Nike Expert Panel Discussion

In advance of Nike’s (NKE) Q3 FY25 results, I moderated an expert panel discussion with two former employees, Greg Merrill and Cheryl Hunter; collectively, Greg and Cheryl spent more than three decades at the athletic apparel juggernaut, including direct experience with individuals like John Donahoe and Elliott Hill. At a time when Nike’s leadership position and long-term financial trajectory is subject to much debate, this discussion - available on the AlphaSense platform or for anyone with a free trial - provides unique and valuable insights. For investors interested in Nike, this conversation sheds light on the company’s culture, balancing the Direct channel and wholesale partners, Nike’s product / people / purpose flywheel, and more.

To give you a taste of our conversation, here are three notable comments.

Greg on Nike leadership: “Mark Parker grew up with the brand, he grew up with the company. He bleeds Nike and he understands the culture… Parker was so successful because he understood the swoosh, the brand, and how things get done inside this massive corporation… John Donahoe was on the board [since June 2014]. Being on the board, you’re sort of an insider, but you’re also shielded from the true reality, the way the company operates. I don’t know that John had a good sense of what was going on before he was tapped to the CEO role [in January 2020]… I know firsthand, the amount of filtration layers to the CEO, you’re kind of disconnected from what’s actually going on in the company; that’s a tough part of being CEO… [Donahoe] really wasn’t, in my opinion, a product guy – and Nike is a product company. I think there was a mismatch from a cultural and background standpoint [Donahoe’s prior experience at Bain, eBay, and ServiceNow] that led to challenges.”

Cheryl on Nike’s retail partners: “You need wholesale partners. There are things they do incredibly well; they reach so many consumers, both physically and digitally… Nike’s partnership with wholesalers - for example, ‘House Of Hoops’ with Foot Locker – where I worked on their first store in Harlem… When those retail partnerships are executed well, when everybody involved knows what they are good at and what they are there for, that works.”

Cheryl on internal reception to new CEO’s: “When Bill Perez replaced Phil Knight [as Nike’s CEO in December 2004], within six weeks the company knew it was wrong… I think when Donahoe started, everyone wanted to give him a chance… Donahoe was more right than Bill Perez was… It took longer for the wrong fit to surface… People get hired for talent and fired for fit.”

For those who have followed my Nike research over the past three years, you know that I’ve long been concerned about management’s overly optimistic financial targets, along with the impact that it had on decision-making and, ultimately, brand equity - a concern that has since been confirmed by Hill, and who is now working to address excess promotional activity at Nike Direct. (Q3 FY25 call: “Comparing last year's January and February to this year's, Nike Digital in North America went from over thirty promotional days to zero.”)

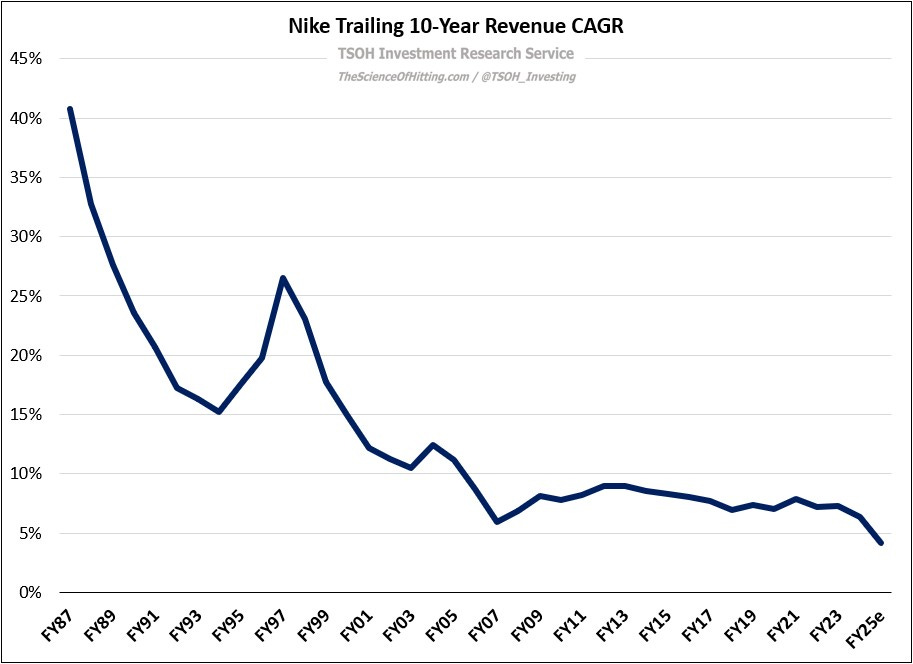

As we look to FY26 and beyond, will Nike emerge from this difficult period with renewed focus and a sound long-term strategy that leverages its competitive advantages, or are today’s headwinds more structural in nature?

I will work through my answer to that question in Monday’s update.

NOTE - This is not investment advice. Do your own due diligence.

I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information presented in this report. Assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Projections are based on a number of assumptions, and there is no guarantee that they will be achieved. TSOH Investment Research is not acting as your advisor or in any fiduciary capacity.

Can’t wait to go through all this. Though Nike is not a company I would traditionally invest in, your insights are always incredibly profound and make me a better investor. Keep up the great work!