Airbnb: Reinvent Yourself

Airbnb CEO Brian Chesky: “You can think of a company as going through a few phases. Phase one is you have an idea and you achieve product market fit. Phase two, you try to go into hyper-growth, and we've done that. Phase three, you become a real company - you go public and you generate a return for shareholders. Phase four, and very few companies have ever achieved this, is you reinvent yourself; you go from offering one thing to many things.”

Airbnb’s strong results in recent years have been a testament to focus and efficiency following a near death experience in 2020. Throughout that time, CEO Brian Chesky led the company to new heights by emphasizing “ruthless prioritization”. But as I watched Airbnb’s 2024 Summer Release, I sensed that the story is changing. Or, as Chesky said a few months ago, “We are at an inflection point. We spent the last three years perfecting our core service, and we’re ready to embark on our next chapter… We can go far beyond travel.”

As opposed to highlighting innovative and scalable new features that would broadly improve Airbnb’s alternative accommodations platform for hosts and guests, Chesky’s presentation focused on a small list of unique stays and experiences called “Icons” - for example, a real life version of the “Up” balloon house that can be hoisted 50 feet above the ground. Through one lens, this is an innovative marketing strategy, which has been effective for Airbnb in the past with the Barbie House. (“Our theory is that this will be some of the best ROI that we’ll ever get from marketing.”) But even if that’s the case, the timing seems odd; it was a notable departure from prior releases that focused on platform improvements (things like “I’m Flexible”, “Similar Listings”, and Categories). As I’ve dug deeper on this announcement, the reason why has become clearer: Chesky views “Icons” as much more than a marketing ploy.

Airbnb is embarking on a new chapter, and its priorities are changing; as Chesky noted during the company’s Q1 FY24 call, “The majority of my time… is focused on transforming Airbnb from an accommodations business to a multi-vertical / multi-category company… Over the next three years, you're going to see this play out quite substantially.” How we get there, or even where “there” is, still remains somewhat unclear. But what we can say with confidence is that Airbnb comes to this moment with key experience under its belt, most notably its prior (largely unsuccessful) attempt to expand beyond alternative accommodations (“I learned the hard way that we weren’t quite ready”). I’d also note that Airbnb is missing some of the key pieces required to build an AI-powered concierge - for example, restaurant reservations and a broader collection of online bookable experiences - which may impact what they decide to build and / or buy next. (Q1 FY24 letter: “Our capital allocation strategy prioritizes investments in organic growth, strategic acquisitions where relevant, and return of capital to shareholders, in that order.”)

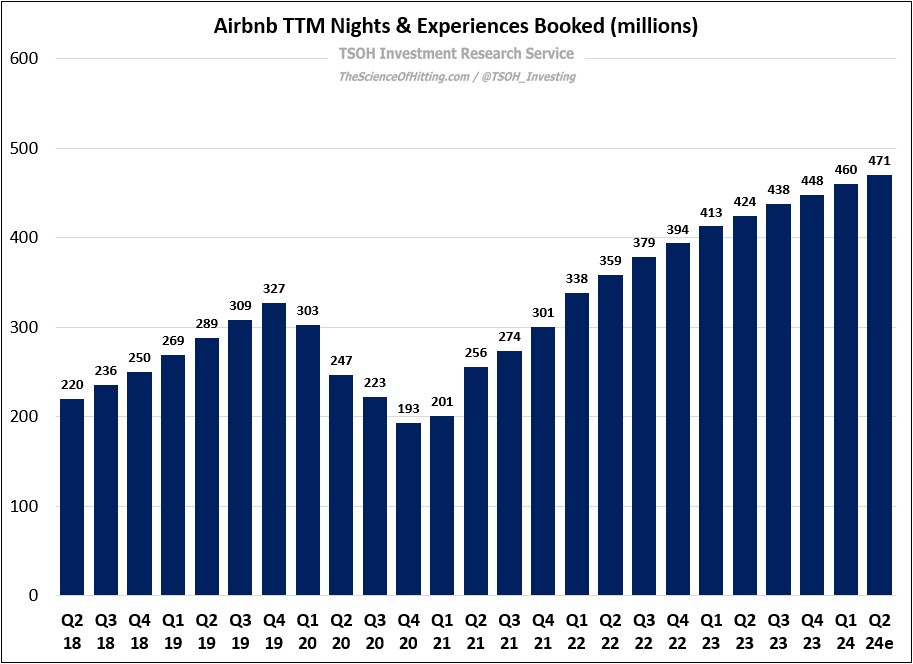

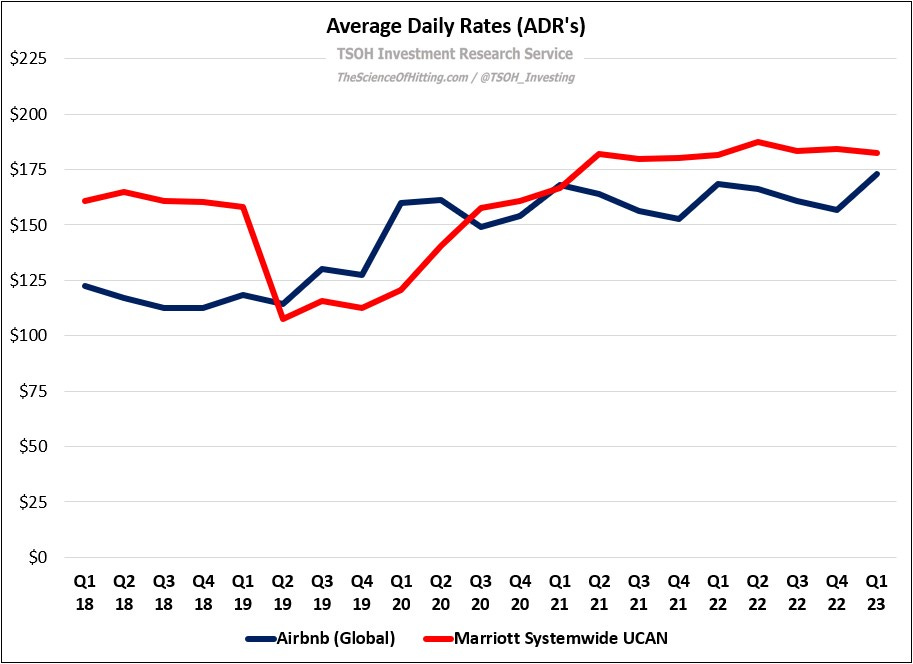

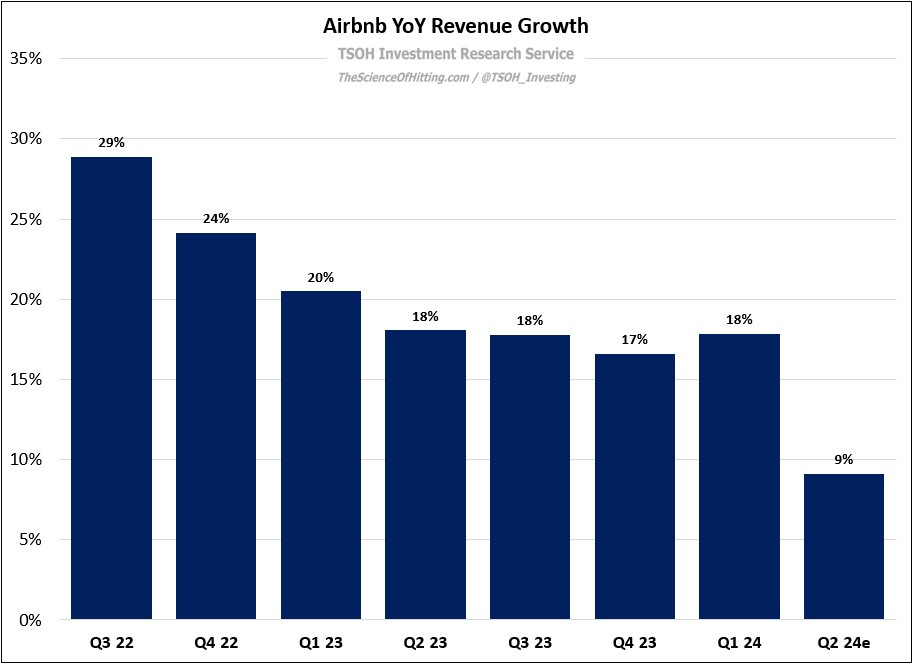

In the near term, this is a secondary consideration for equity markets; the primary focus is the company’s alternative accommodations business, which continues to benefit from N&E booked / volume growth, along with ADR’s that remain more than 40% above pre-pandemic levels (Q1 FY24 vs Q1 FY19).

Over time, those strong tailwinds have diminished (as I’ve discussed on ADR’s, this is a desirable outcome for the long-term health of the business). Management’s Q2 FY24 guidance calls for ~9% YoY revenue growth – a material deceleration from the top-line results reported in recent quarters (note that Easter timing is a roughly two point headwind to growth in Q2).