Letting Winners Run

In “The Art Of Execution”, fund manager Lee Freeman-Shor recounts his lessons learned on the keys to investment success; Freeman-Shor’s conclusions were informed by running a “best ideas” fund that featured the top stock picks from a few dozen highly regarded investors. There are a number of interesting takeaways in the book, but there was one comment in particular that stuck with me (from page 114): “The most successful investors that I worked with, those that made the most money, all had one thing in common: the presence of a couple of big winners in their portfolios.”

Freeman-Shor’s conclusion is very similar to something Gavin Baker once wrote: “Selling winners too early has been a persistent problem for me. No matter how much I tell myself that I am going to learn and let them run - I still begin trimming my winners way too early. Letting winners run is the most common shared trait amongst great investors.”

One of my favorite examples of a long-term “let your winners run” strategy comes from Robert Kirby’s “The Coffee Can Portfolio”. As he wrote in “The Journal Of Portfolio Management”, Kirby first recognized the merits of this approach while advising a client in the investment advisory business:

“The potential impact of this process was brought home to me dramatically as the result of an experience with one client. Her husband, a lawyer, handled her financial affairs and was our primary contact. I had worked with the client for about ten years, when her husband suddenly died. She inherited his estate and called us to say that she would be adding his securities to the portfolio under our management. When we received the list of assets, I was amused to find he had secretly been piggybacking our recommendations for his wife‘s portfolio. Then, when I looked at the total value of the estate, I was shocked. The husband had applied a small twist of his own to our advice: He paid no attention whatsoever to the sale recommendations. He simply put about $5,000 in every purchase recommendation. Then he would toss the certificate in his safe-deposit box and forget it. Needless to say, he had an odd-looking portfolio. He owned a number of small holdings with values of less than $2,000. He had several large holdings with values in excess of $100,000. There was one jumbo holding worth over $800,000 that exceeded the value of his wife’s portfolio and came from a small commitment in a company called Haloid; this later turned out to be a zillion shares of Xerox.”

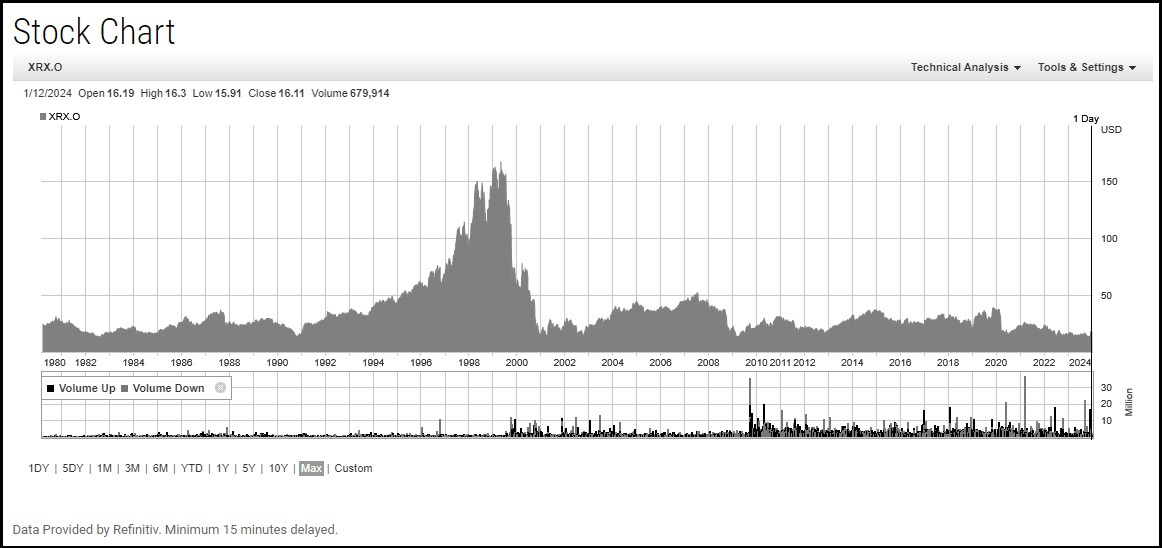

As with any approach, the coffee can strategy isn’t a surefire path to success. For one, it can lead to meaningful concentration in 2-3 positions over time, which presents the risk that their fortunes may change (as shown below, Xerox eventually hit a wall). As the example above highlights, that scenario could play out in time even if you start out with conservative weightings; for that reason, it may prove difficult to stick with even if you typically start positions at 2%, 3%, or 5%, let alone if you start them at 15% weightings. (Here’s another way to say that: the “right” weighting, particularly when working with a relatively fixed pool of capital, isn’t typically just a question of relative IRR’s.) That said, it’s interesting to consider how similar the coffee can approach taken by Kirby’s client sounds to the portfolio construction strategy employed by someone like Herbert Wertheim. It’s an approach that clearly works when well executed, which has also been successful applied over time by another well-known “investor”: Mr. Market (the S&P 500).

As Warren Buffett noted at the 2021 Berkshire Hathaway meeting (when he was asked whether the Precision Castparts acquisition was a mistake), the relative value / importance of Berkshire’s wholly-owned businesses have developed in a similar fashion to the outcome of a coffee can portfolio: