"We Needed To Find Leverage"

The primary focus of today’s write-up is Spotify’s podcast business.

At a time when the company is receiving a lot of attention, primarily from stakeholders outside of the investment community, I think it would be a mistake to reverse course on O&E podcasts; on the contrary, I’d argue the results of the past few years suggest that they should invest even more aggressively to secure their position as the world’s leading audio platform.

But first, let’s take a closer look at the FY21 financial results.

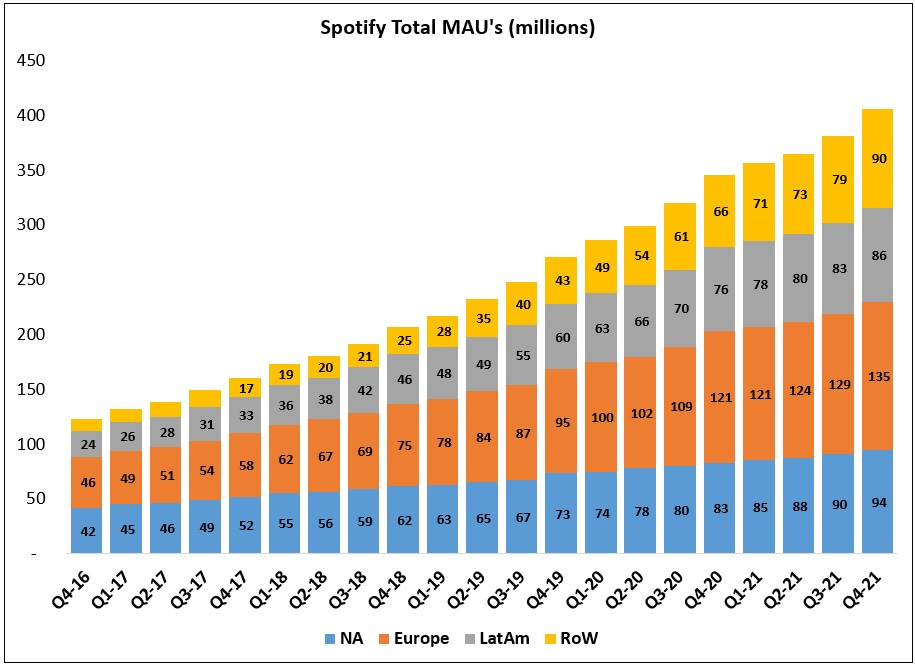

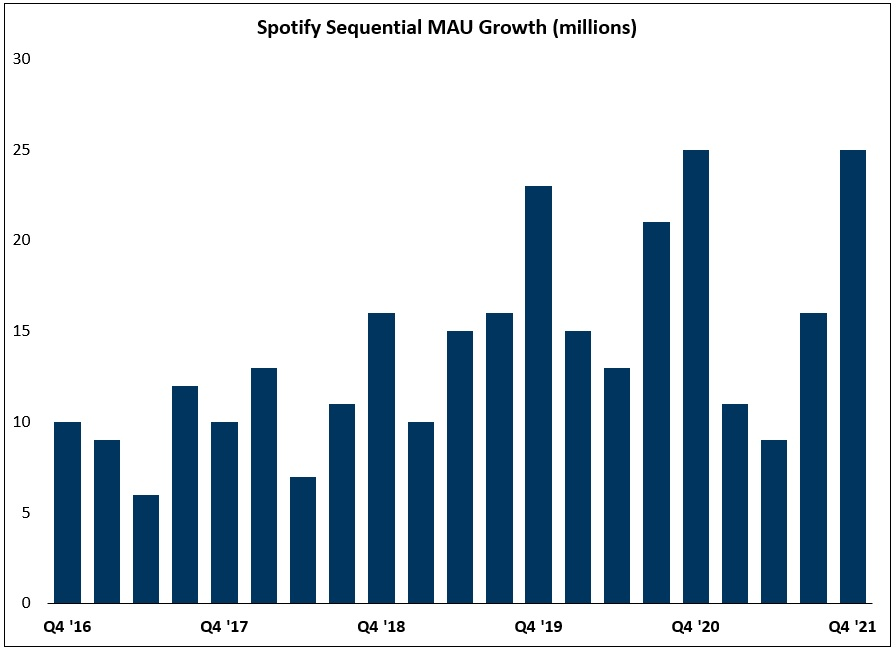

Spotify reached a major milestone in Q4, crossing 400 million monthly active users (MAU’s). For the year, the company added ~61 million MAU’s; that was inclusive of a sequential increase of ~25 million MAU’s in Q4, the strongest sequential MAU growth in the company’s history.

Based on management’s commentary during the Q4 FY21 call, Spotify is likely to end FY22 with nearly 470 million total MAU’s – an increase of roughly 3x since the end of FY17 (trailing 5-year CAGR of ~24%).

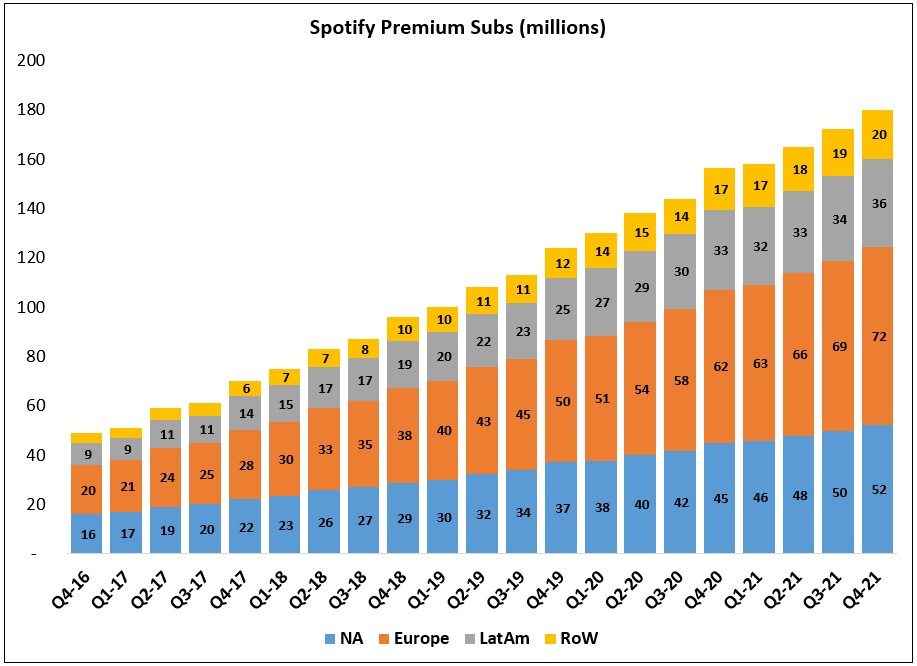

While MAU (top of funnel) growth is important, driving paid penetration is also a significant factor for Spotify’s business (the ARPU on a premium user is roughly 8x higher than the ARPU on an ad-supported user; that said, it’s worth noting that Spotify’s ad-supported ARPU, when calculated as a percentage of the premium ARPU, has roughly tripled since YE FY15).