TKO: Polluting The Story

On October 24th, TKO Group put out the following press release: “TKO Announces Approval of Capital Return Program; Also Announces Strategic Acquisition of Sports Assets From Endeavor”. I found that headline revealing, specifically the order in which management chose to list those two announcements. I suspect that may reflect an appreciation of how the investment community was likely to respond to the news (negatively).

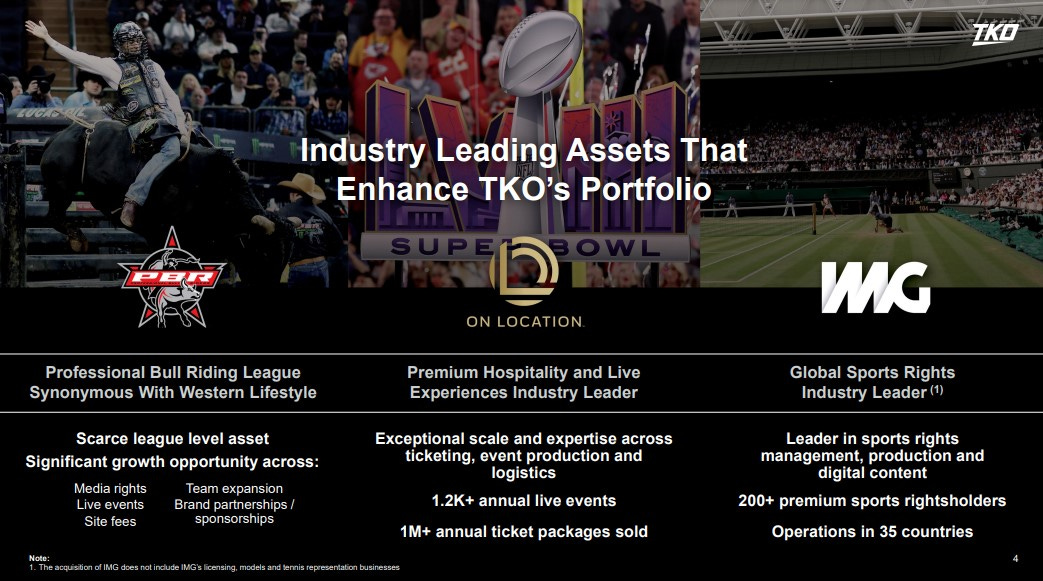

Here are the pertinent details: TKO will acquire Professional Bull Riders (PBR), On Location, and IMG Media assets from Endeavor in a ~$3.25 billion all-stock deal (expected close in 1H 2025); as a result, TKO will issue more than 26 million shares, which will increase the diluted share count by ~15%.

While PBR is undoubtedly a similar business to the UFC and the WWE, it’s much smaller, with FY25e revenues of ~$215 million (FY25e includes the impact of PBR’s latest media deal renewals). The other assets are IMG Media and On Location; while both play a clear role in the operation of TKO’s business - rights management, premium hospitality, etc. - they are different than owning and operating a sports league. Note that On Location and IMG have both been mentioned at various times on TKO calls over the past year, with no indication that the separation between TKO and Endeavor hindered their collective commercial opportunities. (Along with the press release, TKO held a ~15 minute deal call; they did not take any questions from investors.)

From a review of the financials - see slide 17 from the deal deck - I estimate that the normalized earnings multiple paid for these assets is in a similar ballpark to Mr. Market’s TKO valuation (in that calculation, I account for a reasonable estimate of the step-up from the 2025 UFC and WWE media renewals). Beyond the price tag, this comment from TKO COO Mark Shapiro on the Q2 FY24 call in August is also worth remembering: “TKO is one of the cleanest stories in media, and we do not want to pollute our story. We do not want to complicate our model. We are not creating Endeavor 2.0.”