The Oracle and OXY: "The World Has Changed"

Last week, Berkshire Hathaway filed a Form 4 disclosing it purchased another 4.3 million shares of Occidental Petroleum (OXY) for ~$250 million. Berkshire now owns 179.7 million shares of OXY, in addition to the Series A Preferred Stock that it acquired through its 2019 agreement with the company (more on this in a moment). At Friday’s close of ~$59 per share, Berkshire’s stake in the common is now worth ~$10.5 billion (~19% of the company).

This story started in May 2019, when Berkshire committed to a $10 billion investment in Occidental preferred stock, contingent upon the completion of its ~$38 billion takeover of Anadarko, which was finalized in August 2019. (CEO Vicki Hollub in May 2019: “The Berkshire deal was important to make… the timing was critical… Berkshire could do it in an hour and they could do it on public information… Given the timing that we had, there was no other choice.”) As part of the financing agreement, Berkshire also received warrants; as noted in the 2021 10-K, Berkshire has the option to purchase 83.9 million shares at an exercise price of $59.62 per share. (“The preferred stock accrues dividends at 8% per annum and is redeemable at the option of Occidental commencing in 2029 at a redemption price equal to 105% of the liquidation preference plus any accumulated and unpaid dividends, or is mandatorily redeemable under certain specified capital return events. Dividends on the preferred may be paid in cash or, at Occidental’s option, in shares of common stock. The warrants are exercisable in whole or in part until one year after the redemption of the preferred stock.”)

When Buffett committed to the $10 billion back in May 2019, here’s what he told CNBC’s Becky Quick about how it came together (by the way, Buffett told Becky in this interview that he was willing to put up $20 billion if needed):

“I got a call yesterday evening [on May 5th], which is the first time I’ve talked to Occidental since last Sunday [April 28th]. They told me they were going in this direction, which I like, but I had nothing to do with it. We committed $10 billion, and it had nothing to do with how they framed their offer, how much they offered, or anything else – all they knew was that would be sure that they could get $10 billion from us if they completed the deal with Anadarko.”

The ”direction” Buffett referred to was Occidental’s ability to avoid a shareholder vote on its Anadarko bid by raising the $10 billion from Berkshire. In (lightly) defending management’s actions, which was loudly questioned by investors like Carl Icahn, Buffett made the case for Occidental’s stock:

“I would think if you owned Occidental, you’re bullish on oil over the years – and you’re probably bullish on the Permian Basin because they have such a significant portion of their assets there. So, the idea that they will use less stock and more cash as part of the deal… I would think, net, if I had been an OXY holder at the time, I probably would like that kind of a deal… It’s a bet on oil prices over the long-term more than anything else. It’s also a bet the Permian Basin is what it’s cracked up to be… If oil goes way up, you make a lot of money… You have to have a view on oil over time. Charlie and I have some views on that… We feel good about doing the financing.”

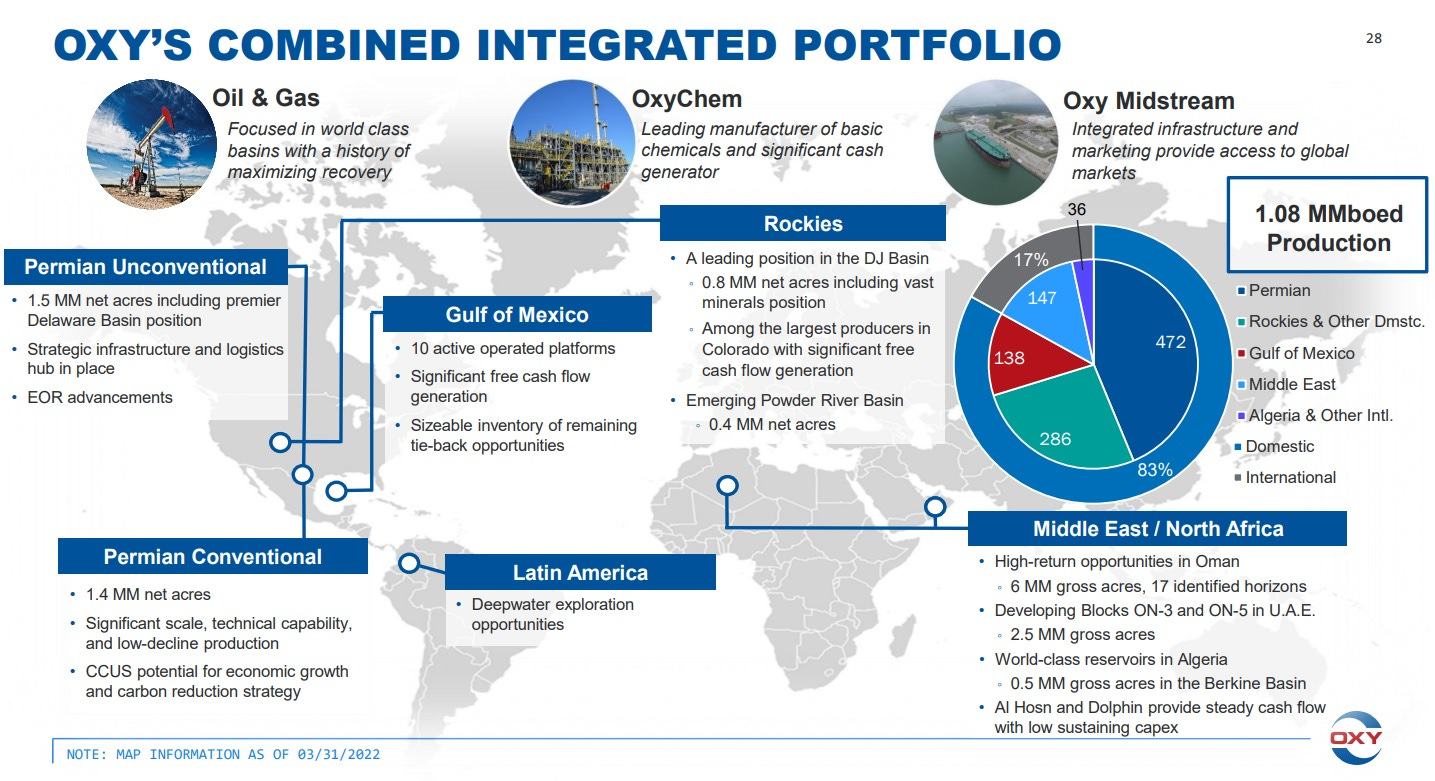

(From an Oct 2021 EIA report: “The Permian Basin, which spans western Texas and eastern New Mexico, represents the most prolific hydrocarbon production region in the United States. They accounted for about 30% of U.S. crude oil production and 14% of U.S. natural gas production in 2020.”)

After that comment, Becky asked Warren why he didn’t just go ahead and buy all of Anadarko if that’s how he felt; his response was noteworthy:

“Well, that might have happened if Anadarko had come to us [directly], but we wouldn’t jump into some other deal that we heard about from somebody coming to us and seeking financing. We hope people come to us on businesses, but I had no idea this transaction was going to happen…”

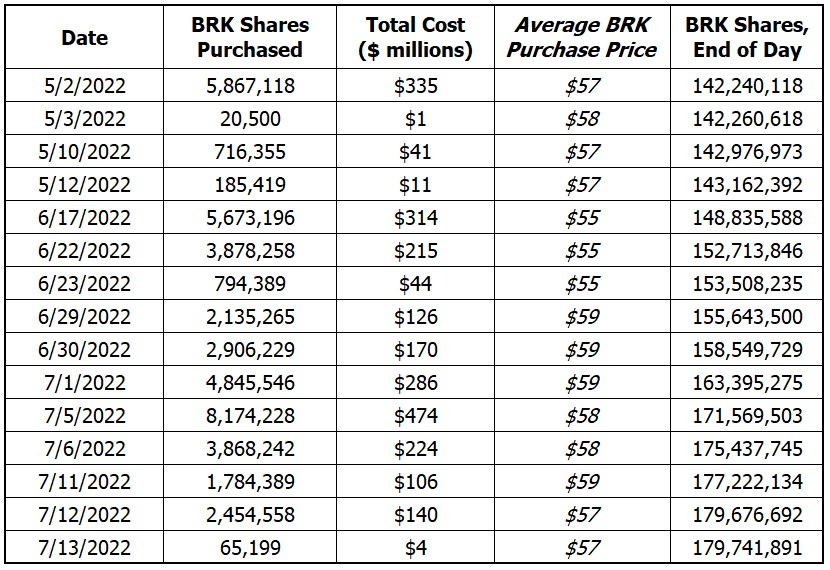

Three years later, in March 2022, it became apparent that Buffett’s interest in OXY went beyond the preferreds and the warrants. As discussed in detail at the 2022 Berkshire Hathaway shareholder meeting (held on 05/03/2022) and disclosed in SEC filings, Berkshire started buying OXY common on February 28th, 2022 (it didn’t own a single share before that date). Over a three week period, Buffett went on a major buying spree: he invested ~$7 billion to buy ~136.4 million shares of OXY (at an average price of ~$51 per share).

I’ve pulled the data from the subsequent Form 4’s, which show that Buffett added an additional 43.4 million shares from May 2nd to July 13th. In total, Berkshire Hathaway has spent $9.5 billion since February 28th to buy 179.7 million shares of OXY stock (at an average price of ~$52.8 per share).

The initial purchase timing is notable: on February 24th, just a few days before Buffett began buying OXY, Russia invaded Ukraine. Buffett didn’t specifically talk about these geopolitical developments during the shareholder meeting, but he did note that something changed his perception of the bet: “Somebody asked a very good question: Why weren’t you doing anything on February 20th and why were you doing it, in the case of Occidental, on February 28th? It’s because things developed in a way, and in the case of Occidental specifically, they had an analyst presentation that I read over the weekend… It made nothing but sense, and I decided it would be a good place to put Berkshire’s money… Two weeks later we had 14% of the company… The world changed… We should be very happy that we can produce 11 million barrels a day in the U.S. rather than being able to produce none and having to find those 11 million barrels a day somewhere else in the world to keep the American industrial machine working.”

Revisiting PetroChina

At the 2003 Berkshire Hathaway shareholder meeting, Buffett and Munger were asked about their decision to invest in PetroChina; at the time, they owned ~1.3% of the company. (That stake, which was purchased for $488 million, was sold in late 2007 for a profit of ~$3.5 billion.) In his response to the question at the 2003 shareholder meeting, Buffett said the following: