Netflix: "Not Fantastic, But Reasonable"

From “In The Right ZIP Code” (July 2022):

“Mr. Market is clearly concerned by this recent course of events; despite a nice pop for the stock in response to the Q2 results, NFLX is still down ~70% from its November 2021 highs. The question that matters most to me is what these recent results indicate about the long-term health of the business; is Netflix wilting in the face of heightened competition, or does it have some combination of factors – namely competitive advantages and a best-in-class leadership team - that will enable the company to navigate through this current malaise while continuing to hold onto the leadership position that it has established in the global streaming / VOD business?”

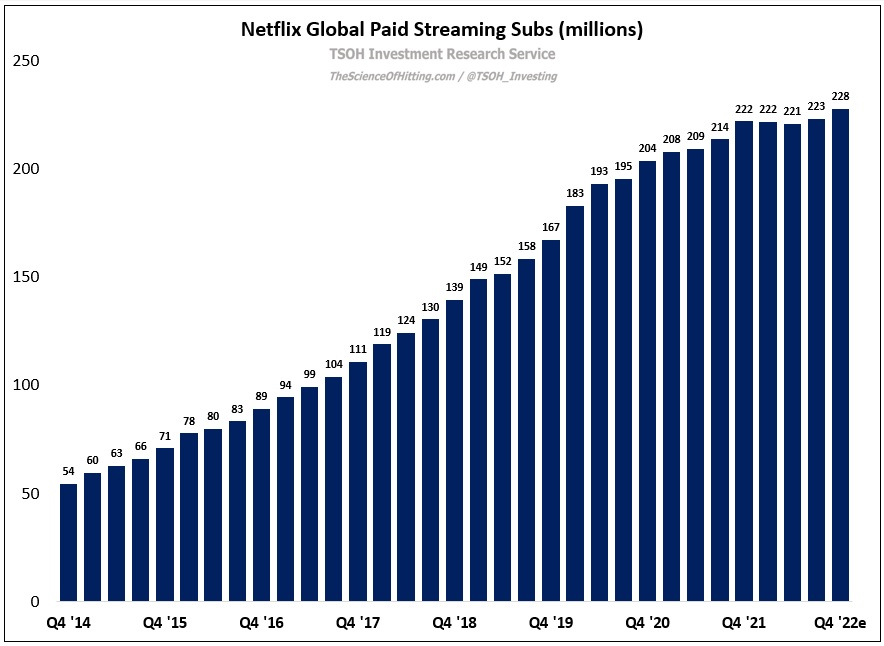

With another quarter behind us, the story continues to evolve. Netflix returned to sub growth in Q3, with ~2.4 million sequential net adds putting it back on track for customer growth in FY22 (as a reminder, Netflix lost ~1.2 million net subs in 1H FY22). In addition, Netflix is quickly approaching two important consumer-facing changes to its business: the launch of an ad-supported tier and a crackdown on password sharing. As always, my objective is to try and decipher how these recent developments impact the long-term health of the business, which is the key consideration for the long-term investment thesis.

I won’t bury the lede: I think Netflix remains in the pole position in the global streaming / VOD business, and I expect that the long-term results for the winners in this industry (as measured in terms of revenues and profits / free cash flow) will be significantly improved relative to their current standing.

An Update on UCAN

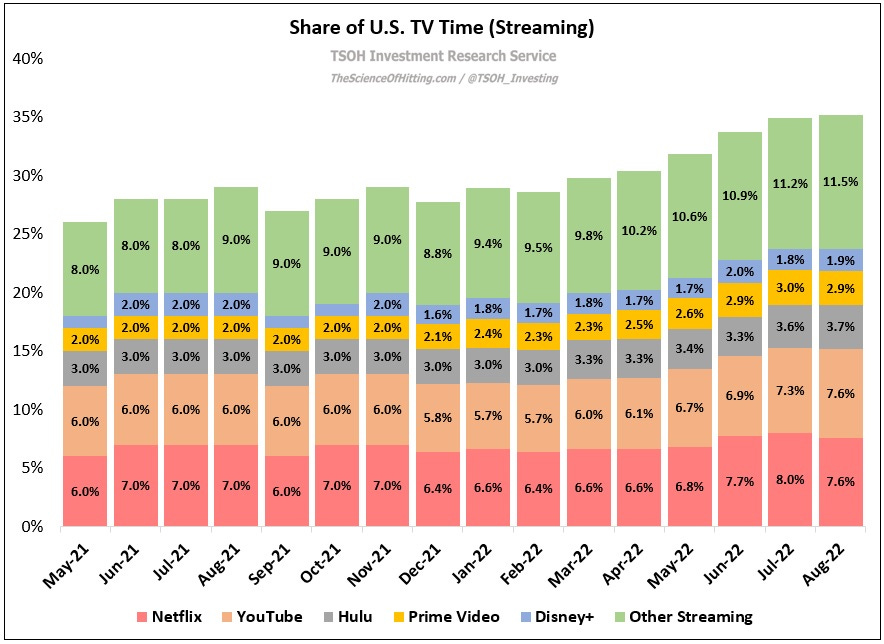

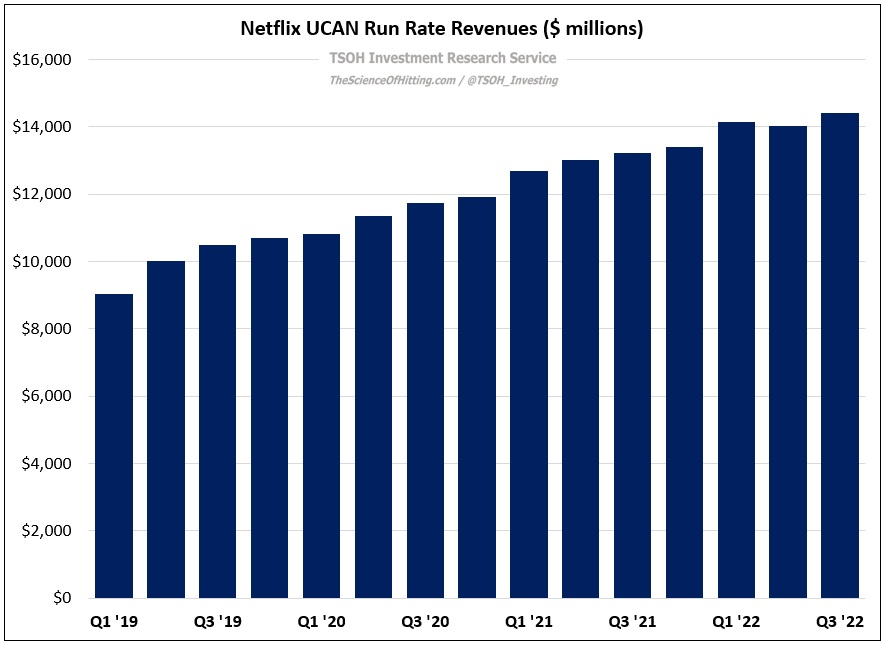

As I discussed last quarter, Netflix’s results over the past five-plus years in the most competitive market in the world provide a strong indication that this company is positioned for long-term success (“This is the Netflix playbook – and it’s working.”). This quarter provided further evidence to support that argument, with a slight increase in the UCAN sub base (to ~73.4 million paid members) despite a double digit YoY increase in average revenue per membership (ARM) and a large number of high profile content releases from competing services. I won’t read too deeply into the results from a single quarter, but I’d argue Netflix’s numbers over the past few years (during a period of significantly heightened competitive activity, which has included frequent promotional offers from emerging players at low price points with the hope of driving sub growth) are supportive of a point I’ve made previously: Netflix has replaced linear TV for millions of U.S. households as the place to start their viewing experience at night. That is a very attractive position (mind share) to hold, and it presents something of a “chicken or the egg” problem for its competitors (especially those with significant financial leverage who do not have the ability or willingness to incur years of multi-billion dollar losses / negative FCF in the DTC business); my view has been, and continues to be, that Netflix will largely be able to maintain its separation from the pack.

International Growth

On top of its strong position within the UCAN market, Netflix’s business shines even brighter when its viewed across the global stage. As shown below, revenues have increased at a ~22% CAGR over the past five years, with an outsized contribution from International (since YE FY18, quarterly International revenues have more than doubled, to ~$4.3 billion in Q3).