GAMB: Conviction vs Capital Allocation

Gambling.com (GAMB) initiation

“Our North Star has always been organic growth.”

While it came eight years after Charles Gillespie registered his first gaming industry related domain name - StartGamblingOnline.com in the summer of 2003 – the Gambling.com story really begins in 2011: “The previous owners of Gambling.com, which was a UK listed company, were in deep [trouble] and needed to raise money quickly. They tried to auction the domain name for $9 million; they took $2.5 million from us so they wouldn’t go bust.” (Gillespie and Kevin McCrystle are still at GAMB, as CEO and COO, respectively.)

In 2021, a decade after the Gambling.com purchase, the company went public at $8 per share. While its corporate name reflects that 2011 deal, Gambling.com (GAMB) has since grown into a portfolio of 50+ websites where bettors can compare gambling operators, i.e. the deposit bonuses offered by online casinos (iGaming) and online sportsbooks (OSB’s).

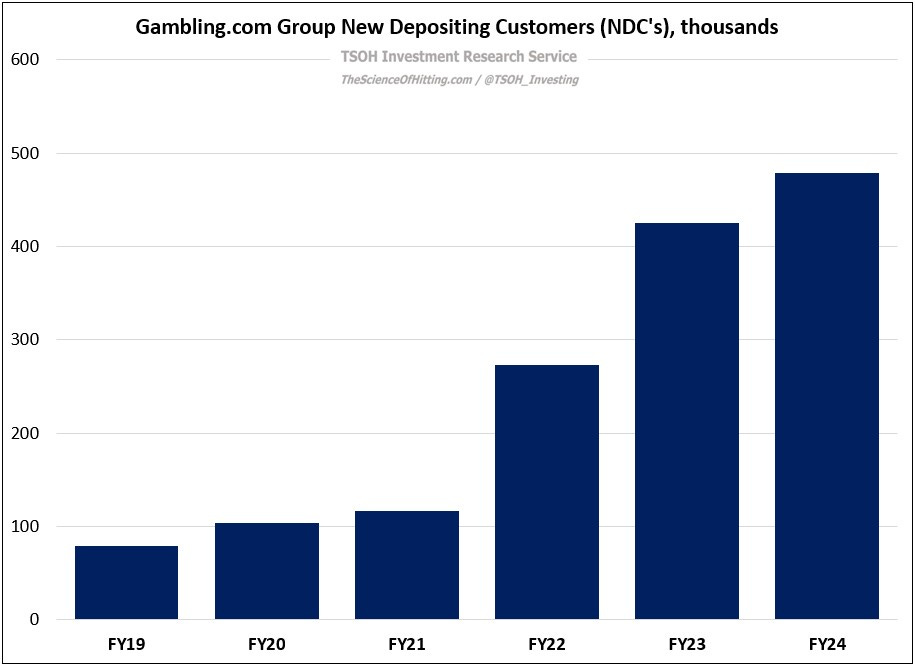

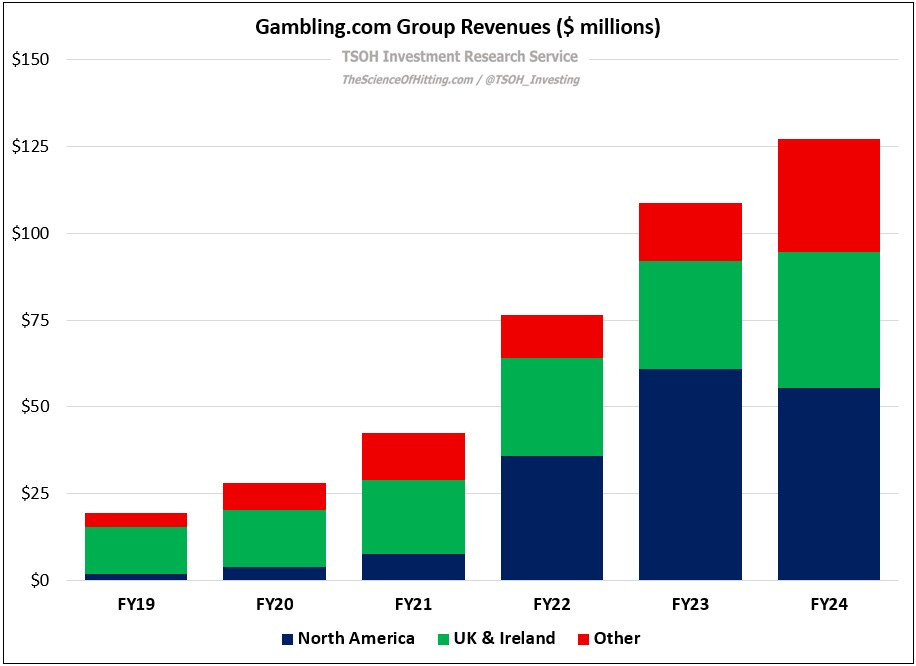

GAMB’s revenues, which totaled $127 million in FY24, are primarily attributable to payments from gambling outlets in exchange for recruiting customers to their platform (GAMB’s top ten customers accounted for ~25% of its YTD FY25 revenues, down from ~50% in FY22). As shown below, the company sourced ~479,000 new depositing customers, or NDC’s, for its operator clients during FY24, a roughly 6x increase from five years earlier.

The company’s geographic focus was historically the UK & Ireland, which accounted for ~70% of its FY19 revenues; that changed with legalization of iGaming and OSB’s in certain U.S. states, with North America accounting for 50% of GAMB’s YTD FY25 revenues. (As shown on slides 26 and 27, online gaming remains nascent in the U.S. compared to mature European markets.)

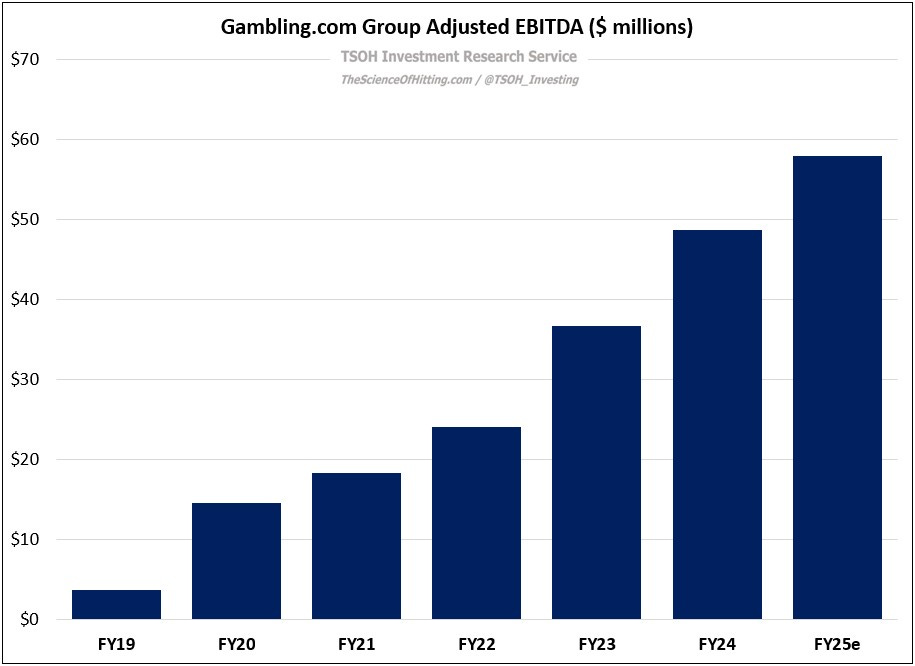

Therein lies a straightforward thesis: as legalized iGaming / OSB arrives in new markets like the U.S., there’s competition among various operators to win and retain new customers; GAMB has a proven ability to source bettors, which underlies its solid financial trajectory over the past five years (revenues and adjusted EBITDA were up ~6x and ~4x, respectively, for FY20 - FY25e).

And yet, the stock price is telling a different story: GAMB closed on Friday at ~$4.9 per share, down ~65% from where it traded a year ago.

Gillespie, for one, sees opportunity.