Back On The Bike

An update on Peloton (PTON)

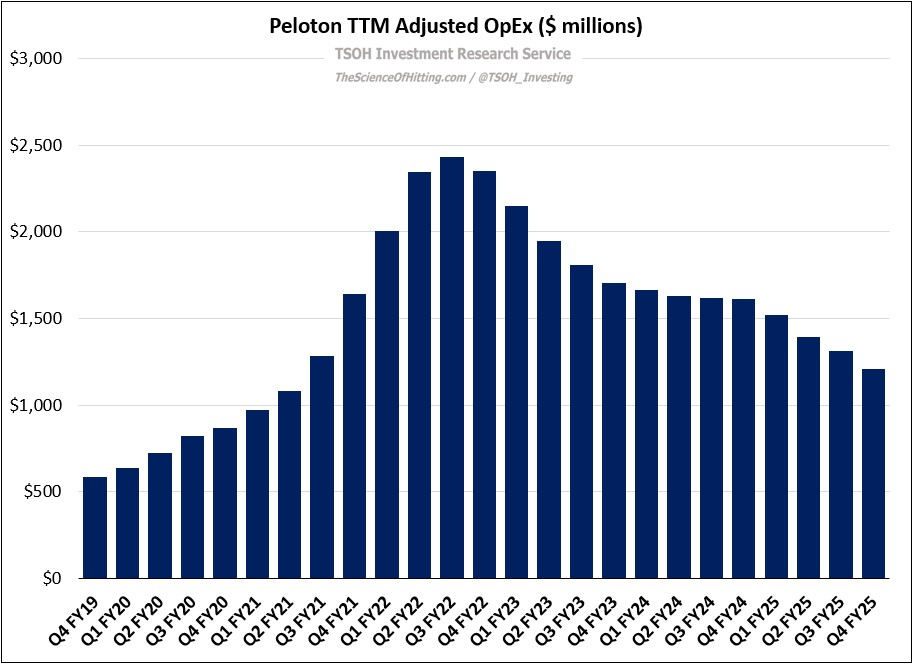

From “McCarthy's Missteps” (May 2024): “Peloton sells high-end home fitness equipment (namely the bike). They compete and win when their hardware and software are packaged together as a single product… That model - with its $44 monthly fee - isn’t for everybody. This, in my view, is where management misplayed their hand. They were convinced Peloton should be a much larger business [100 million paid subscribers]... In that pursuit, the brand was somewhat diluted and OpEx exploded, rising 4x from FY19 to FY22… Peloton’s recent experience reminds me of something that Charlie Munger once said to Chris Davis: ‘It’s the intelligent loss of sales… You think more is better, but more isn't necessarily better’… The problem was an unwillingness to adjust, to narrow their focus to the core opportunity… Peloton needs someone to truly address the outsized cost structure - now.”

I’ve been closely following Peloton’s journey since early 2022, and have developed views over time on the “right” path forward for this business. As stated above, I think their focus had become far too broad, most notably during the last years of co-founder John Foley’s tenure. (A timely example is Peloton Guide, which was discontinued three weeks ago.) There’s a good business to be had here, but economic realities demand strategic focus.

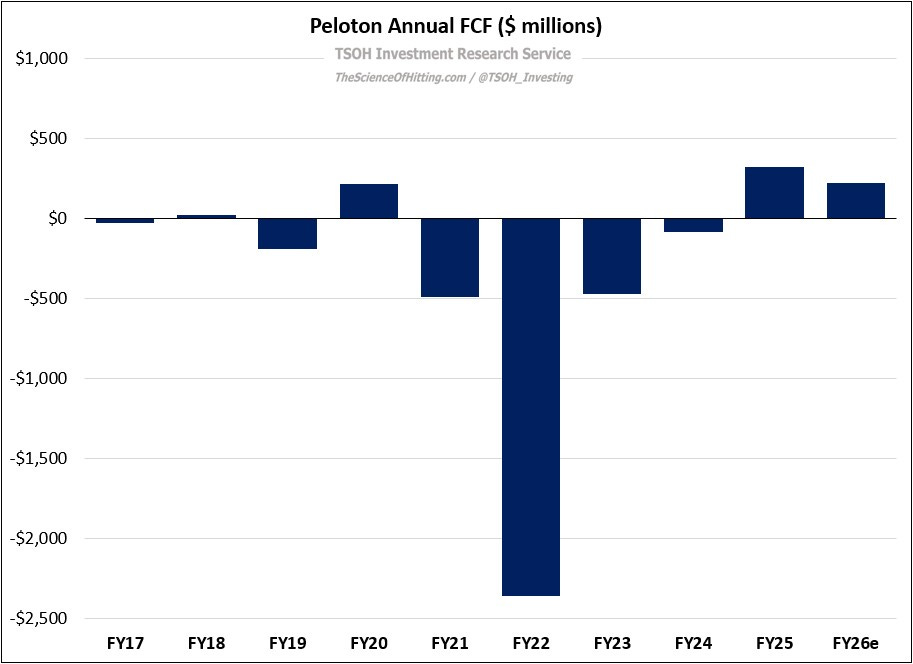

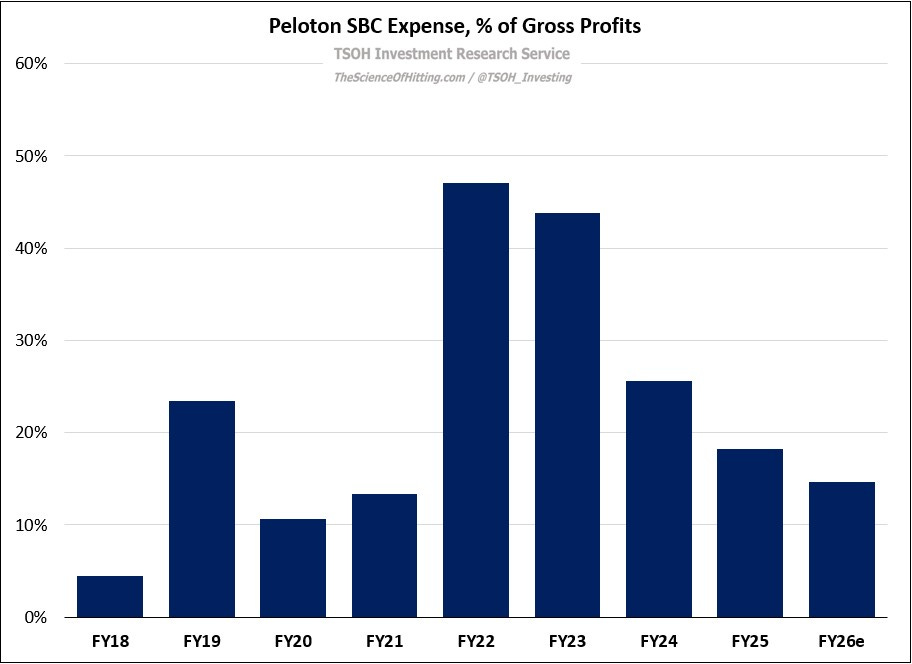

While the company’s financials improved materially in FY25, with guidance calling for further progress to be made in FY26e, you can see below that Peloton has reported ~$2.8 billion of cumulative negative free cash flow (FCF) over the past decade (FY17 - FY26e). That was despite ~$1.8 billion of non-cash stock-based compensation (SBC) over the same period, which has led to a share count increase of more than 30% in just the past four years.

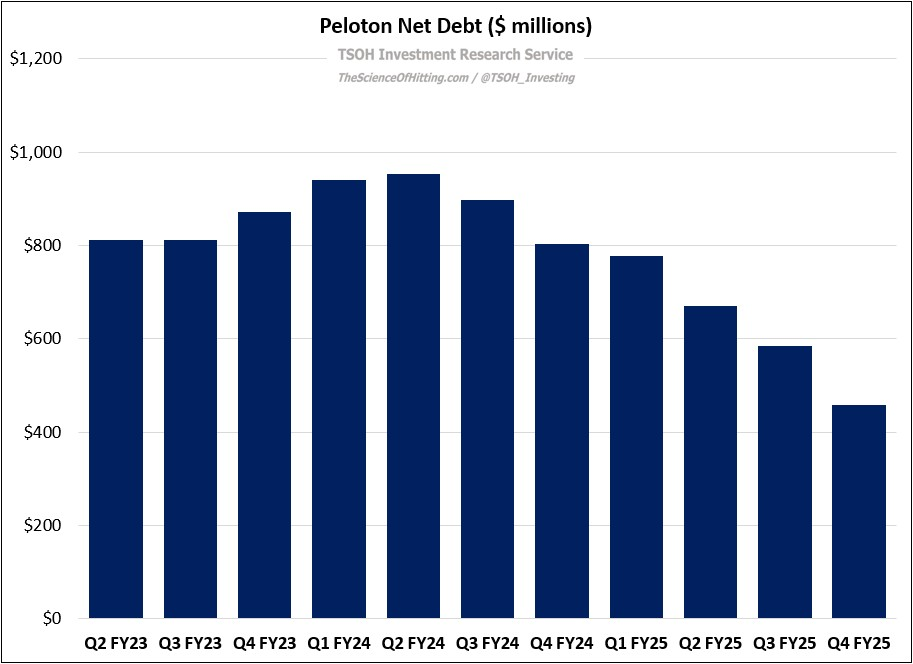

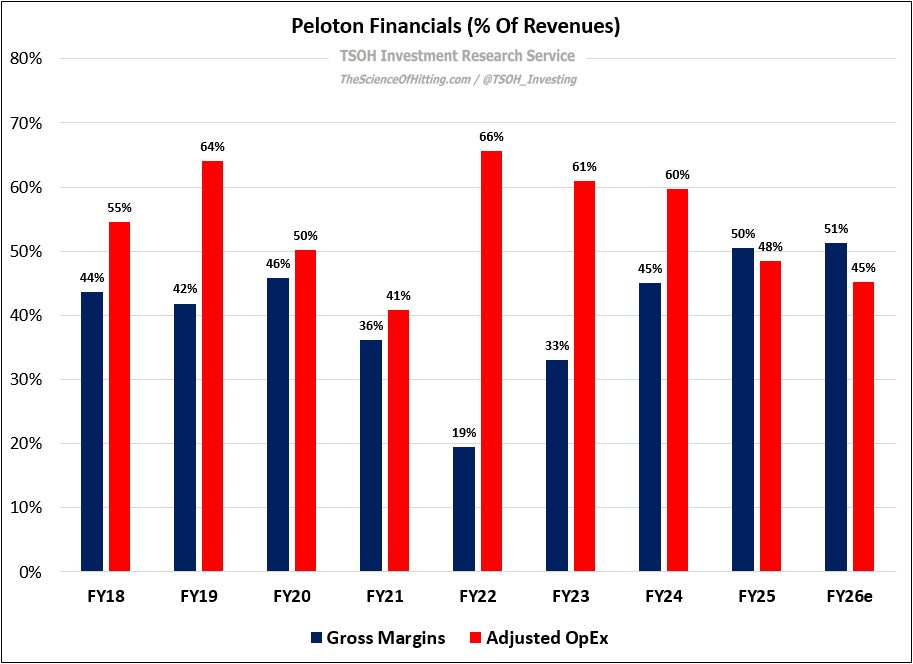

As the massive tailwinds during the early days of the pandemic turned to headwinds, financial pressures shifted Peloton’s priorities to a clear objective: stop the bleeding. Meaningful progress has been made on this front, with adjusted operating expenses (OpEx) falling to ~$1.2 billion in FY25 – nearly 50% lower than three years earlier. In addition, with help from more than $300 million of FY25 free cash flow (FCF), Peloton reduced its net debt by nearly $500 million over the past 18 months. This has happened despite FY25 revenues that were ~39% lower (cumulative) than the FY21 highs.

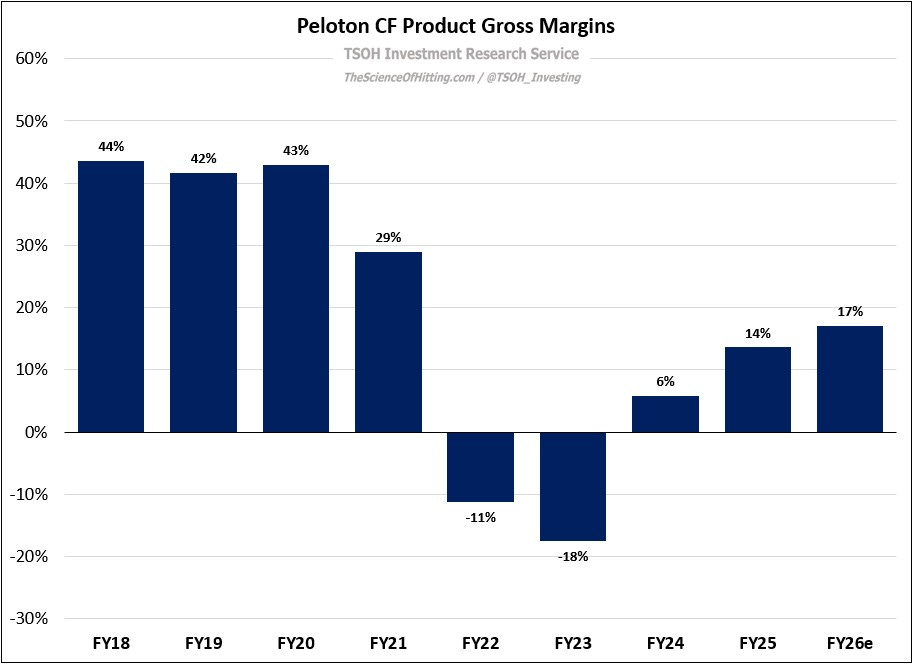

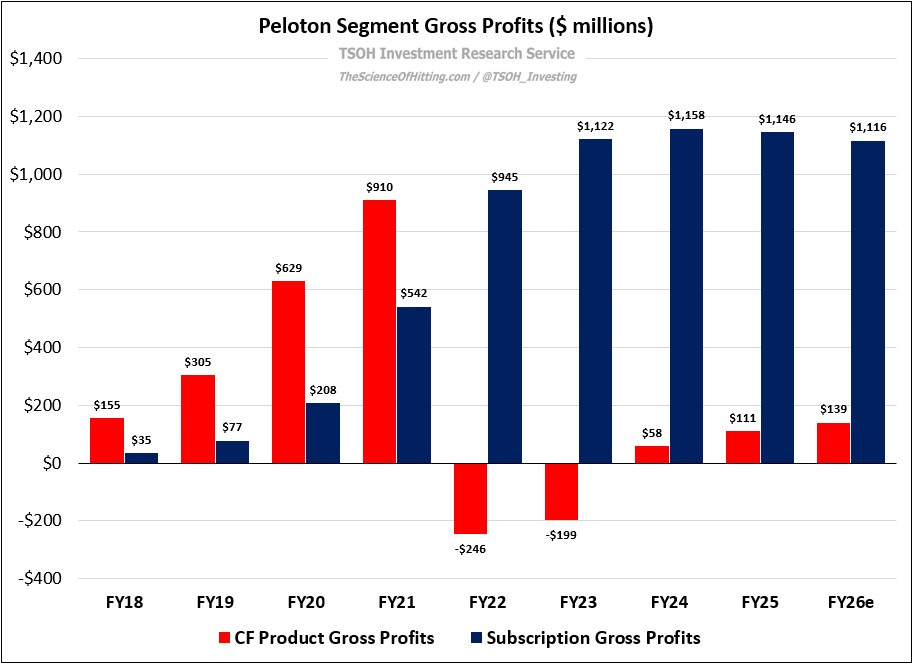

As we look by segment, we see two notable trends: First, the company has made significant progress on cost controls despite sustained pressure in the hardware (CF Product) business, with segment gross margins climbing to 14% in FY25 – still well below FY18 – FY20, but much improved from FY22 and FY23. Second, the Subscription business continues to be a critical source of gross profit dollars for Peloton, holding at >$1.1 billion in FY25.

As a result of those two factors, FY25 consolidated gross profits were ~$1.26 billion – still a low-double digit decline from the FY22 highs (~$1.45 billion), but a much better outcome than the ~39% revenue decline from the peak.

After accounting for the adjusted OpEx improvements - down ~25% in FY25 to ~$1.2 billion - management has achieved their most pressing need (to stop the bleeding). With another $100 million of cost cuts expected next year on roughly flat revenues, there’s a path to mid-single digit FY26e EBIT margins.

With line of sight to sustained profitability, along with an improved balance sheet, I think we can confidently state Peloton has avoided the worst case scenarios that were plausible 12-24 months ago. Of course, “we survived” isn’t a particularly compelling long-term thesis. What will Peloton need to do for profits / FCF, and the stock, to be meaningfully higher in a few years?