"A Mature Retailer In Growth Mode"

In “We Went Where They Ain’t”, my June 2021 deep dive on U.S. discount retailer Dollar General (DG), I concluded with the following:

“In summary, I believe Mr. Market has some doubts about the company’s ability to grow beyond ~25,500 units and / or questions the sustainability of the business and its economics at maturity. I’d argue the market has held some version of this belief for much of the past five years, which is why the stock trades at a pretty large discount to a company like Costco. Personally, I think that conclusion has been, and continues to be, too pessimistic.

For that reason, I will make DG a 5% position tomorrow morning.”

On to today’s update (DG reported Q3 FY21 results on December 2nd).

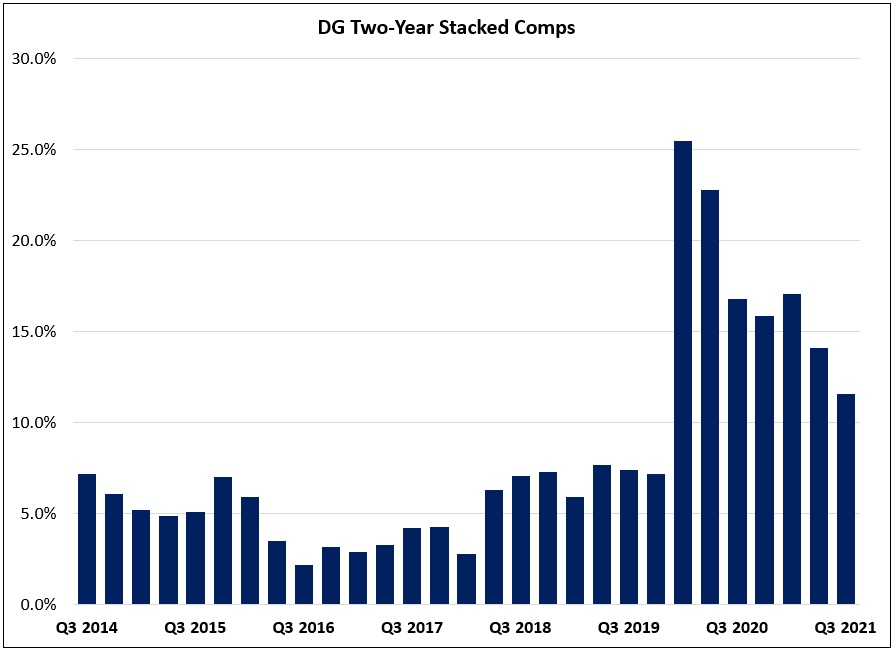

In the third quarter, the company’s revenues increased by 4% YoY to $8.5 billion, with a slight decline in same store sales offset by mid-single digit unit growth (the company added nearly 1,000 net new stores over the past year, and recently crossed 18,000 total stores). Two-year stacked comps were +12% in Q3, most notably due to continued strength in the Consumables and Home product categories. While this is still well ahead of what Dollar General typically reported in the years prior to the pandemic, we can see that the two-year stack has decelerated meaningfully from the highs of early FY20.

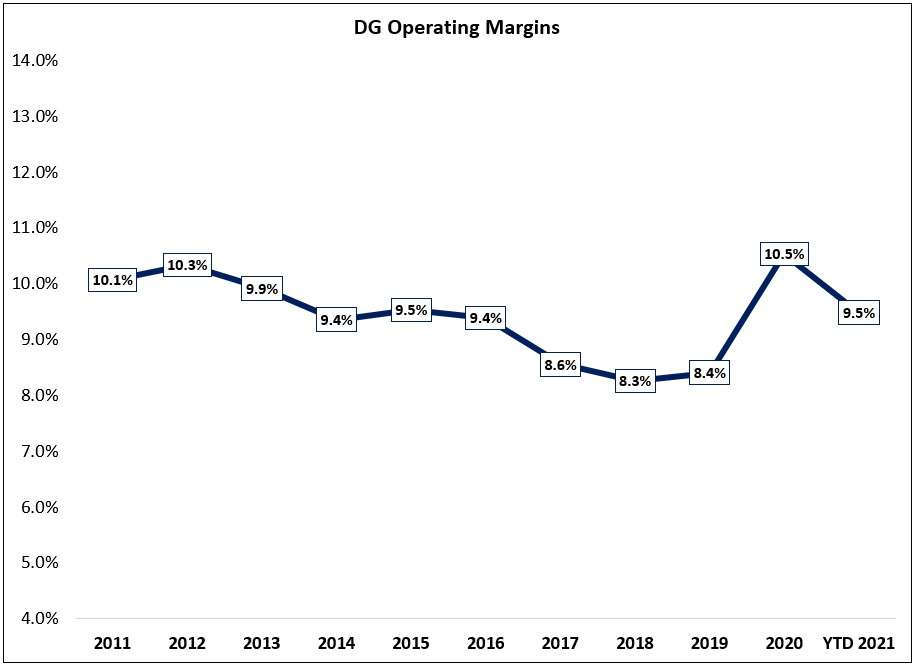

While the revenue story remains encouraging, DG is now being forced to navigate various headwinds further down the income statement (“higher-than-expected costs, both from a product and supply chain perspective”). Through the first nine months of FY21, operating margins have contracted by ~110 basis points, largely attributable to an outsized increase in SG&A expense (“the most significant of which were retail labor and store occupancy costs”). While this is notable YoY decline, consider that YTD FY21 EBIT margins, at ~9.5%, are still 180 basis points higher than they were through the first nine months of FY19; for a business that has historically reported high-single digit operating margins, that has a sizable impact on earnings.

DG ended Q3 with $5.3 billion in inventories, unchanged from the year ago period on a per store basis. As CFO John Garratt noted on the call, “we're not satisfied with our overall in-stock levels… we’re focused on improving our position, particularly in consumables”. I don’t want to minimize or overlook the current headwinds; there are numerous challenges that DG is now being forced to navigate, and it’s unclear whether they’ll subside anytime soon.

That said, from the perspective of a long-term investor, I do think it’s worth noting that this is an unavoidable reality of competitive businesses: strategic vision and adept execution are a must in order to achieve long-term success in the retail industry. Thankfully, for DG shareholders, I’d argue we’re partnered with a highly effective management team with a proven track record under the leadership of CEO Todd Vasos. As they’ve done in the past, I expect DG to effectively navigate the challenges they’re currently facing.