“A New World of Travel”?

Note: Last week, I recorded a podcast with Andrew Walker focused on the media industry (NFLX, DIS, etc.). You can listen to the episode here.

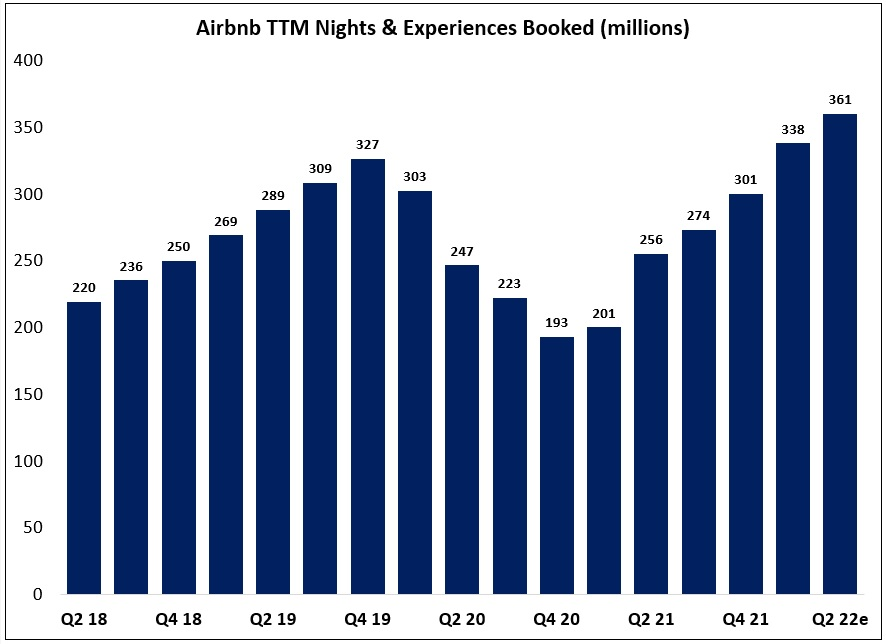

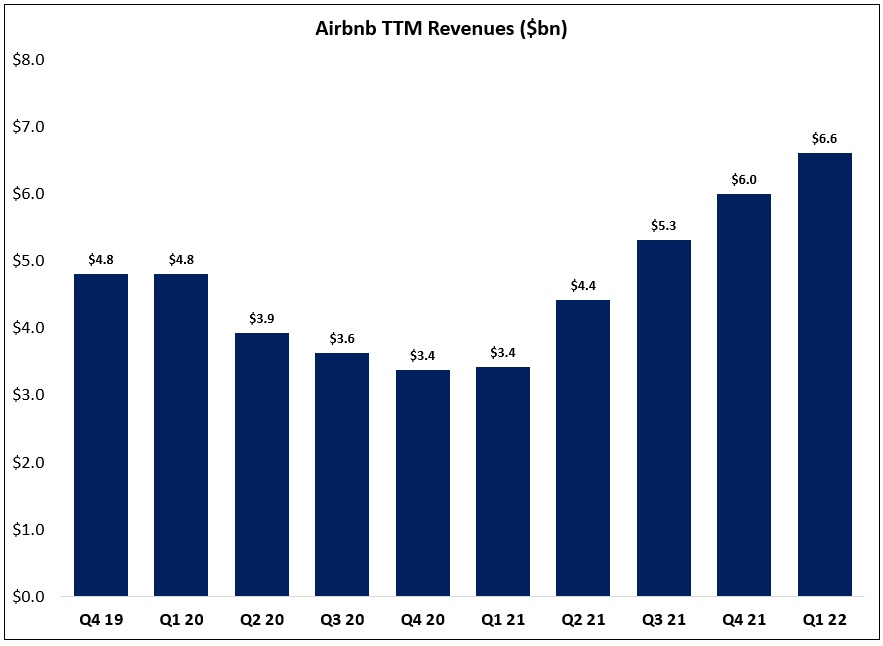

In Q1 FY22, the global leader in alternative travel accommodations reported the strongest quarter in the company’s history, with Nights & Experiences (N&E) booked through Airbnb crossing 100 million for the first time (+59% YoY); this reflects strength in LatAm, North America, and EMEA, offset by weakness in APAC due to subdued cross-border travel. As shown below, trailing twelve month (TTM) N&E booked were 338 million, an all-time record for Airbnb. Guidance calls for another quarter of more than 100 million N&E booked in Q2, with the TTM figure climbing to ~361 million; at current ADR’s, that’s an annual GBV of >$60 billion, up ~2x from FY18.

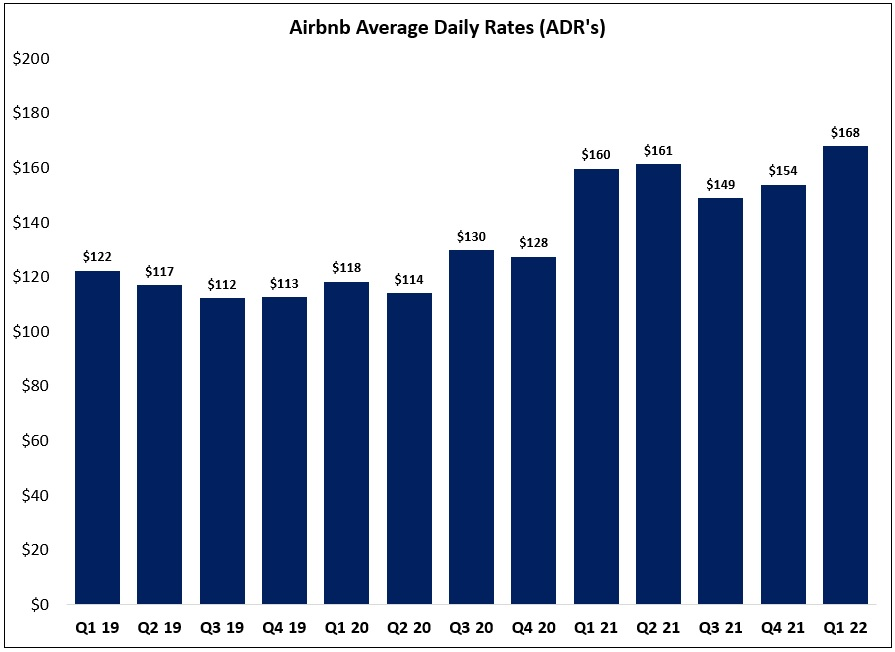

On top of 26% growth in N&E booked versus pre-pandemic levels (Q1 FY19), GBV and revenues both grew by >70%. That outcome is largely reflective of a nearly 40% increase in average daily rates (ADR’s), with the cost of an average night climbing from $122 in Q1 FY19 to $168 in Q1 FY22. (As noted in the letter, revenues and EBITDA are “highly sensitive” to ADR’s.)

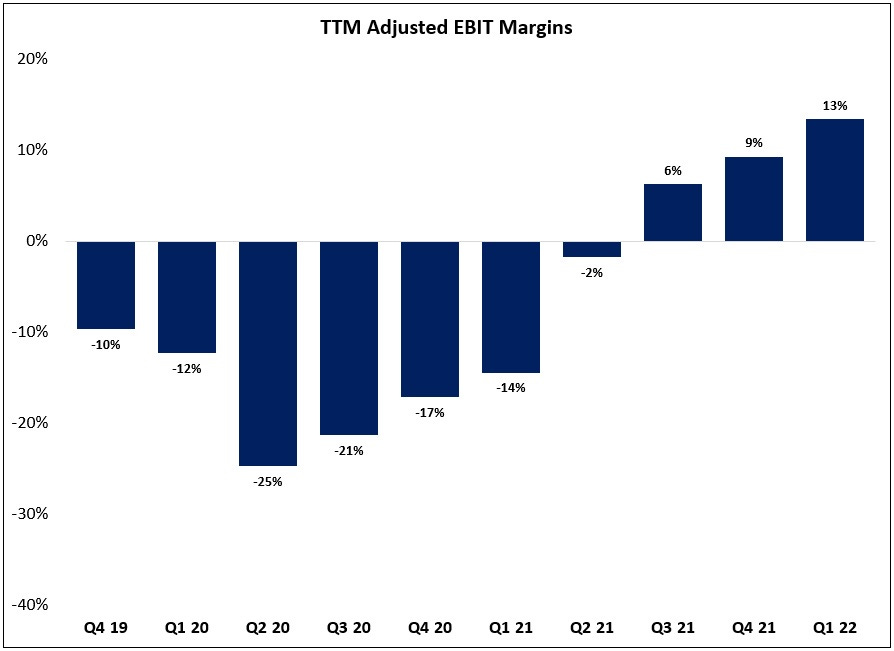

The company reported mid-teens adjusted EBITDA margins in the first quarter, attributable to a combination of underlying business strength and the heighted cost discipline that I’ve written about previously (on a dollar basis, adjusted EBITDA in Q1 FY22 improved by nearly $500 million versus Q1 FY19). TTM adjusted EBIT margins were ~13%, a significant improvement relative to all prior reporting periods (this is my preferred metric of profitability for ABNB, which accounts for SBC and D&A). From my perspective, the financial results reported over the past 12-18 months clearly show the underlying attractiveness of Airbnb’s business. (And the balance sheet remains very strong as well, with ~$3 billion of net cash at quarter end.)