Netflix: "Uncharted Territory"

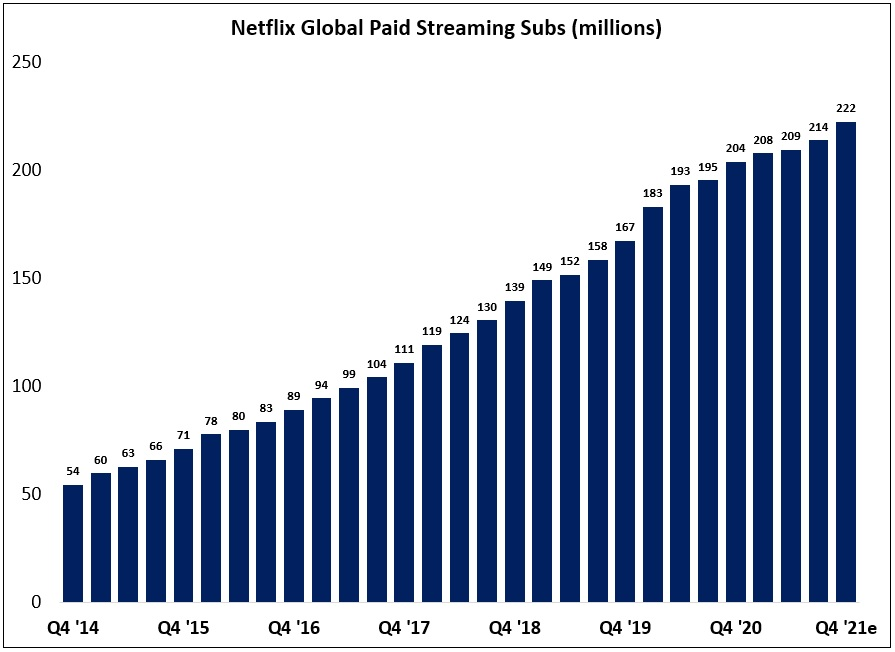

Netflix, the global leader in the subscription video on demand (SVOD) business, reported results for Q3 FY21 on Tuesday. The business, which has experienced COVID-related volatility around net subscriber additions, showed a nice rebound in the quarter: relative to expectations of 3.5 million net adds, Netflix added 4.4 million subscribers over the past 90 days. In addition, management guided to a strong Q4 (+8.5 million subs), which implies 222 million global paid subs at year-end FY21 – an increase of roughly 60% over the past three years (trailing three-year paid sub CAGR of ~17%).

As I discussed last quarter, Netflix was delivering trailing 24-month (T24M) net sub adds in the mid-50’s (millions) pre-COVID. Using the Q4 guide, the company will report 55 million T24M net adds in Q4 FY21 (in-line with Q3 FY21). As you can see below, it looks like the growth trajectory has settled again (from the inflated COVID growth rates). That said, the question I asked last quarter remains: is this a new base to grow off of or will we flatline at these levels? This is bound to happen eventually - Netflix can’t add a larger number of subs every year in perpetuity - but if it’s happening now, that’s a notable development. With a meaningful ramp in content releases to close FY21 and into FY22, the company will have the wind at its back (co-CEO Reed Hastings: “We’re in uncharted territory in that we have so much content coming in Q4 like we've never had before… Some of our biggest bets yet are coming in Q4 and 1H of next year.”). Personally, I remain confident that the current pace (mid-50’s T24M net adds) will not be the peak (normalized) growth rate. That said, if the results in FY22 do not support that conclusion, there will be some questions to answer.

“Squid Game”

In mid-September, Netflix released “Squid Game”. The TV show, which had been rejected by local studios in South Korea for a decade, came to fruition when writer and director Hwang Dong-hyuk signed a deal with Netflix’s local content team in 2019 (over the past six years, Netflix has invested $1.2 billion to support the creation of new Korean films and TV shows for its service). In the past month, the show has become a global sensation: 142 million member households watched the title in the first four weeks after it was released (and that number is surely much higher today as the buzz has continued since). As noted on the third quarter call, “Squid Game” has become the biggest title in Netflix’s history; its currently the top program in nearly 100 countries around the world.

The success of “Squid Game”, along with other titles like “La Casa de Papel” (“Money Heist”), speaks to the competitive advantage that Netflix currently holds as a result of its unrivaled global scale (both in terms of paid subscribers and its ~$30 billion revenue base). As noted in the Q3 shareholder letter, Netflix is now producing local TV and film content in 45 countries globally (“it will be more than 50 next year”). If shows created for audiences in South Korea, Germany, or the United States can travel globally, Netflix has a massive leg up on its smaller / regional competitors. (“Squid Game” has likely crossed 150 million member households - meaning the show’s audience is roughly three times larger than the total population of South Korea; as reported in the WSJ, roughly 95% of “Squid Game” viewers to date have been outside of South Korea.)