DG: "A Low-Cost Operator"

My deep dive on small box retailer Dollar General (“We Went Where They Ain’t”), which was published in June 2021, concluded with the following:

“I believe Mr. Market has some doubts about the company’s ability to grow beyond ~25,500 units and / or questions the sustainability of the business and its economics at maturity. I’d argue the market has held some version of this belief for much of the past five years, which is why the stock trades at a pretty large discount to retailers like Costco. Personally, I think that conclusion has been, and continues to be, too pessimistic.”

On March 17th, DG reported financial results for Q4 FY21. The quick summary is that the investment thesis remains on track; while the quarterly numbers over the past two years have been irregular, the net result has been better than expected comps, profit margins, and EPS growth.

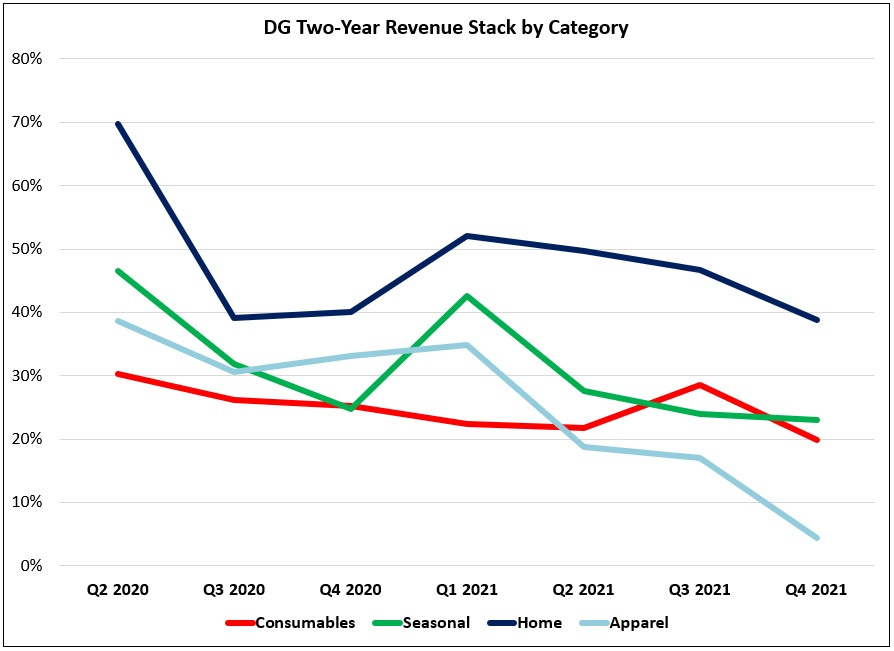

In FY21, DG generated $34.2 billion in revenues, up ~1% from FY20. As a reminder, the company experienced significant tailwinds during the heart of the pandemic, with 20%+ YoY sales growth in all four product categories in both Q2 FY20 and Q3 FY20. While those tailwinds have started to normalize, the net result is still impressive: over the past two years (FY19 - FY21), DG’s revenues increased ~11% p.a., or ~300 basis points higher than the ~8% annualized growth reported over the prior five years (FY14 – FY19).

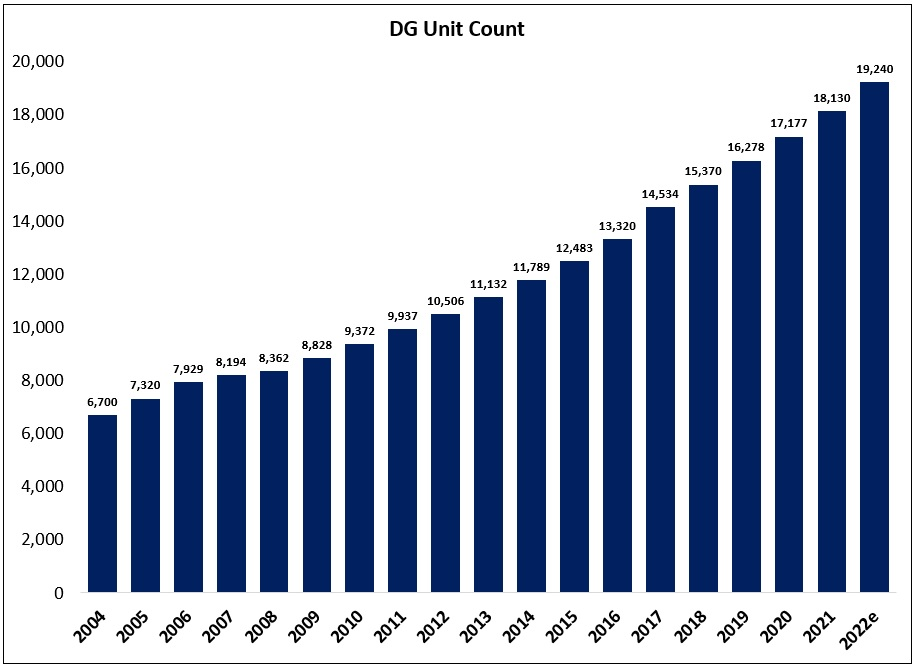

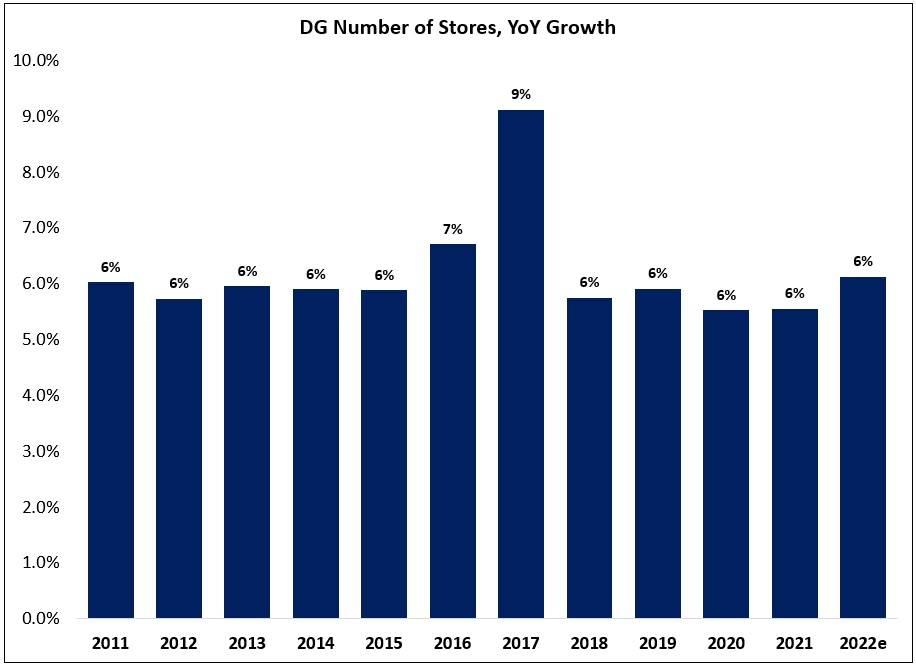

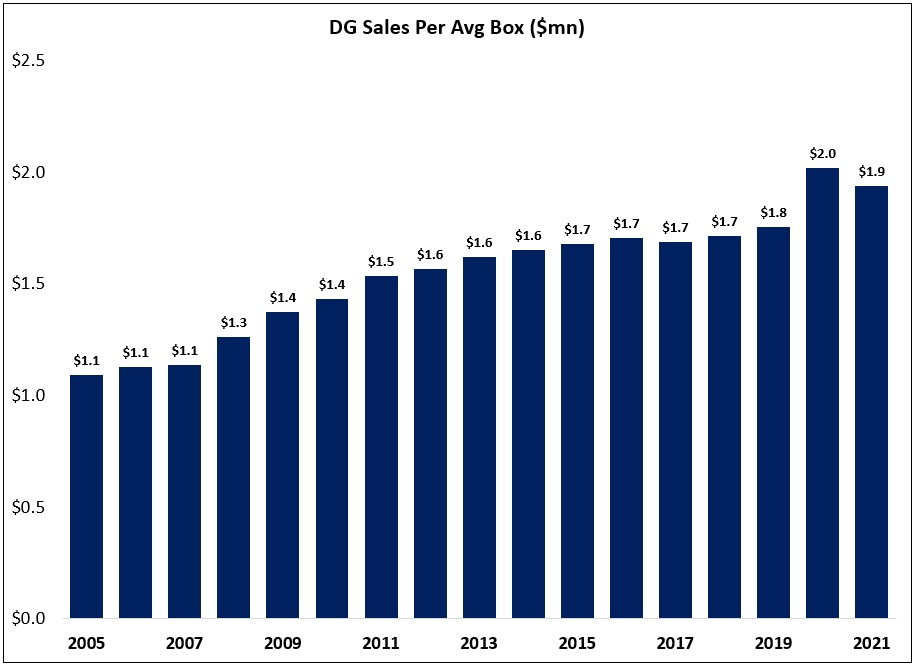

Looking at the five year period from FY16 – FY21, DG reported a ~6% annualized increase in the store count, along with a ~3% annualized increase in average unit volumes (AUV’s). This is roughly in-line with the top-line growth algorithm I expect the company to deliver for the foreseeable future.

Let’s drill down on unit growth, which is key to the long-term thesis.