Ally: A Smoother Ride

From “Ally Financial: Speed Bump” (October 2024): “Now that Ally is being more cautious on retail auto originations, they have some flexibility on how aggressively to chase deposits… Given what’s happening on the asset side of Ally’s balance sheet, they may be more willing to let OSA (retail deposit) pricing widen further from what others pay. In doing so, they can test how different customer segments value / weigh the importance of relative interest rates versus the other considerations that lead them to bank with Ally; I think it is likely that this answer has somewhat changed over the past decade…”

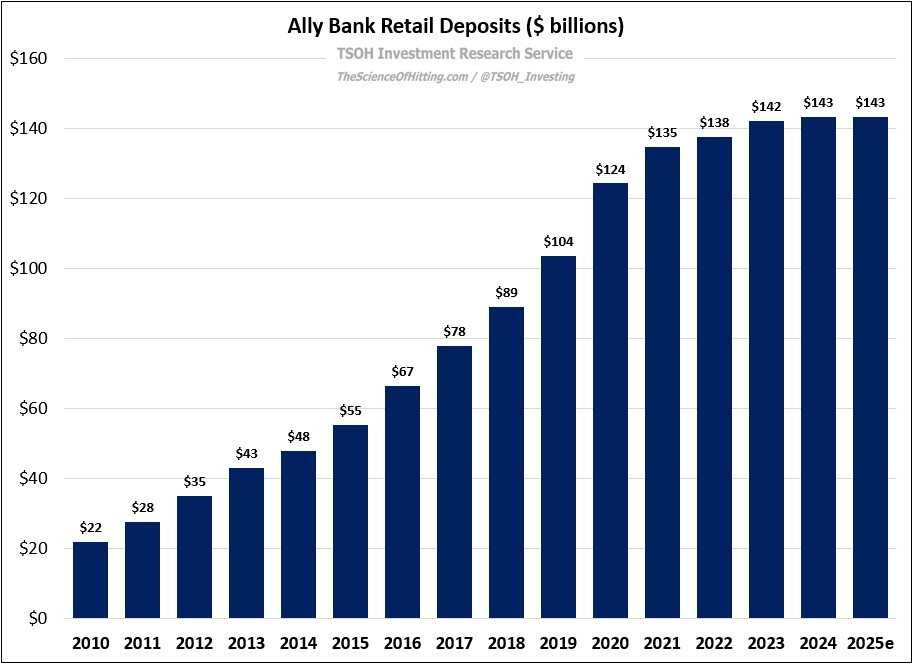

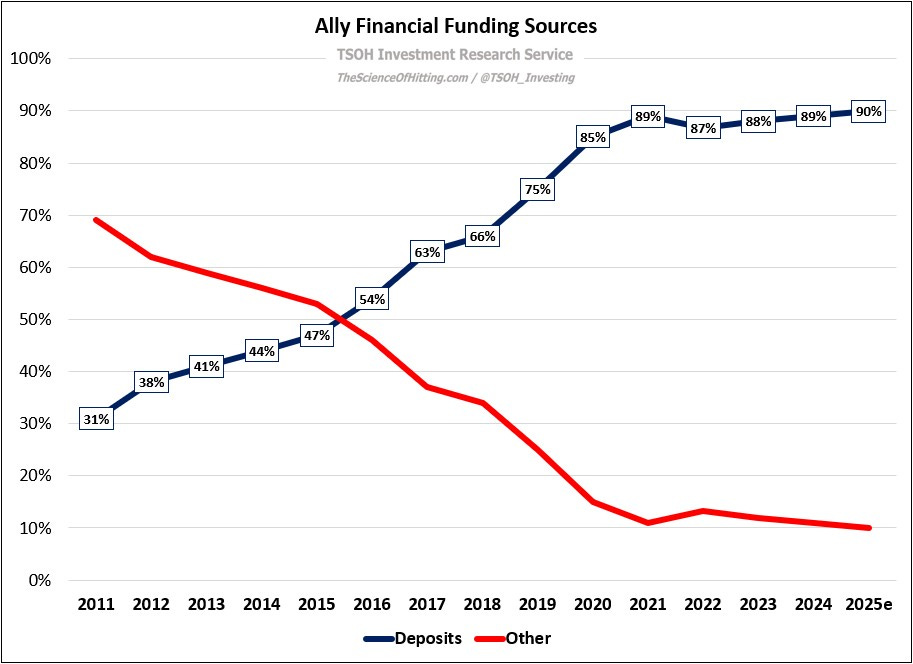

My original interest in Ally was due to their retail deposit franchise, which grew from ~$22 billion in FY10 to ~$143 billion in FY24 (over the same period, deposits have increased from ~30% of the company’s total funding to ~90%). As noted in “Speed Bump”, this part of the Ally story has taken an interesting turn over the past few quarters: with pressures in the loan book, most notably due to the 2022 retail auto vintage, management has pulled in the reins on near term asset growth. As a result, we are witnessing a real time experiment on a key variable for the long-term Ally investment thesis: how sensitive are deposit (OSA) customers to pricing / rate changes?