Nike: "Managing Through Volatility"

In the Nike deep dive (published 07/11/22), I concluded with the following:

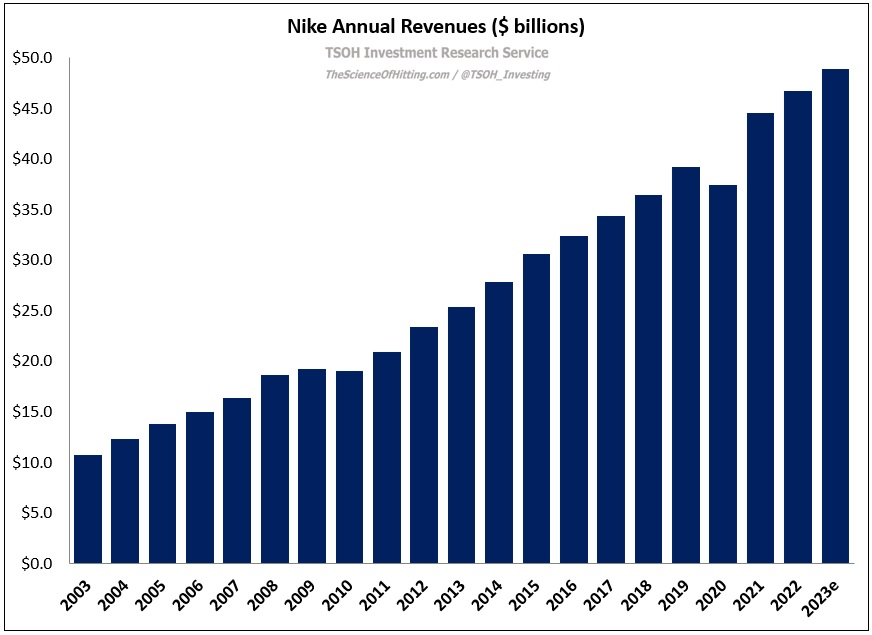

“While I don’t question the long-term sustainability of the business, the results of the past decade indicate that double digit annualized revenue growth over the long run would be a major accomplishment. (On that point, I’d note that management set aggressive revenue targets at the 2015 Investor Day, which they missed by a mile – ‘deliver $50 billion in revenues by FY2020’).

In summary, I believe Nike has a bright future ahead. That said, at ~27x forward, it appears Mr. Market largely agrees with that conclusion. As I think about opportunity costs, my sense is that the business quality / long-term growth / valuation trade-off currently offered at NKE is less attractive than for the names in the portfolio, as well as for a few companies on the watchlist.”

Mr. Market has been helpful in the interim, with the stock falling ~20% since the deep dive was published (the S&P 500 has declined by a high-single digit percentage over this period). In addition, Nike recently reported its Q1 FY23 results, which provides a chance to revisit some conclusions from that post.

Broadly speaking, this is an interesting moment in the athletic apparel industry, which may ultimately present some compelling opportunities for long-term investors. Specifically, Nike is working through excess inventories, primarily in North America, which is something we’ve seen before and will see again (an inherent part of the business); while these issues are a short-term headwind, I think it’s important to understand that the cash flow dynamics of this business offer defensive characteristics to the industry leader (Nike).

Stumbling Into FY23

Nike is navigating through a challenging environment; the pandemic has had irregular impacts on demand for its products, as well as for its business operations (notably in terms of supply chain / inventory management, as I’ll discuss in the next section). That said, in the grand scheme of things, the results over the past few years have been reasonably strong: in Q1 FY23, revenues were $12.7 billion, or ~19% higher than its pre-pandemic print in Q1 FY20 (relative to the prior year period, Q1 FY23 revenues were +4% as reported and +10% in constant currencies). While Nike’s trailing three-year revenue growth rate (~6% p.a.) has fallen short of management’s high single digit to low double digit target, I think these results are understandable in light of today’s environment (and relative to the results at some of Nike’s peers).

Top-line growth in Q1 FY23 was impacted by ongoing pressures in Greater China, with sales down 16% YoY (-13% in constant currencies); in each of Nike’s other three regions - North America, EMEA, and APLA - constant currency revenues increased double digits YoY. In terms of mix, we continue to see the business shift towards Nike Direct (the company’s stores and its digital properties): in Q1, Direct revenues were +8% YoY (+14% in constant currencies), compared to a 1% increase in Wholesale revenues (+8% in constant currencies). Within Direct, the company continues to see outsized growth in Digital (+23% YoY in constant currencies); given that the Digital business generated ~$10.5 billion in FY22 revenues – up nearly 3x versus FY19 – it has clearly become a key contributor to Nike’s top-line growth.

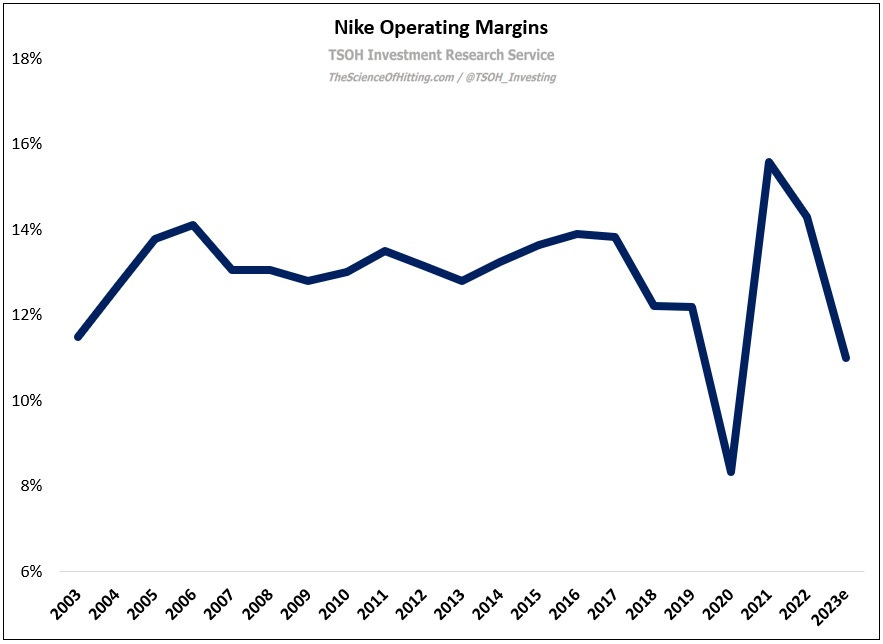

As we move past the revenue line, the story gets messier. Gross margins in Q1 declined 220 basis points YoY to 44.3%, primary due to elevated supply chain (freight and logistics) costs, as well as lower margins in Nike Direct driven by higher markdowns. As noted on the call, this impact was most acute in North America, where the company is taking aggressive action to liquidate excess inventory, most notably by leveraging Nike Direct channels. (On a 13% increase in North America revenues, regional EBIT dollars declined by 4% in Q1.) With gross profits down 1% YoY against a 10% increase in SG&A expense, Q1 EBIT declined ~20% YoY. (On the SG&A increase, note that demand creation expense was +3% YoY, with operating overhead expense +12% YoY; said differently, this largely strikes me as necessary expense growth, not something that’s discretionary / avoidable or timing related.)

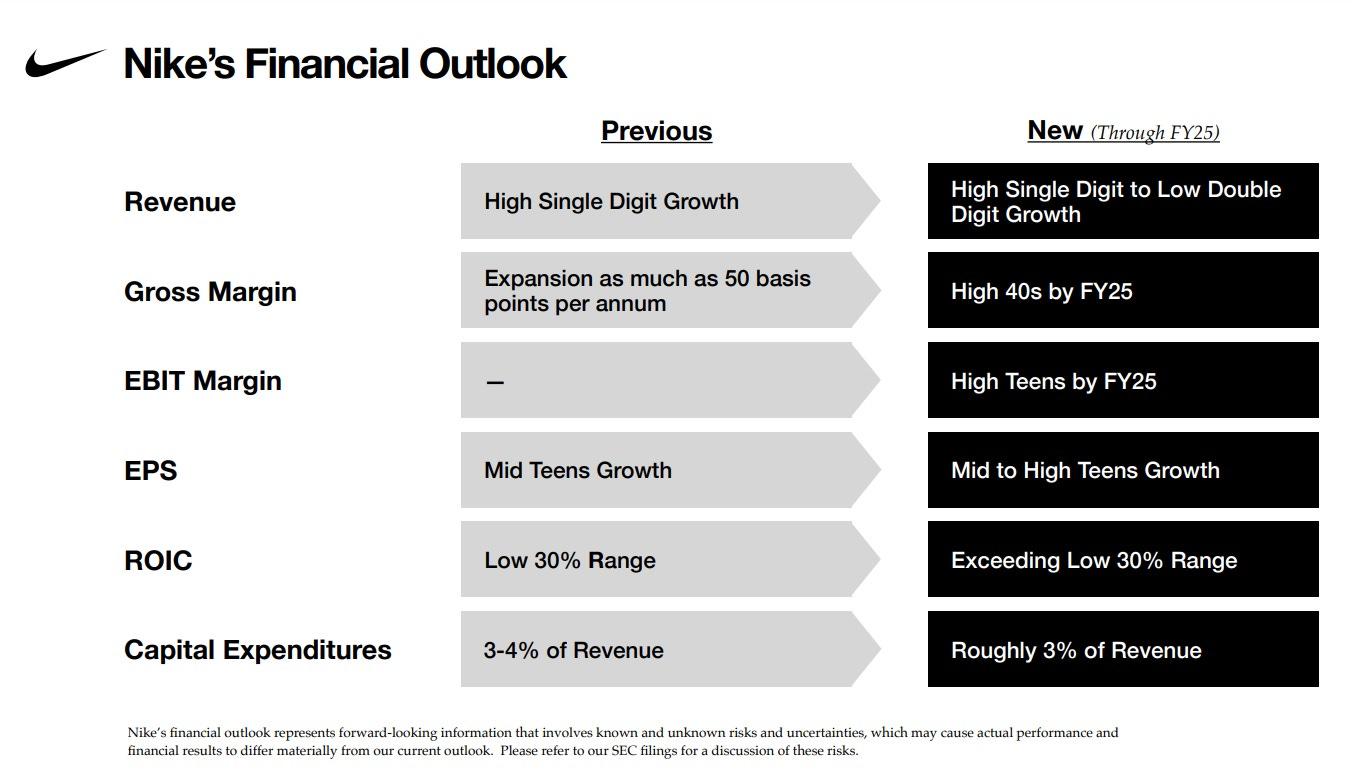

The outlook for the remainder of FY23 suggests Q1 will not be an anomaly. Q2 is expected to see the lion’s share of Nike’s aggressive inventory offloading, with gross margins projected to decline by 350 – 400 basis points YoY. The full year guide call for 200 – 250 basis points of gross margin compression, which suggests limited improvement in 2H FY23 as well. When combined with other expectations (low-to-mid single digit reported revenue growth and a high-single digit increase for SG&A expense), that puts FY23e EBIT margins at ~11%, or down ~300 basis points from FY22. To put that number in context, management’s mid-term (FY25) financial outlook calls for high teens operating margins; there’s a significant disconnect between management’s FY25 vision and the current results in the business.

Inventory & Working Capital: A Two-Sided Coin

The primary problem at Nike is related to supply chain and inventories.