Ollie's: "Over Our Skis"

In August 2020, closeout retailer Ollie’s reported a 43% increase in Q2 FY20 same store sales (SSS); to put that number in context, the company hadn’t reported a single quarter of double digit SSS growth since its IPO in July 2015. That result, which was reflective of a massive tailwind from U.S. government stimulus in response to the pandemic, was clearly unsustainable; as CEO John Swygert noted on the Q1 FY20 call (when it was already apparent that a strong Q2 FY20 was on the horizon for Ollie’s), “While the spike in demand is exciting, a few words of caution are needed as to the sustainability of these heightened comp trends... It's important to not get over our skis when we think about our current trends.” But in the short-term, Mr. Market didn’t share Swygert’s concerns: OLLI, which fell below $30 per share at the market trough in March 2020, would go on to reach a high of ~$110 per share in August 2020 (up ~270% in five months).

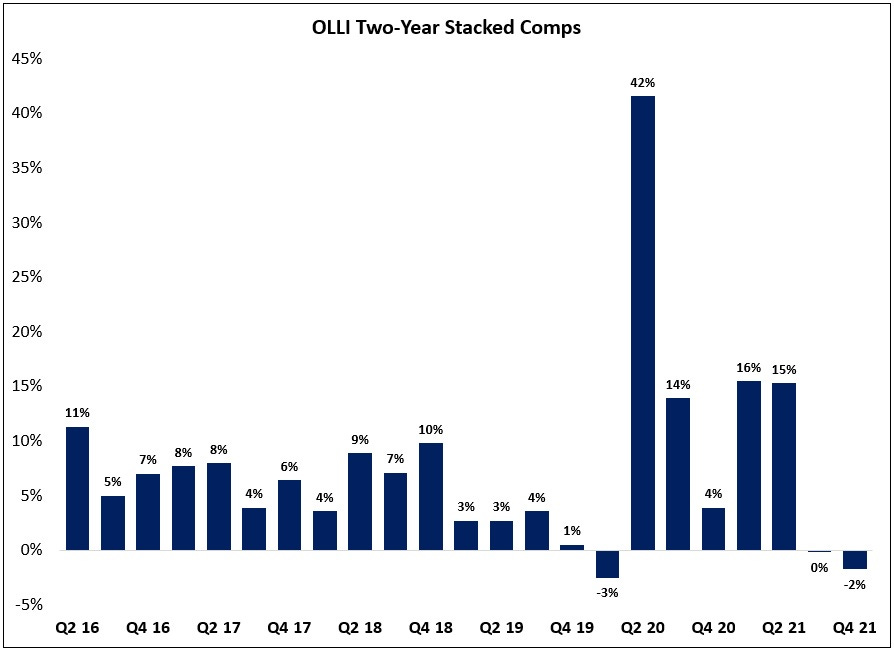

With the benefit of hindsight, Mr. Market erred in his assessment of the pandemic’s impact on Ollie’s business. On March 23rd, 2021, the company reported that Q4 FY21 comps declined by ~11%, compared to ~9% growth in the prior year period. The net result was a slight decline for two-year stacked comps – meaning the average Ollie’s (in the comp base) generated lower revenues in Q4 FY21 than it had in Q4 FY19 (pre-pandemic). The COVID-tailwind, which led to strong two-year stacked comps throughout FY20 and in the first half of FY21, has disappeared. The stock price followed suit: at Friday’s close, OLLI is down more than 50% from its August 2020 highs.

The problem for Ollie’s, at least in the short-term, is that this leaves them with little cover for what’s likely to occur in 2022 – most notably, meaningful cost inflation (guidance calls for ~10% EBIT margins in FY22, which would be ~200 basis points lower than FY21). While other retailers, like Dollar General, are not immune to these pressures, they benefit from the fact that they’ve retained a meaningful amount of the COVID sales tailwind (at least so far).

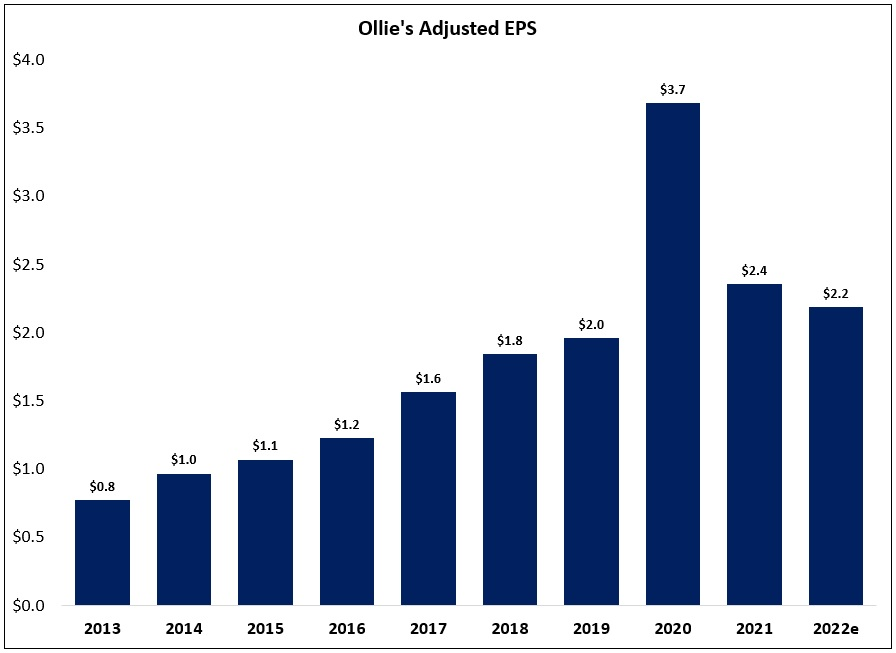

We can see as such in Ollie’s guidance: FY22 EPS of ~$2.2 per share would only be ~10% higher (cumulative) than FY19. That is a clear change in trend from the results that investors had come to expect from OLLI (EPS doubled in the five-year period from FY14 - FY19, a CAGR of ~15%).

The net result, as I see it, is as follows: Ollie’s became a messy story in late 2019, most notably due to lackluster 2019 comps and the passing of co-founder and CEO Mark Butler. Those concerns took a back seat in mid-2020, as pandemic-related headwinds led to a previously unimaginable improvement in comps, profit margins, and earnings. But now, as we look ahead to 2022, the core issue has resurfaced: Is Ollie’s a strong business that has the ability to >2x its U.S. footprint over the next 10-15 years, generating attractive incremental returns in the process, or are underlying issues putting the retailer’s long-term success into question?