Qurate: Behind The Eight Ball

Why I think this investment has run its course (for me)

On Friday, Qurate Retail reported results for Q1 FY21.

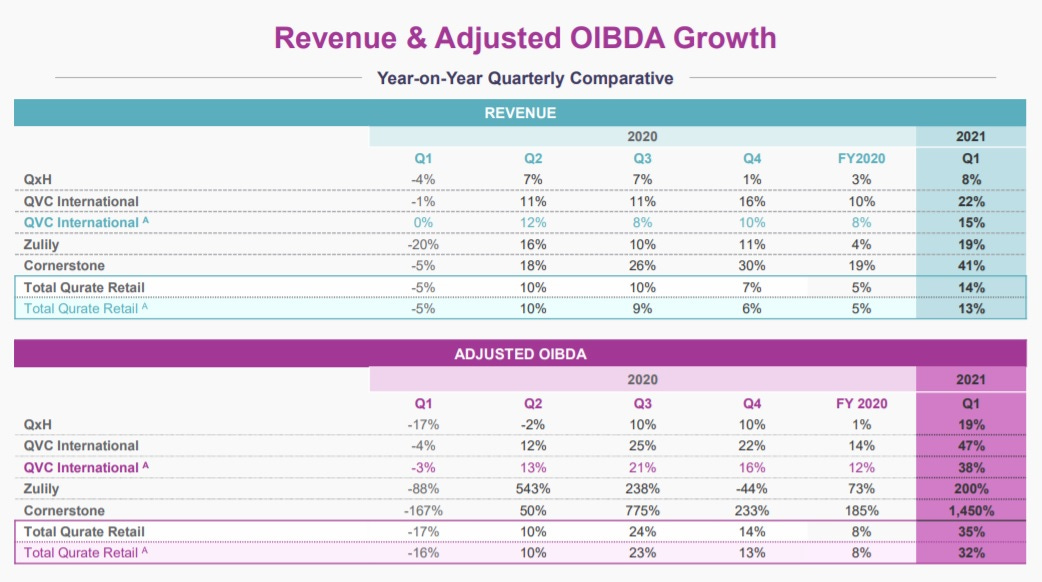

As shown below, it was a strong quarter for the company, with constant currency revenues and adjusted OIBDA climbing 13% and 32%, respectively. As CEO Mike George noted on the conference call, “This was our best quarterly performance since the formation of Qurate Retail in 2018”.

But despite the impressive print, I find myself wavering on this investment.

That partly reflects my belief that the bet has changed since my investment in September 2020 (as a result of a meaningful increase in Qurate’s stock price). But there’s also something in the underlying data that gives me pause.

Let’s start with the positives. The results at QVC International, Zulily, and Cornerstone are encouraging. Collectively, those businesses reported $5.95 billion in TTM revenues in Q1 FY21 (up 17% from TTM Q1 FY20), and $766 million in TTM OIBDA (up 52% from TTM Q1 FY20). While there’s clearly some benefit from the pandemic, I think a fair read on the past few years, most notably at QVC International, is that the business continues to deliver strong results.

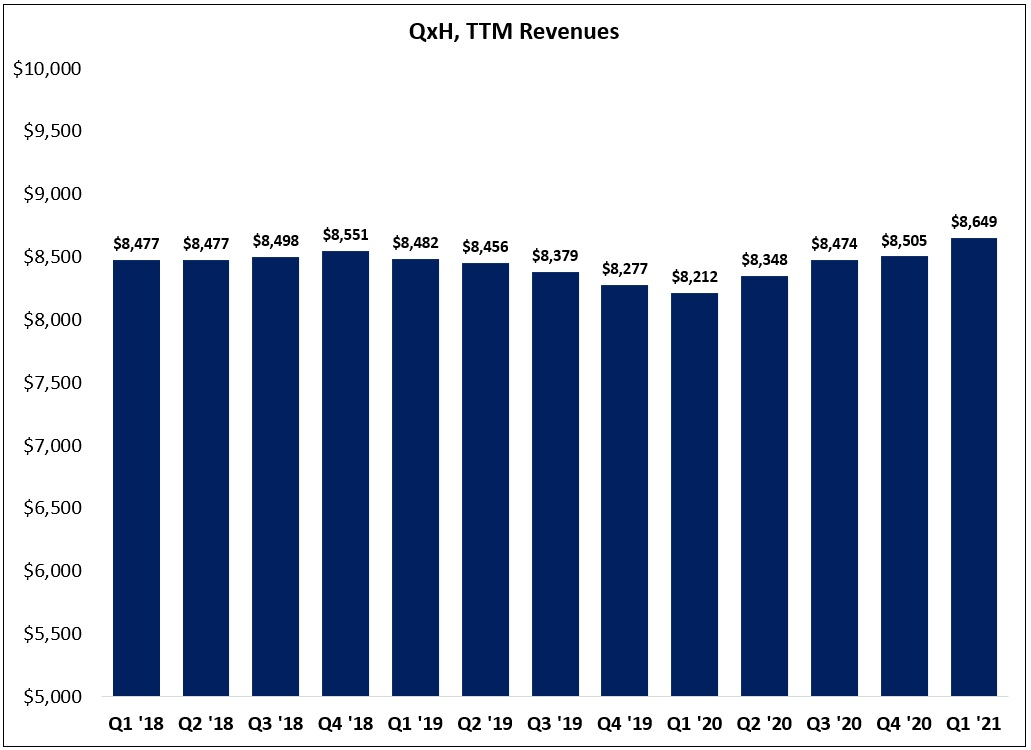

Where I’m struggling with the story is at QxH (the QVC U.S. and HSN businesses). As shown below, QxH TTM revenues in Q1 FY21 were $8.65 billion – marginally higher than the $8.48 billion in TTM revenues that the QxH segment reported three years ago (Q1 FY18). To put it plainly, the QxH business has struggled to report meaningful top-line growth in recent years.

To be clear, the tailwinds that emerged as a result of the pandemic have had some impact. As highlighted in the Q1 FY21 release, LTM customers at QxH were 11.8 million, up 12% from pre-pandemic levels (Q4 FY19). Over the same period, TTM QxH revenues have increased by roughly 5% to $8.65 billion, with average spend per existing customer (those who have made a purchase in two consecutive 12 month periods) increasing by about 2% to $1,337 per year.

Here’s the problem: Given what has happened over the past year, those results feel somewhat underwhelming. It’s difficult to pick a clear comp for QxH, but I think that conclusion holds as you consider the results being reported by various retailers, as well after considering the recent surge in U.S. retail sales, as shown below. The combination of the pandemic / shelter in place orders (“an ideal solution for reaching stay-at-home consumers”) and accommodative fiscal policy by the U.S. Government has been a massive tailwind for Qurate. It gave them an opportunity to acquire millions of new and lapsed customers (which they’ve capitalized on), on top of the advantage of keeping their “doors” open while other retailers endured unprecedented headwinds for much of 2020.

That line of thinking (Qurate benefiting from the pandemic) isn’t a new one; as I discussed in the April 2021 Portfolio Review, the short-term and long-term tailwinds that Qurate would experience was a key part of the thesis:

“In addition, there was reason to believe in September (when I bought the stock) that the pandemic would be a meaningful short-term (and potentially long-term) tailwind for Qurate. As the world sheltered-in-place in 2020, millions turned to QVC and HSN. The number of total customers in December 2020 was 11.6 million (LTM), a 9% YoY increase, with 2020 revenues climbing 5% to $14.2 billion. Importantly, as noted on the Q4 call, the company has seen a similar percentage of new customers who purchased 20+ items within the first 90 days (cutoff to be considered a “best customer”) as they have in prior periods, resulting in the largest addition of “best customers” in any year in the company’s history. If the “best customer” results are maintained, the pandemic has effectively gifted Qurate a higher base to work from than what existed at the end of 2019.”

Lately, I’ve begun to question both the magnitude and the sustainability of that step-up. Said differently, I’m not sure that the short-term benefits we’re currently seeing will translate into long-term results. Specifically, I worry what will happen as our lives return to some sense of normalcy, government stimulus is curtailed, and comps become more difficult. (In management’s defense, they haven’t changed their tune one iota: as noted on the Q1 call, they remain “encouraged by the projected lifetime value” of newly acquired customers.)

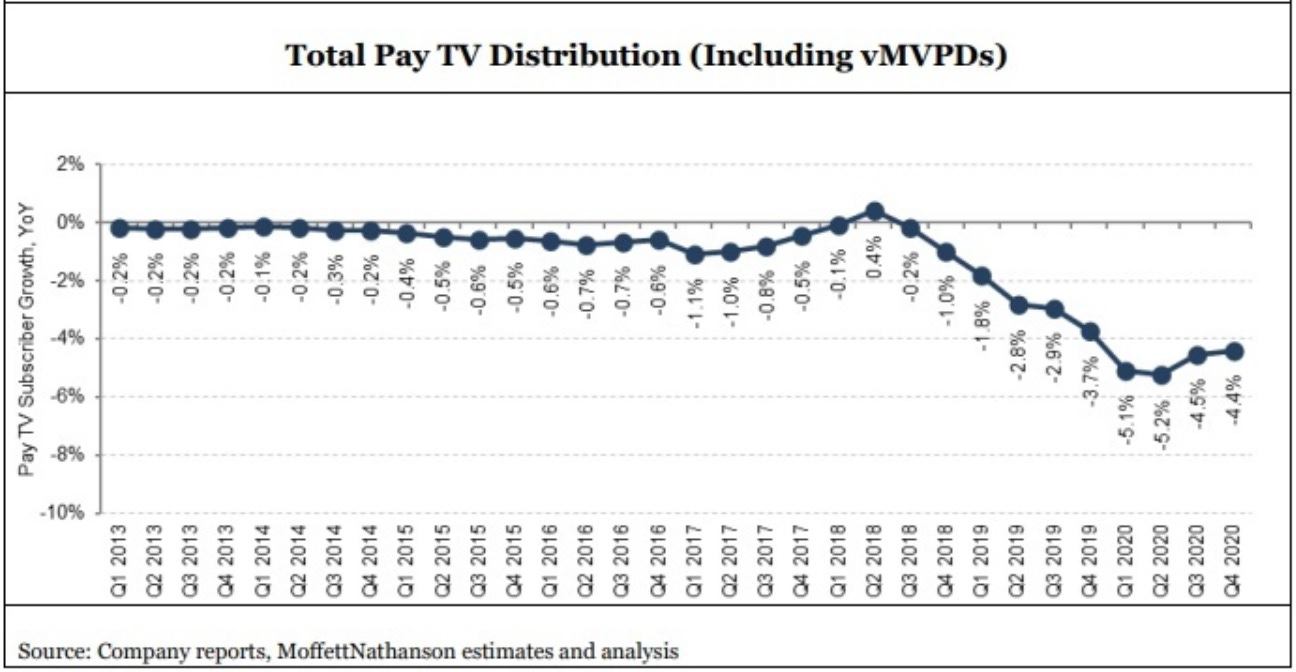

In addition, the company’s reliance on linear TV has been, and continues to be, a concern for me. As you’ve likely picked up from my commentary on Disney and Comcast, I am quite pessimistic about the pay-TV bundle (the value proposition continues to worsen), particularly relative to the plethora of DTC options that have launched in the past few years. As shown below, U.S. pay TV subscribers declined by a mid-single digit percentage in 2020, a meaningful acceleration from prior years. While Qurate remains relatively well-positioned given its customer demographics, I do wonder if the entire ecosystem will eventually reach a breaking point (at some level of pay-TV and DTC subscribers, a company like Disney may decide that it makes sense to abandon the bundle entirely).

The other concern that I have is Qurate’s competitive standing in a digital world. This comment from CEO Mike George on the Q1 call stood out to me: “I think we've got to be in constant test, learn, innovate mode because this ecosystem is going to continue to evolve in ways that are hard to predict.”

I’m even less confident in my ability to predict the future than Mr. George.

But as I think about a company like Facebook, to pick one notable example, it’s clear that they have long-term ambitions in commerce. Through properties like Instagram, they want to become a major player in the kind of screen based, experiential shopping that Qurate excels at. Personally, I have no idea if they will achieve that goal; but what I do know is that they have the massive user base (including social media influencers), financial resources, and long-term time horizon to give it a fair shot. (And as Bloomberg reported earlier this week, TikTok also has its sights on opportunities in commerce, “to further blur the line between social media and online shopping”).

Conclusion

I want to be clear: I think there’s a good chance that QRTEA remains attractively priced at current levels. In addition, commentary by Chairman Greg Maffei on the Q1 call leads me to believe that another capital return is likely before the end of the year (which would be welcomed by equity investors).

The problem is that I no longer feel comfortable with the bet I’m being asked to make. When I first invested in QRTEA in September 2020 (at an average cost of ~$7 per share), I felt that I had a pretty straightforward understanding of what needed to happen for the investment to be a success.

But today, at ~$13 per share, I honestly feel a bit behind the eight ball.

(And when financial leverage is involved, that’s not the place to be.)

As a result of the strong returns over the past eight months, I now feel that I need to have confidence in the sustainability of the uplift that Qurate received as a result of the pandemic in order to continue owning the stock. As of today, that isn’t a belief that I have enough conviction in to risk my capital on.

For me, this bet was always based upon an exceedingly low valuation and a clear path to value creation. And I think that story has largely played out.

For that reason, I have decided to sell QRTEA (and will do so tomorrow).

As noted in the April 2021 Portfolio Review, QRTEA was a ~5% position as of March 31st. I will send out an update tomorrow morning outlining what I intend to do with the capital that will be freed up as a result of this sale.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial, accounting, tax, or other adviser or in any fiduciary capacity.

FWIW I think this is the right call. A good business, but one that is in structural decline given linear tv dependence and user demographics. Which is why it was available at such an attractive valuation vs other Covid beneficiaries. But as the world opens up, I'm not sure you want to continue owning this for the long term. I could easily be wrong and management is great, but lots of headwinds long term.

I looked at it last spring but couldn't get comfortable that it was a business I wanted to own for 5+ years. Clearly a mistake! Bought the prefs instead as a good cash place holder.

At the risk of sounding ignorant, which I am unabashedly so, I have a few questions/observations: Would it be fair to say that, given what are still low cash flow/earnings multiples, you foresee a potential precipitous decline in the next few--like three--years that puts the potential return of invested capital (at today's prices) at risk? Do you think that demand for live video curated sales content will evaporate as the monetization of personalities/brands via avenues like Instagram and Tik Tok proliferates (which, in my opinion, implies a pivot in the current behavior of Qurate's prized 'core' customers)? Am I correct in assuming by your statements about dtv that you also believe that virtual mvpds--e.g. YoutubeTV, Sling, Fubo--will never become ubiquitous? In the event that one or more do, do you think that they would present a higher hurdle to paid programming placement than traditional linear tv? Just on an n of 1 basis, the digital streaming world seems so disaggregated right now. While the disaggregated nature of streaming combined with households transitioning from cable puts Qurate's challenges in relief, and I don't think one should rely on uncertain externalities benefitting the business, the ice cube just seems so far from melting at this point that I have trouble seeing a downside that involves negative returns in the next couple years (lost opportunity cost seems given if you have a bunch of other great bets). Has Qurate ever broken down QxH viewership by linear/streaming? I've looked at a couple presentations and statements but haven't seen it. If they've never done it then perhaps the ommission of such a statistic says something.