Netflix: Steady As She Goes

In an industry that continues to navigate uncertainty in the face of structural change - with notable recent additions to the list being the Paramount / Skydance deal and discussions of a potential break-up at Warner Bros. Discovery – Netflix’s Q2 FY24 print stood out for its lack of surprises.

As opposed to many of the legacy U.S. media companies, the global leader in DTC video streaming isn’t struggling as a result of significant – and in many cases still unanswered - questions on its long-term strategy and its ability to effectively execute against that vision. Instead, Netflix’s 1H FY24 performance and full year guidance speaks to a well-oiled machine that continues to make steady forward progress in a large and growing global market (in terms of its financial results, as well as its competitive standing).

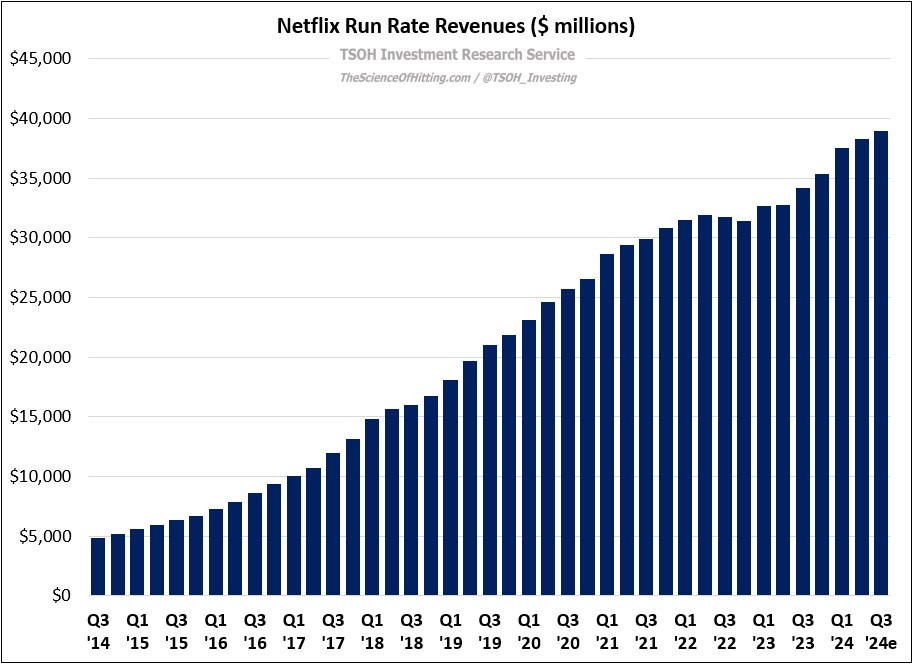

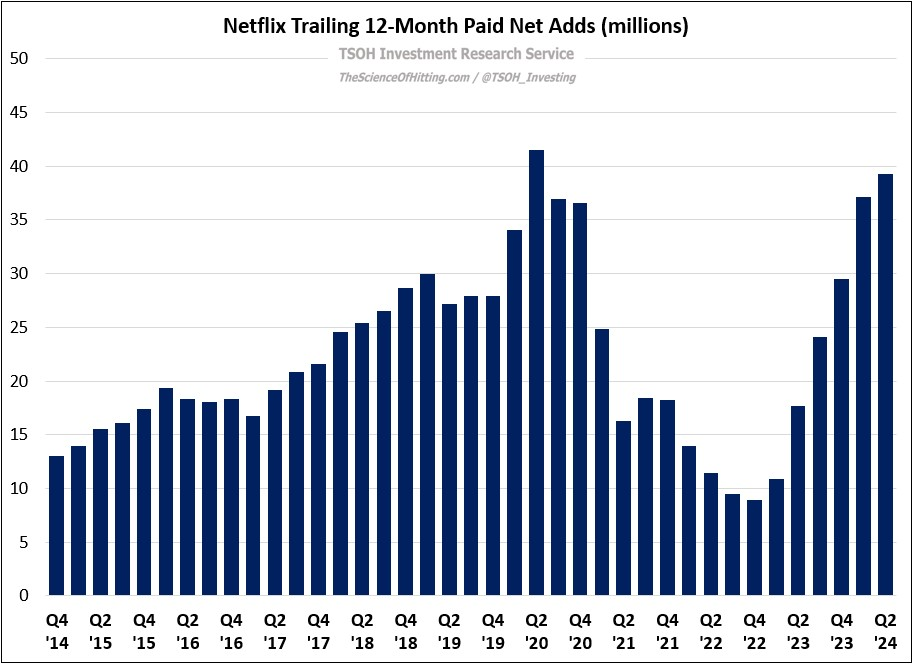

For the year, Netflix now expects to report mid-teens revenue growth (up ~15% to ~$39 billion), largely attributable to higher volumes; as you can see below, Netflix added 39.3 million net new paid subscribers over the past year, which is the second best result in the company’s history (only outdone by +41.5 million in Q2 FY20, which benefited from pandemic-related tailwinds).

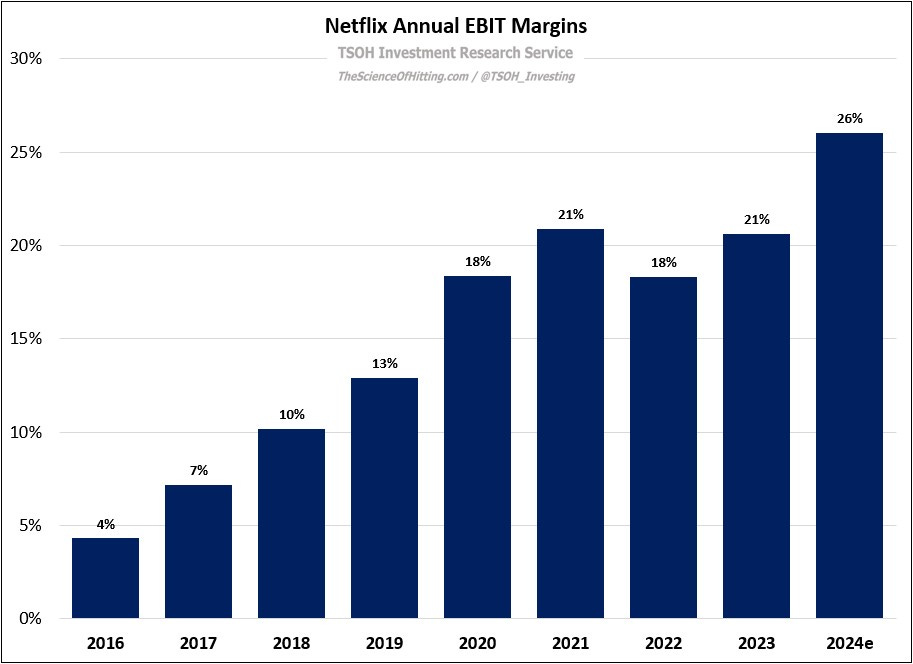

In addition, management now expects FY24 operating margins of 26%, or roughly 2x higher than their EBIT margins five years ago (13% in FY19).

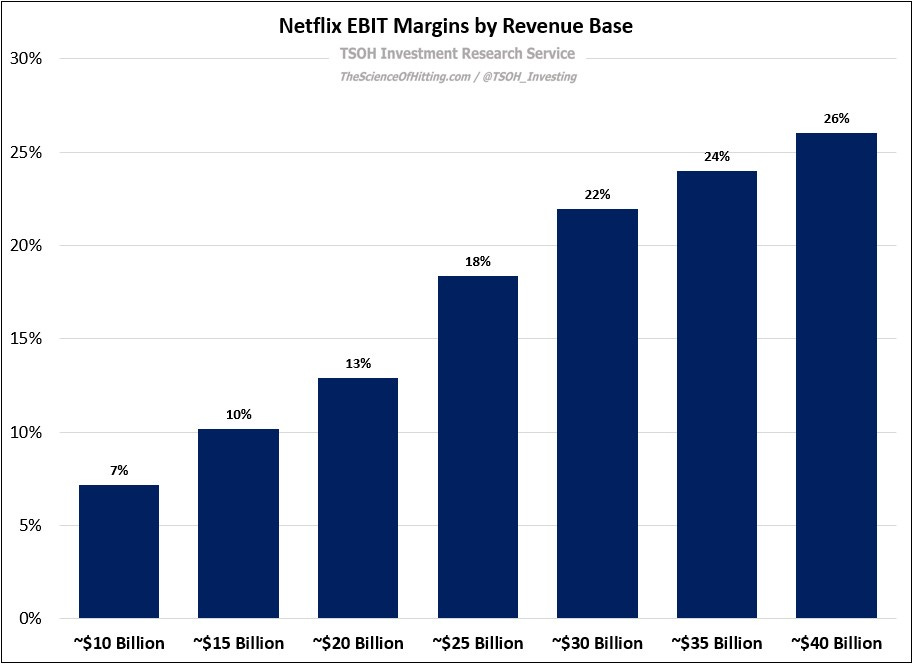

As you can see in the chart below, which shows Netflix’s EBIT margins over time as the revenue base scaled, its profitability has greatly improved with size: over the past five years, from FY19 to FY24e, Netflix generated ~$7.5 billion in incremental annual operating income (EBIT) on ~$18.6 billion of incremental annual revenues – incremental EBIT margins of roughly 40%.