Airbnb: "Growth Mode"

From “A Bridge Too Far?” (November 2022):

“These initiatives point to an important consideration that I think is key to Airbnb’s long-term success: category leadership cannot be taken for granted. Defending that position will require constant improvement. In my opinion, Airbnb is living up to that requirement, with new product features and tools that make the experience better for guests and hosts alike. Initiatives like I’m Flexible, Categories, and Aircover are reinforcing the leadership position that Airbnb holds within the alternative accommodations category.”

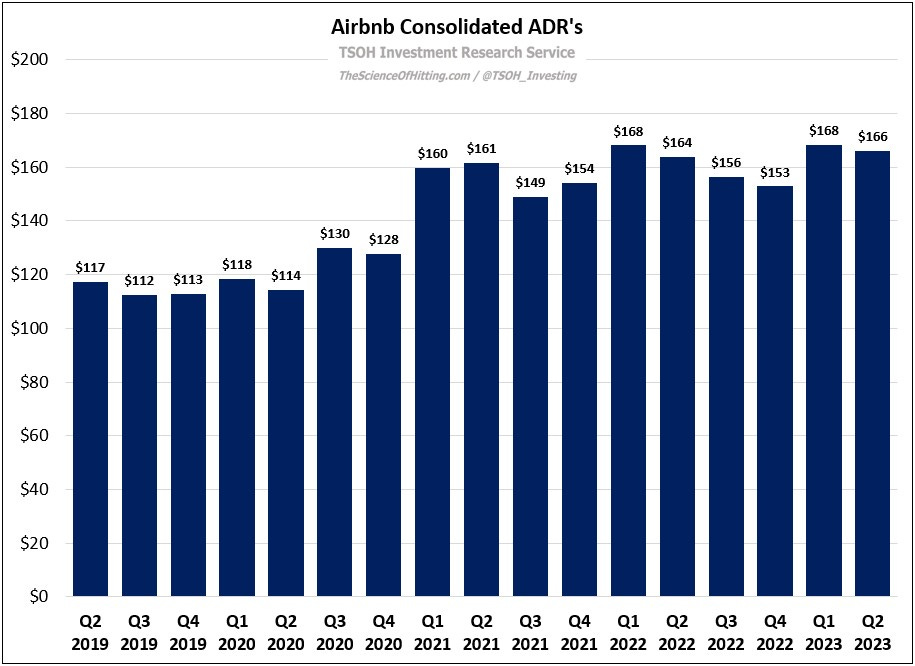

After a near death experience during the early days of the pandemic, Airbnb finds itself in a very different place in mid-2023. For example, management’s commentary around average daily rates (ADR’s) points to an interesting situation: while Airbnb and hosts have both benefited from the >40% increase in ADR’s (from Q2 FY19 to Q2 FY23), it may be too much of a good thing.

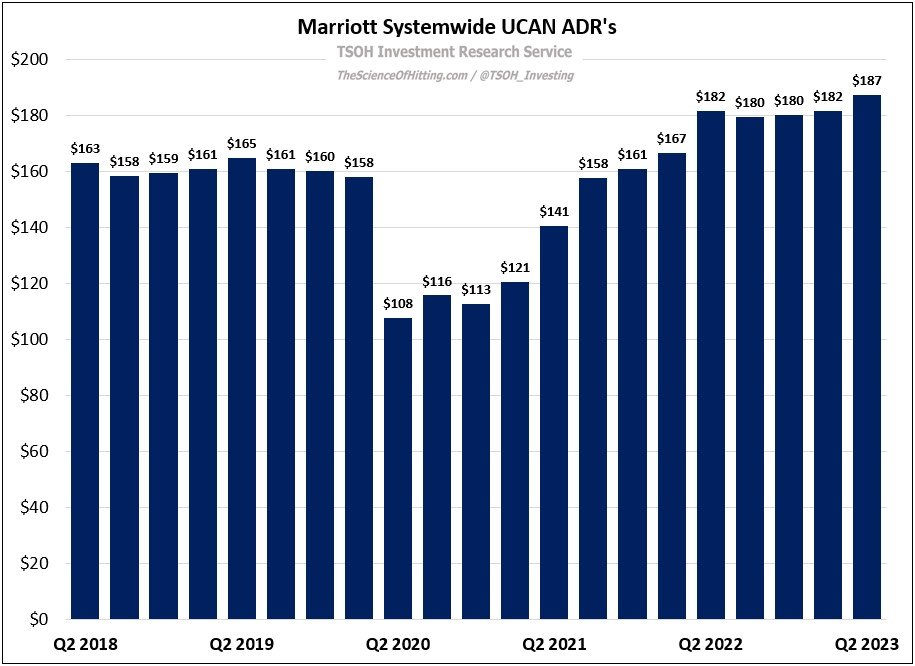

The problem is that this is impacting affordability for travelers, particularly in North America: ADR’s in the region were at ~$240 in 2022, an increase of nearly 50% versus 2019 (~$165). By comparison, Marriott’s systemwide ADR’s in the region have only increased by 10% - 15% over the same period.

As a result, management has placed a higher priority on finding ways to alleviate this issue. One example is Rooms, which is a throwback to Airbnb’s original use case (with an average rate of <$70 per night). This quarter, the company introduced a new host feature / tool that should also help called Similar Listings. Here’s CEO Brian Chesky discussing it on the Q2 call:

“Hosts told us our pricing tools were difficult to use, and they had trouble setting competitive prices. To address these concerns, we redesigned our pricing tools, making it easier to add discounts and promotions. We also added a new feature called Similar Listings, making it easier for Hosts to set a competitive price… Since offering these tools, we’ve seen Hosts begin to lower their prices, with more of them offering weekly and monthly discounts… Most hosts are not booked most nights. If they lower the price just a little bit, they will add more bookings (nights) and they'll end up making more money… We believe these changes will drive greater affordability and value for Airbnb guests, ultimately supporting bookings growth.”

As noted in the introduction, I’ve long been impressed with the company’s launch of new features like I’m Flexible, Categories, and Aircover. Similar Listings joins that group, but it’s distinct in one important way: while the others on the list have been a net positive for guests and hosts alike, I think Similar Listings will primarily benefit Airbnb guests at the expense of hosts (in aggregate) through lower ADR’s. By design, Similar Listings will provide the relevant information / data for hosts to develop a clearer understanding of where they stand in the market; in doing so, its adoption will likely lead to improved platform efficiency. (On that point, this comment stood out to me: “ADR remained stable YoY as increases in prices listed by Hosts were offset by guests’ willingness to pay… In North America, we saw a 2% decrease in available prices as Hosts reduced prices.” This is the first time they’ve discussed this “available prices” metric; that timing surely isn’t coincidental.)

What does this all mean? Imagine a market with three listings of comparable quality / value at $120, $140, and $160 per night. The $160 property, which is ceding bookings to the cheaper listings (and potentially to other alternatives in the market / region like hotel rooms), may only be seeing ~20% occupancy rates. Over time, you could imagine a scenario where Similar Listings could show this host how lowering their “available price” to $130 - $140 per night would likely result in a meaningful increase in their occupancy rates. In that scenario, if the volume gains for this host are not fully incremental to Airbnb (i.e. sourced from competing hotel rooms in the region or trips that would’ve otherwise not been booked), that would suggest the second host, at $140 per night, could see an impact on their volumes… which may lead to a response on their end too. This (overly simplistic) example helps to illustrate why Similar Listings could be supportive of Airbnb’s goals. (Whether that’s aligned with the goals of Airbnb’s hosts is a tricker question; nobody likes the prospect of facing more knowledgeable / tougher competitors, but that’s life.)

With Similar Listings, Airbnb can nudge the decision-making of hosts. To be clear, I don’t think there’s anything about this that should be perceived as unprincipled or in bad faith. Airbnb is simply providing it hosts with the data and tools to enable them to make better decisions (and remember that lower ADR’s, all else equal, are bad for Airbnb’s short-term financials). That said, the long-term impact of Similar Listings is that the platform is likely to become more price competitive than it would be otherwise, particularly for listings that struggle to differentiate themselves on any variable besides price. (For any given change, there’s some balance of what’s good for Airbnb hosts and what’s good for Airbnb guests; this one should be to the benefit of guests.)

Long-Term Stays

A frequent topic of discussion for TSOH has been the evolution of long-term stays; on the Q2 FY23 call, Chesky made a notable comment on this topic: