"We Can't Just Maintain A Pat Hand"

Disney outlines its vision for a massive content ramp in FY22

As noted in the Q4 2021 Portfolio Update, The Walt Disney Company (DIS) was a 7% position at yearend 2021. In today’s write-up, which I’ve compiled based on disclosures in the company’s FY21 annual report, as well as Bob Iger’s exit interview with David Faber, I will discuss why I continue to believe Disney remains incredibly well positioned for the future. While there are substantial short-term hurdles, they will achieve long-term success due to an unrivaled and (very) difficult to replicate asset base. Today’s discussion will focus on three areas: (1) content investments, (2) parks, and (3) valuation.

Content Investments

On page 49 of the FY21 10-K, Disney disclosed the following:

“The Company currently expects fiscal 2022 spend on produced and licensed content, including sports rights, to be as much as approximately $33 billion, or approximately $8 billion more than fiscal 2021 spend of $25 billion. The increase is driven by higher spend to support our DTC expansion and generally assumes no significant disruptions due to COVID-19.”

I won’t bury the lede: this is a major development.

Disney is stepping on the gas in DTC, particularly entertainment programming, and it will have a meaningful impact on the business.

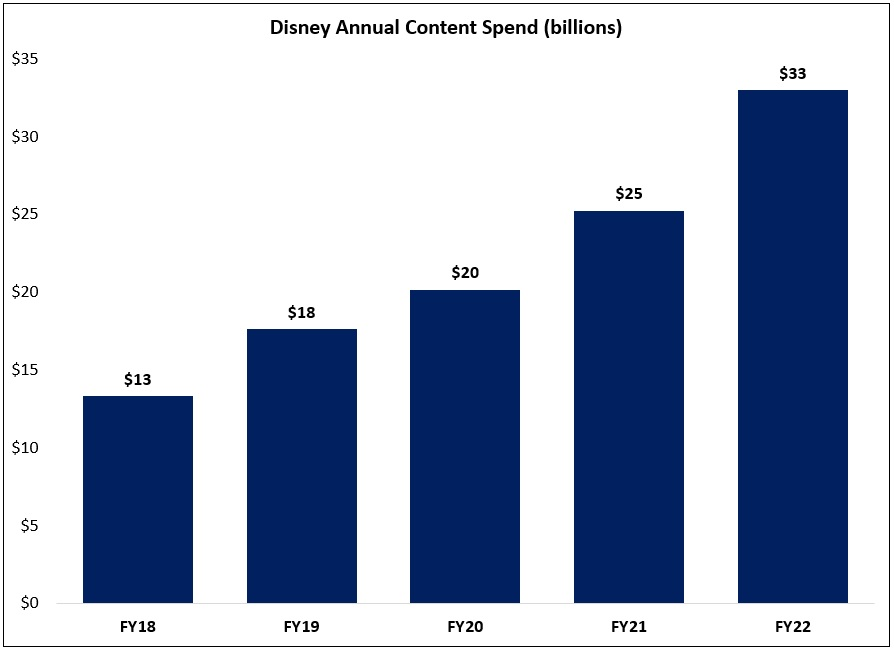

First, let’s look at Disney’s overall content budget; as you can see below, the company’s projected FY22 spend of $33 billion is ~150% higher than what it invested in FY18. Some of this increase has been inorganic, but that was key to the rationale for the 21CF deal (Iger: “When we did the Fox deal, it was all through the lens of needing scale to achieve success in the DTC / digital platform space. None of it was viewed as a traditional media play.”).

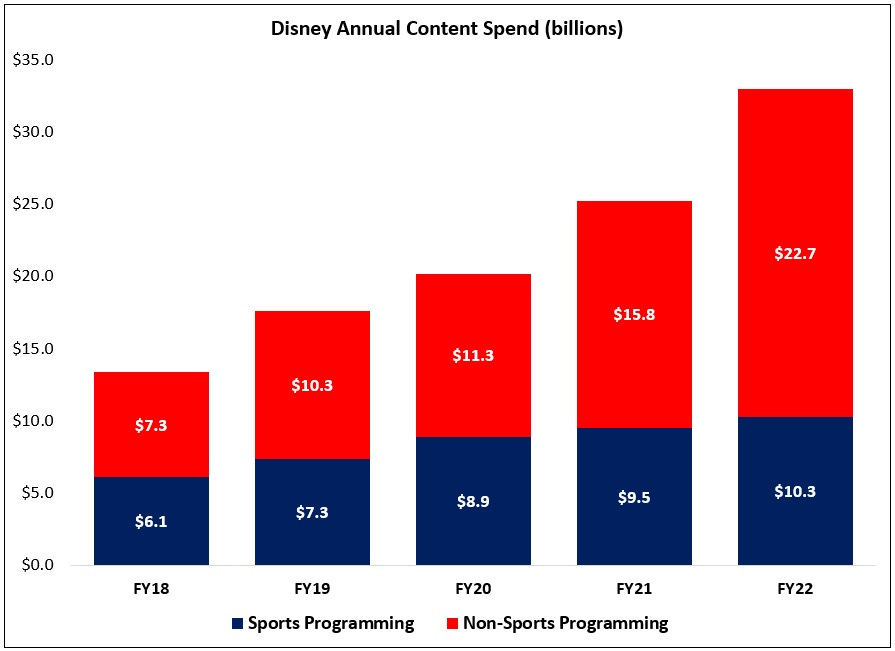

The picture becomes even more revealing when we look at the breakdown of Disney’s content spend by category. In Disney’s annual filing, the company discloses its contractual commitments for sports rights (see page 111 of 132 in the FY21 10-K); if we use the one-year forward commitment as a rough estimate for annual sports programming costs, this is what the breakdown between Disney’s sports and non-sports (entertainment) programming costs looks like over the past five years (through FY22e).

From FY18 to FY22e, Disney’s budget for (non-sports) entertainment programming tripled, inclusive of a 40%+ increase in FY22e (with the growth “driven by higher spend to support our DTC expansion”). When measured relative to Disney’s video revenues (defined as Linear + Studio + DTC / International), non-sports programming spend has increased from roughly 20% of revenues in FY18 to roughly 40% of revenues in FY22e.

This is the clearest sign yet that Disney is “all-in” on streaming.