The Future Of Airbnb

“May 2025 will be crazy. Beyond that, it gets crazier and crazier.”

From “Turning The Corner” (November 2023): “Airbnb remains in a grey area for me. It’s a company I could see myself owning long-term, but I also believe Mr. Market’s ask remains demanding. In the deep dive [published September 2021], I said $50 - $75 billion was a level that would pique my interest [at that time, the company’s market cap was ~$110 billion]… Being overly stingy on the price tag is a good way to miss out on great businesses that you’d like to own long-term, but I am going to remain patient at this time.”

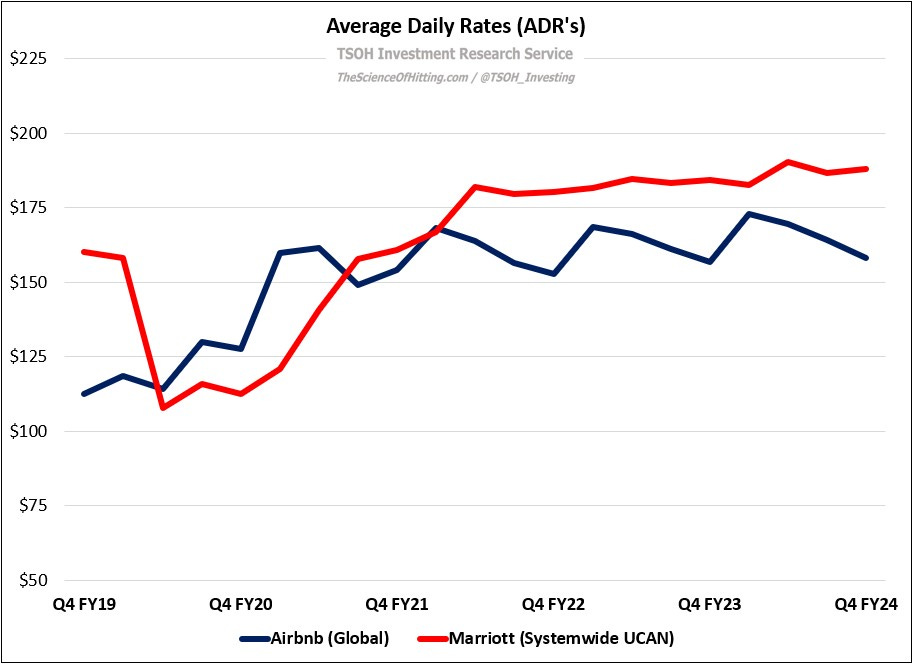

You wouldn’t necessarily know it from looking at the stock price, which trades at a lower level today than it did shortly after their December 2020 IPO, but this has been a transformative period for Airbnb. The beginning of the story is growing traveler demand, with nearly 500 million room nights booked through the platform in 2024. With an average cost per room night (ADR) of ~$166, that resulted in ~$81.8 billion in FY24 gross booking value (GBV), or roughly half the size of the leading online travel agency (OTA), Booking Holdings.

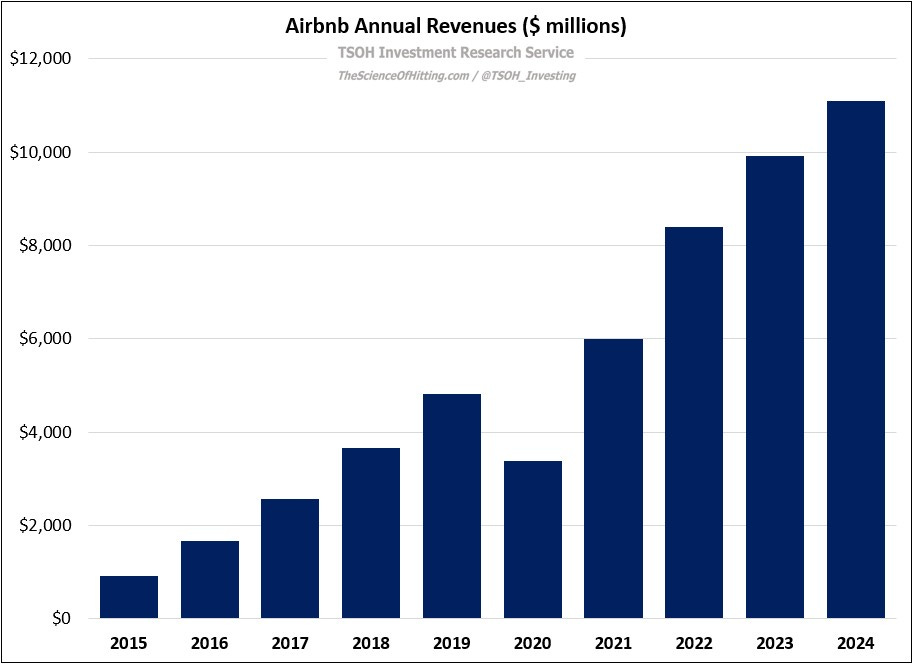

Along with significant GBV growth (up ~115% from FY19 – FY24), attributable to a roughly equal split from volumes (N&E booked) and pricing (ADR’s), ABNB benefited from a slightly higher take rate – a tailwind that continued with the introduction of travel insurance and higher service fees on cross-currency bookings. As a result, revenues increased by ~130% over the past five years (~18% CAGR), from ~$4.8 billion in FY19 to ~$11.1 billion in FY24.

The final piece of the puzzle, and the one that has had the most significant impact on the income statement and free cash flow, is management’s focus on cost efficiencies following their near death experience in early 2020.