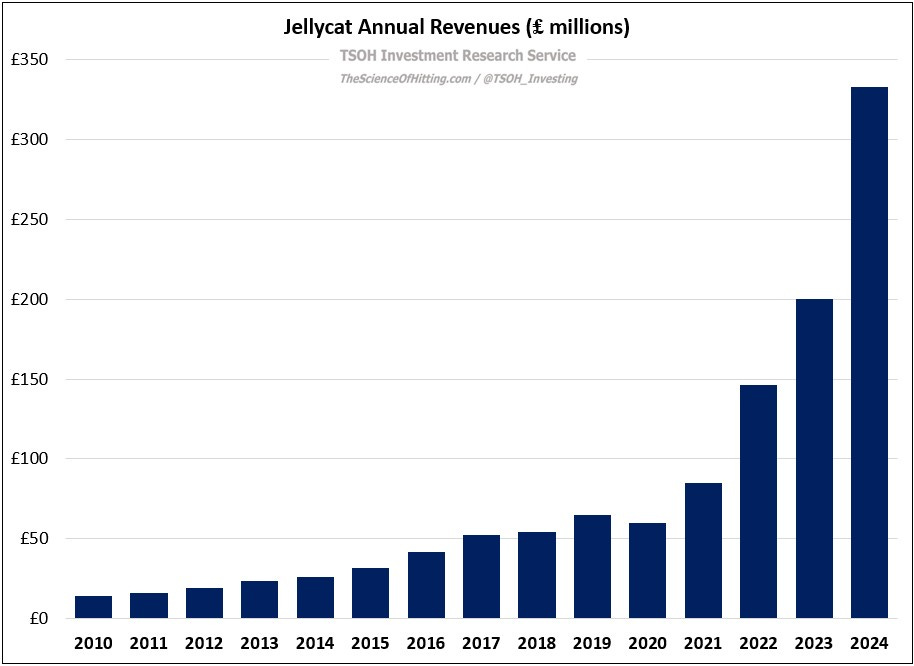

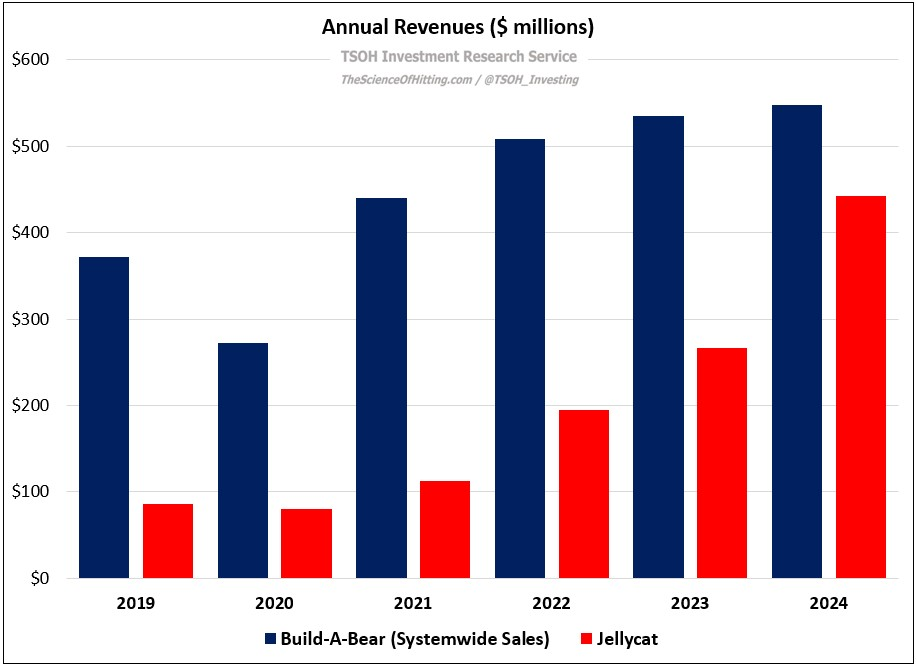

Jellycat is a clear example; its ascent over the past five years, along with notable developments at Build-A-Bear, are important topics to understand.