Ally Financial: Momentum

From “Ally Financial: The Importance Of Focus” (April 2025): “While the Ally thesis has faced its share of challenges, some of which are still present in 2025, the pieces are in place for stronger results ahead. That reflects improvement in the core, most notably auto lending… Ally is positioned to generate attractive results if they remain focused on their core franchises.”

Ally’s Q3 FY25 results were largely uneventful – a statement that might not sound particularly bullish in isolation, but it’s a welcome change for owners who have lived through the ups and downs of the past few years. With FY25e revisions moving in the right direction on key metrics like net interest margin (NIM) and auto / consolidated net charge-offs (NCOs), the quarter offered additional evidence to support the belief that more attractive results lie ahead.

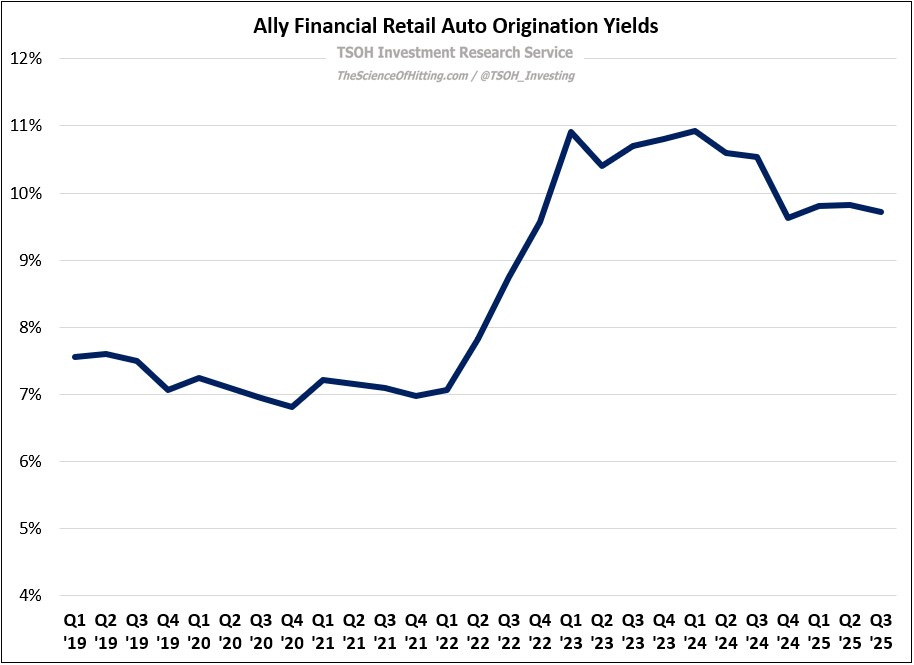

The biggest concern on the Ally investment thesis has been credit quality, primarily due to the troublesome performance of the 2022 vintage. The good news is that the loan book turns fairly quickly, with the 2022 vintage now accounting for less than 15% of Ally’s retail auto portfolio. The large majority of what remains is from newer vintages (2023 – 2025), loans added to the auto book with 9%+ origination yields and which are more heavily weighted to Ally’s highest quality credit tier (S-tier). In effect, the pain that preceded this period set the stage for improved retail auto underwriting conditions; Ally and peers like J.P. Morgan and Wells Fargo are reacting accordingly. (I suspect that will also be evident when Capital One (COF) reports tomorrow morning.)