Facebook: "Get To Scale"

FB update following strong 1H FY21 results and a solid guide

Death, taxes, and Facebook sandbagging guidance.

Maybe that last one isn’t a certainty, but it sure seems to have happened frequently in the past few years. Consider, for example, the company’s Q2 revenue guidance (from the Q1 FY21 earnings release):

“We expect second quarter 2021 year-over-year total revenue growth to remain stable or modestly accelerate relative to the growth rate in the first quarter of 2021 as we lap slower growth related to the pandemic during the second quarter of 2020.”

Compared to the Q1 print (+48% reported, +44% in constant currencies), the revenue growth rate accelerated by roughly 800 basis points in Q2, with revenues climbing 56% YoY to $29.1 billion (+50% in constant currencies). Of course, that outsized result partly reflects a meaningful tailwind from an easy comparison during the heart of the pandemic (revenues in Q2 FY20 were +11% YoY). What’s even more encouraging, in my opinion, is that the two-year stacked revenue growth rate was very strong (+72% vs Q2 FY19, or a two-year CAGR of+31%).

What explains this outcome? First, the number of active users across Facebook’s family of services continues to grow: from Q2 FY19 to Q2 FY21, DAU’s increased by roughly 30%, from 2.14 billion to 2.76 billion. Second, the company has benefited from an increase in the average price per ad delivered (high single digit annualized growth, on average, over the past two years), as well as a roughly 50% cumulative increase in the total number of ads delivered (Q2 FY21 vs Q2 FY19). Expressed another way, the combination of these factors led to a roughly 35% increase in average revenue per user from Q2 FY19 to Q2 FY21 (based on monthly actives across all of FB’s services).

Subscribe to the TSOH Investment Research service for complete access to high-quality equity research, including deep dives on companies like Spotify, Costco, Dollar General, GoodRx, Twitter, Airbnb, Disney, Netflix, and Microsoft, in addition to the disclosure of all portfolio changes before they’re implemented.

In the Q2 press release, management gave the following guidance for the back half of the year: “In the third and fourth quarters of 2021, we expect year-over-year total revenue growth rates to decelerate significantly on a sequential basis as we lap periods of increasingly strong growth. When viewing growth on a two-year basis to exclude the impacts from lapping the COVID-19 recovery, we expect year-over-two-year total revenue growth to decelerate modestly in the second half of 2021 compared to the second quarter growth rate.”

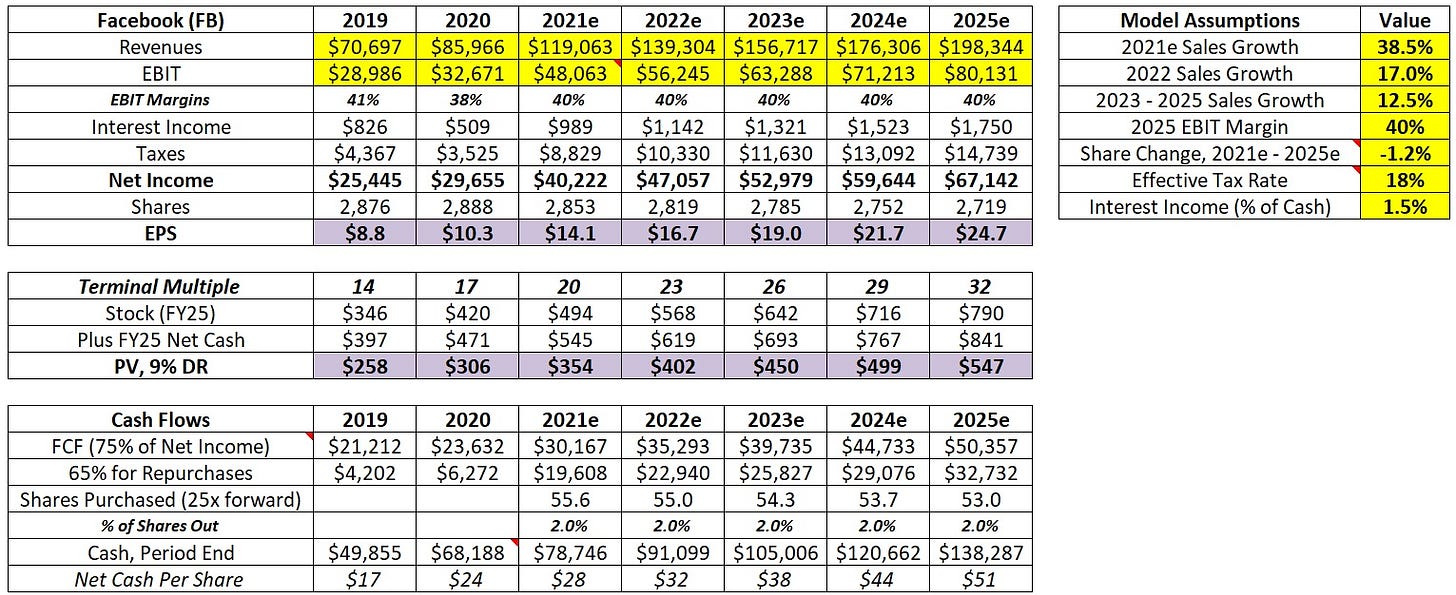

If we assume that the two-year stack falls to +65%, or seven points lower than the Q2 FY20 stack at +72% (seven points seems like a conservative guess for “decelerate modestly”), that implies Q3 revenues will be up mid-30’s YoY and Q4 revenues will be up mid-20’s YoY. In total, that would put Facebook’s 2021 revenues at roughly $119 billion, or up nearly 40% from 2020 (trailing five-year revenue CAGR of roughly 34%).

It’s worth noting that even +65% in 2H FY21 implies stabilization on the two-year stack (the company ended FY19 with a two-year stack of +63%). That’s a meaningful improvement from the persistent deceleration witnessed in the periods leading up to the pandemic. I think that change suggests some acceleration of the major structural changes that were already underway (for example, share shift from offline to online commerce). Said differently, it appears this was a (sizable) net benefit for Facebook.

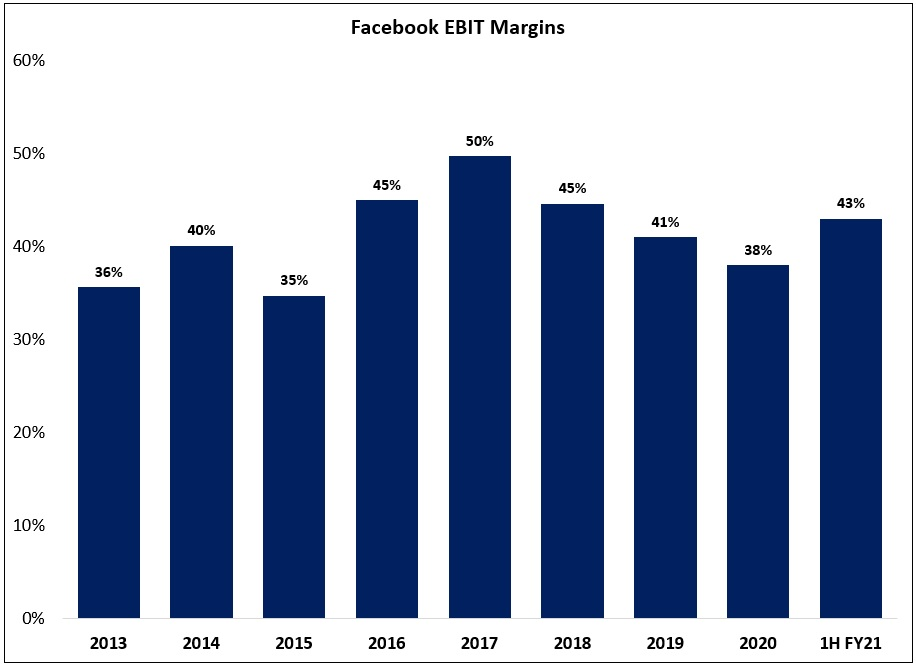

In addition to impressive top-line growth, we’ve also seen some improvement in the company’s profitability: through the first six months of FY21, Facebook has reported EBIT margins of 43% - a few hundred basis points higher than the full year FY19 and FY20 results (and well above the mid-30’s guide that we’ve been trending towards for the past three years). I’d note that this outcome occurred despite the fact that Facebook continues to “invest aggressively” behind initiatives / opportunities that will (hopefully) generate shareholder value over the long run.

In summary, as a result of revenue growth and higher margins, operating income through the first half of FY21 was nearly $24 billion – up more than 80% compared to the first half of FY19 (the result in FY19 is adjusted for the $5 billion FTC settlement).

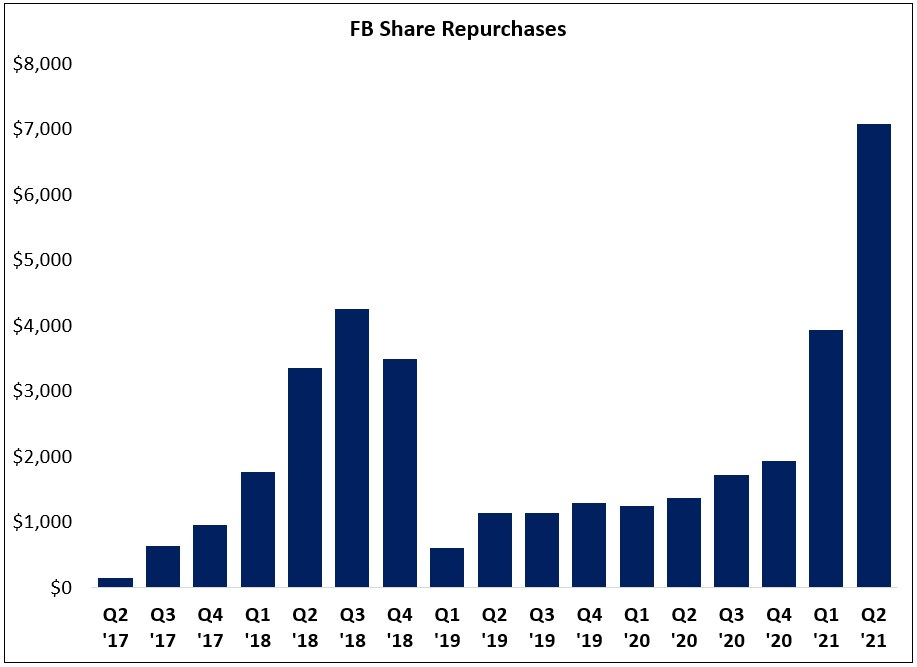

Continuing down the income statement, a gripe of mine since I first purchased Facebook in 2018 has been the company’s capital allocation posture. I’ve argued that the balance sheet positioning has been way too conservative, particularly in light of the fact that a large deal anywhere close to the company’s core business would likely attract intense regulatory scrutiny (above what the company is already facing on a daily basis). While there’s still a long way to go on this front - the company ended Q2 with $64 billion in net cash and investments - we’re starting to see some encouraging signs; for example, as shown below, the company repurchased more than $7 billion of stock in Q2 – the largest allocation to repurchases in its history (by a wide margin).

In summary, 1H FY21 was a trifecta for shareholders, with an improvement in the two-year stacked revenue trends, profitability (margins), and capital returns. As it relates to EBIT margins, the astounding thing is that they’re achieving these results while making major investments for future growth (said differently, the incremental margins in the core business continue to be masked): as CEO Mark Zuckerberg noted on the Q1 call, “We will continue to invest aggressively to deliver new and meaningful experiences for years to come, including in newer areas like AR and VR, commerce, and the creator economy.” Based on recent disclosures, we can guesstimate that these investments are a 300 – 500 basis point headwind to 2021e EBIT margins; they truly are investing aggressively.

Subscribe to the TSOH Investment Research service for complete access to high-quality equity research, including deep dives on companies like Spotify, Costco, Dollar General, GoodRx, Twitter, Airbnb, Disney, Netflix, and Microsoft, in addition to the disclosure of all portfolio changes before they’re implemented.

This quarter, Zuckerberg provided some commentary on how he thinks about the next computing platform (“What is the metaverse? It's a virtual environment where you can be present with people in digital spaces... Think about this as an embodied internet that you're inside of rather than just looking at. We believe that this is going to be the successor to the mobile internet.”)

Personally, while I’m far from an expert in this area (and that’s unlikely to change), there are a number of factors that give me confidence that Facebook is likely to emerge as one of the winners: first, Zuckerberg is a young and visionary CEO; second, he is willing and able to invest aggressively behind initiatives like AR/VR, Oculus, etc. (they’re investing “billions of dollars annually” at Facebook Reality Labs); and third, he is focused on long-term results, not quarterly earnings. Success in these areas will require many years of investment and effort. That said, in time, I think this is likely to be a massive opportunity that justifies the significant commitment of resources that Facebook is currently making (“Our basic playbook as a company is to build products that get to scale, especially social products… we're going to focus on having hundreds of millions of people use the metaverse and the new platforms that we're building.”).

Conclusion

In the April 2021 Portfolio Review, I concluded the Facebook discussion with the following: “Even with assumptions that I believe will prove conservative, FB appears undervalued.”

Well, it looks like those assumptions require (further) adjustment. Based on management’s updated guidance, it’s likely that 2021 revenues will be in the range of $115 billion to $120 billion (as noted earlier, that assumes the two-year stack growth rate in 2H FY21 falls by about 700 basis points versus Q2 FY21, compared to the “decelerate modestly” guide). Based on expense guidance of $70 billion to $73 billion, as well as a high-teens effective tax rate, that implies Facebook will generate about $40 billion of net income in FY21 (to put the recent growth in context, note that the company reported $41 billion of revenues in FY17).

With those tweaks to the model, as well as more aggressive repurchase assumptions given heightened activity in Q2 and recent management commentary (“we see an opportunity to deploy a greater percentage of our FCF towards share repurchases”) I now believe 2025e EPS will be $24 - $25 per share (at $360 per share, FB trades at a mid-teens multiple on 2025e EPS).

As I disclosed to subscribers in mid-May, I added to FB following the Q1 results. While the stock has done well since that time, I think that move has been more than justified by the clear improvement in the underlying results of the business. For that reason, despite recent price action, I continue to believe the equity is attractively valued.

Despite the fact that it’s already a sizable position, I’m tempted to add more.

Subscribe to the TSOH Investment Research service for complete access to high-quality equity research, including deep dives on companies like Spotify, Costco, Dollar General, GoodRx, Twitter, Airbnb, Disney, Netflix, and Microsoft, in addition to the disclosure of all portfolio changes before they’re implemented.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial adviser or in any fiduciary capacity.