Peloton: Clipping In

Note: Review all prior Peloton research at the “PTON” tab on the website.

From “Peloton: A Costly Turnaround” (November 2025):

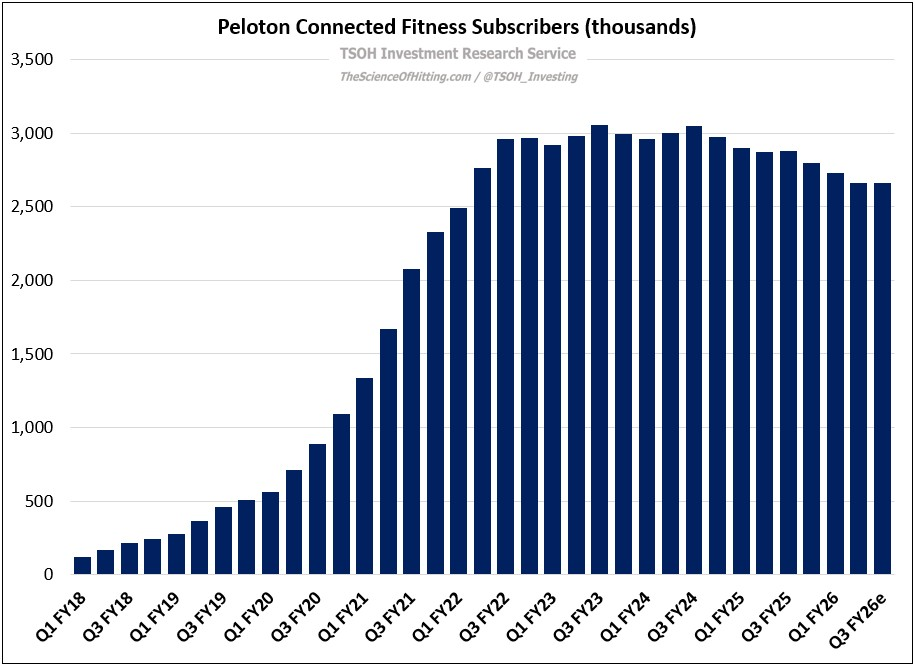

“When the initiation was published in February 2022, PTON was a ~$30 stock that had fallen >75% from the all-time highs; it’s now a ~$7.5 stock that has fallen another ~75% since early 2022. Their current pace of subscriber declines is unsustainable, and the level of equity dilution in recent years has been staggering… I will need further help on the company’s stock price and / or a notable improvement in their CF subscriber trends to invest in Peloton.”

My views on Peloton have long been painted by the belief that it is a leading brand with a unique product that is an attractive value proposition for the target customer - but roughly quantifying that opportunity has proven quite challenging (it’s safe to say the number will be well short of the “tens of millions of subscribers” that co-founder John Foley once expected). As it relates to the investment thesis, this is the crux of the debate: we’re well past the astounding growth of the pandemic era, when Peloton’s subscriber base expanded ~6x in 36 months, but when will recent subsequent declines end?