Spotify: "Room To Run"

“Everything changes at scale.”

- Spotify CEO Daniel Ek, “The Spotify Play”

(Note: On Tuesday, I sat down with @FrancoOlivera and @SleepwellCap to discuss the Spotify investment thesis. You can listen to the podcast here.)

Following a difficult start to the year, with lackluster MAU additions in both Q1 and Q2, Spotify’s growth algorithm got back on track over the past 90 days. As shown below, the company ended Q3 with more than 380 million global users, with forward guidance suggesting Spotify will end 2021 with more than 400 million MAU’s around the world (at the end of Q3, SPOT had 172 million premium subscribers, with an average ARPU of €4.34 per month).

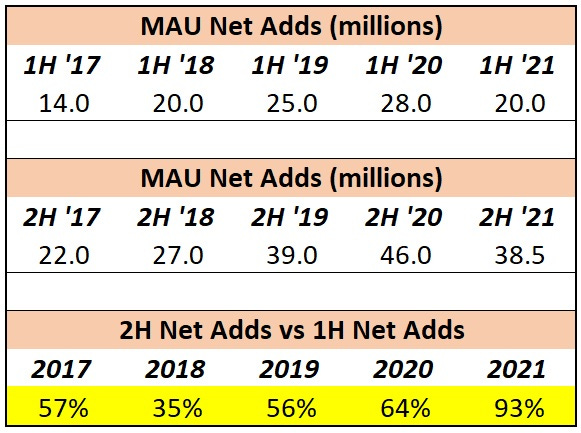

At the midpoint of the Q4 guide, management expects to add nearly 40 million MAU’s in 2H 2021. As you can see, that’s nearly 2x higher than the pace of net adds in 1H 2021, which is the largest 1H to 2H MAU improvement (by far) that Spotify has reported in the past five years (+93% increase in MAU net adds in 2H FY21 vs 1H FY21, compared to a 53% lift, on average, for the comparable periods in FY17 - FY20). Without getting too bogged down by short-term MAU numbers, this outcome suggests Spotify has escaped from the malaise that impacted 1H 2021 (Ek: “I believe the choppiness in 1H 2021 was primarily due to COVID... All signs show we're back to consistently delivering against our forecast.”).

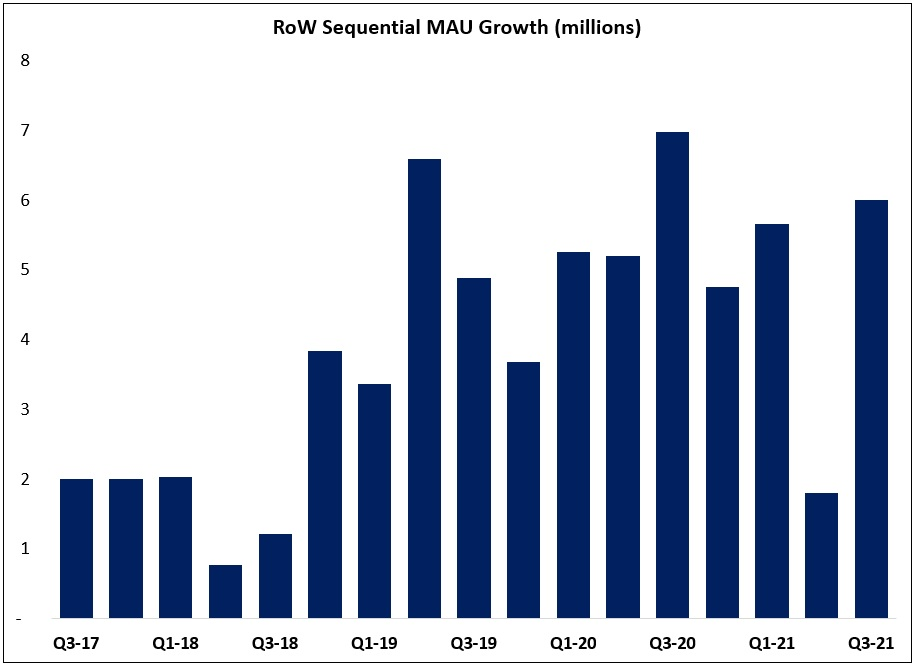

A reacceleration in Rest of World (ROW) was a meaningful contributor to Q3 MAU growth, accounting for nearly 40% of sequential net adds (“aided by the resumption of marketing activity in India along with above-plan growth in the Philippines and Indonesia”). Importantly, as noted in the Q3 letter, Spotify saw improved momentum across the 86 “Stream On” markets launched earlier this year; this should be a tailwind for MAU growth in the coming quarters and years, which funnels down to premium subscriber growth over time.

Podcasts

As Ek noted on the call, Spotify’s broader audio strategy is in full swing.