Facebook: Two Divergent Trends

In the April 2021 Portfolio Review, I concluded the section on Facebook as follows: “All-in, I believe EPS will exceed $20 per share by 2025, or ~15x today’s price ($299 per share). Assuming a terminal P/E in the low-to-mid-20’s, which seems appropriate given a heightened sense of duration risk for FB, my fair value range is $300 - $380 per share. Even with assumptions that I believe will prove conservative, Facebook appears undervalued.”

Since that time, I think we’ve witnessed two divergent trends at Facebook.

In terms of positive developments, we have seen a further strengthening of the underlying business results; on the other hand, questions and concerns among various stakeholders about the role and responsibilities the company (and social media broadly) has in our society have reached new heights.

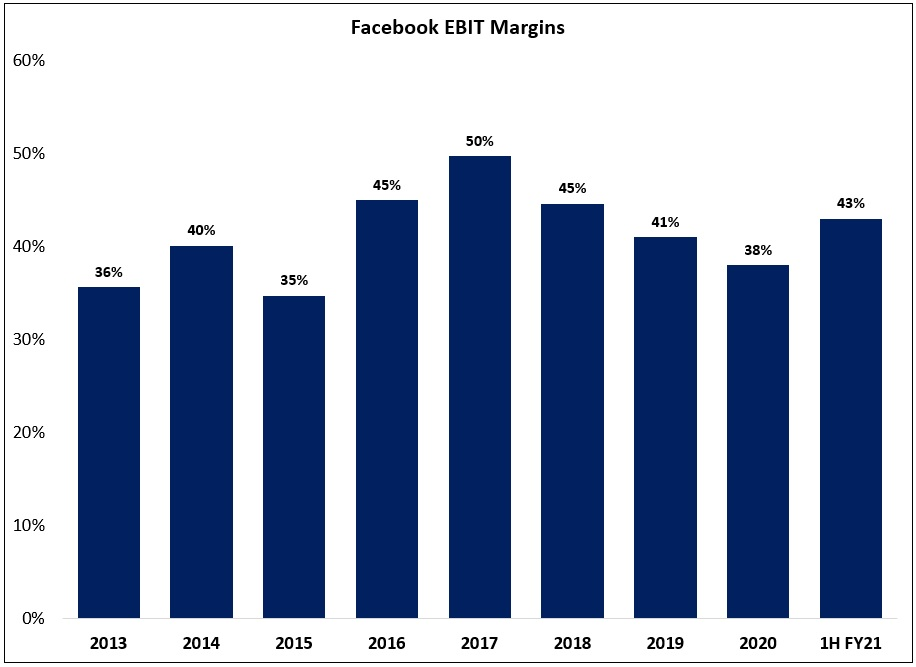

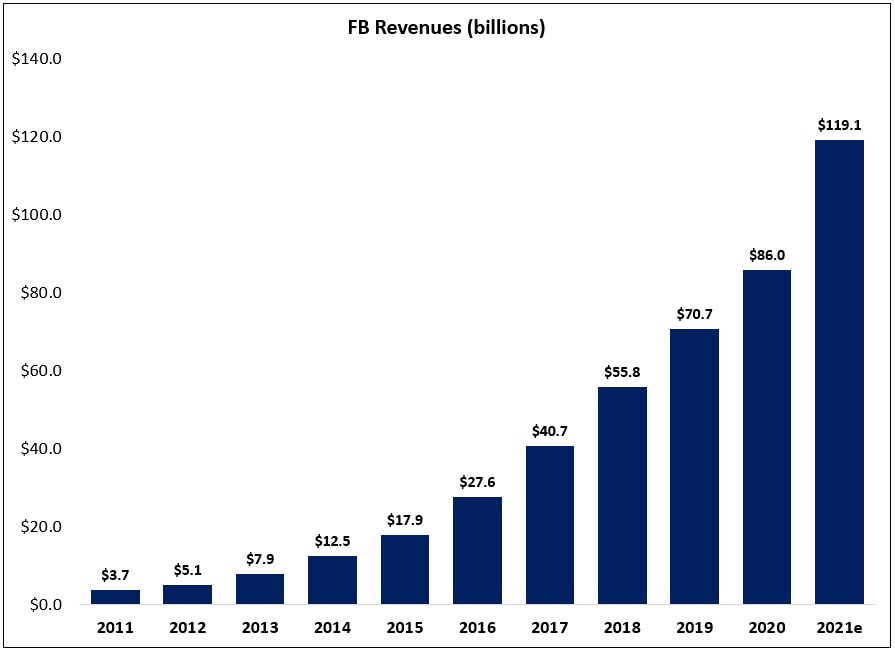

On the first point, Facebook has been firing on all cylinders. As I noted in my most recent update (Facebook: “Get To Scale”), “1H FY21 was a trifecta for shareholders, with an improvement in the two-year stacked revenue trends, profitability (margins), and capital returns. As it relates to EBIT margins, the astounding thing is that they’re achieving these results while making major investments for future growth (said differently, incremental margins in the core business continue to be masked): as Zuckerberg noted on the Q1 call, ‘We will continue to invest aggressively to deliver new and meaningful experiences for years to come, including in newer areas like AR and VR, commerce, and the creator economy.’ Based on recent disclosures, we can guesstimate that these investments are a 300 – 500 basis point headwind to 2021e EBIT margins; they truly are investing aggressively.”

As I showed in that update, my expectations have increased since the start of the year: I now expect the company to report FY25e EPS of $24 - $25 per share, or ~14x today’s stock price ($341 per share). Personally, I come to a similar conclusion on the valuation as I did in April: “Even with assumptions that I believe will prove conservative, FB appears undervalued.”

This brings us to the second question, which I’ll address from the perspective of an investor / equities analyst: do the heightened concerns about FB’s role in society and its impact on the health and safety of its users present a material long-term risk for the owners of the business (in terms of regulatory risk and / or users abandoning its products)?

For a number of reasons, I think the answer is no (it’s manageable).

First, by any reasonable definition, I’d argue that Facebook has invested aggressively to try and alleviate its ongoing platform concerns. As noted in a recent company blog post, there are 40,000 people working on platform safety and security across Facebook, with total teams and technology investments of roughly $13 billion over the past five years (which likely suggests run rate spend of $5 billion a year or more). This is one reason why the company’s operating margins contracted by more than 1,000 basis points from FY17 to FY20 (assuming $5 billion of expenses on $119 billion in 2021e revenues, I estimate that incremental safety and security spend accounts for roughly one-third of the margin degradation reported since FY17).

To put that roughly $5 billion of estimated 2021 spend into context, note that Twitter’s 2020 revenues were $3.7 billion. In my opinion, other platforms will struggle over the long run to address problematic content as effectively as Facebook (naturally, that assumes the funds at FB are being intelligently spent); simply put, they lack the requisite financial resources to “compete” with Facebook. In summary, while people can always argue that current efforts are woefully insufficient (“just spend more”), I think the level of safety and security spend at Facebook – now measured in billions of dollars a year and growing significantly with each passing year - suggests it’s a real focus for management.

Second, Facebook is no stranger to controversy or other questions about its business practices. Since the start of 2018, the company has faced the Cambridge Analytica scandal, U.S. regulatory pressures (record-breaking $5 billion FTC penalty), an advertiser boycott (“Facebook's stock ended Friday down 8% on news that Unilever would halt advertising for the rest of the year”), concerns about user retention / growth (“Facebook lost 15 million U.S. users in the past two years, report says”), GDPR, and the iOS 14 privacy changes (“IDFA could have a significant impact on Facebook’s revenue”). In the face of all these developments, FB’s revenues have nearly tripled over the past four years, from $41 billion in FY17 to $119 billion in FY21e.