"It Has Never Been Not Hard"

An update on Boston Beer (SAM)

From “Boston (Beyond) Beer” (September 2024):

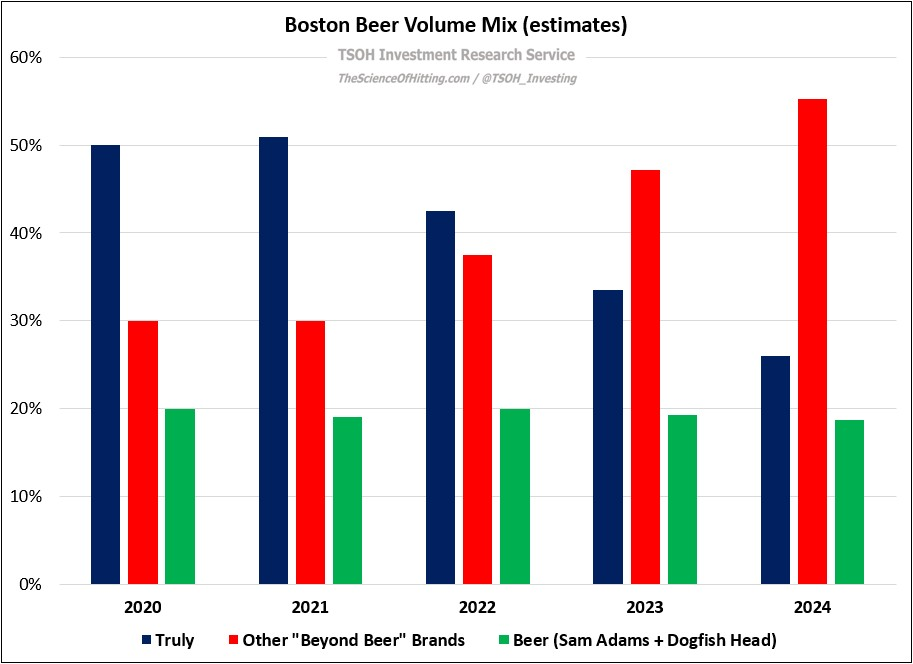

“I came into this exercise with some preconceived notions; chief among them was a belief that while Boston Beer had expanded into different categories over time, the culture and the business was still heavily tied to its legacy beer brand, ‘Samuel Adams’. Now I find myself at the other end of the spectrum… Their business has changed dramatically over time: Boston Beer is primarily a bet on ‘Truly’ and ‘Twisted Tea’, not on ‘Sam Adams’ or ‘Dogfish Head’.”

As detailed in the initiation, Jim Koch was at the forefront of the craft beer revolution; he was an instrumental figure to what’s now a ~$3.6 billion retail category, or about 10% of the traditional beer market. That alone qualifies Koch for an accomplished life in the business world, but he didn’t stop there: Boston Beer also became a leading player in the “beyond beer” category.

For Boston Beer, that started with “Angry Orchard” and “Twisted Tea” (which launched in 1997 and 2001, respectively), and has continued more recently with “Truly” (2016) and “Sun Cruiser” (2024). In the process, Boston Beer was transformed: roughly 85% of its 2024 volumes were from “beyond beer”, a category that is ~3x larger than craft beer in measured (off-prem) channels.

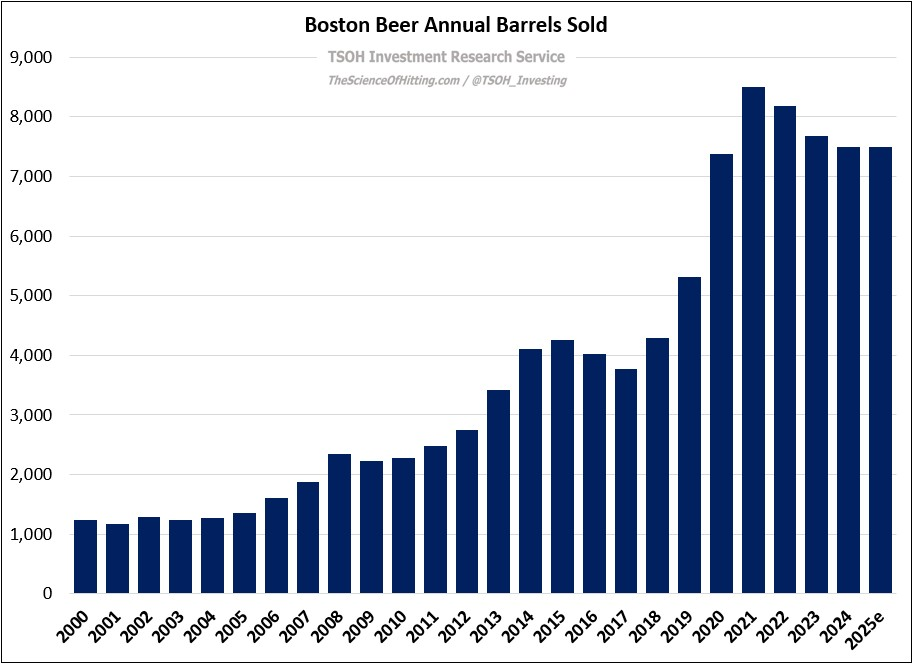

While Boston Beer has reported solid volume growth over the past decade (+6% per annum), its performance was heavily impacted by the rise of “Truly” and the hard seltzer subcategory in the years leading to 2021. It has been tougher sledding subsequently: volumes declined for the third consecutive year in 2024, with initial guidance calling for roughly flat volumes in FY25.