Ally: "A Permanent Change"

In December 2021, I wrote the following in the conclusion of my Ally Financial deep dive (“Ally: A Banking Transformation”): “Over the past five years, Ally has taken significant market share within U.S. retail deposits, with a trailing CAGR in the mid-teens. In addition, they’ve posted solid net interest margins, largely reflective of an improvement in their cost of funding. Finally, the company is in a position where it can aggressively return capital to shareholders, with ~$3.2 billion of repurchases from 2016 – 2020 at an average cost of ~$25 per share. (Through the first nine months of FY21, Ally repurchased another ~$1.4 billion.) At ~$46 per share, the stock trades at ~1.1x tangible book. If you believe normalized ROTCE’s in the mid-teens (%) are sustainable, as I do, that implies a normalized P/E in the single digits. Personally, I expect TBVPS and EPS to increase at double digit annualized rates for the foreseeable future (since YE16, TBVPS has increased >50%).”

On to today’s update, which will review Ally’s Q1 FY21 results.

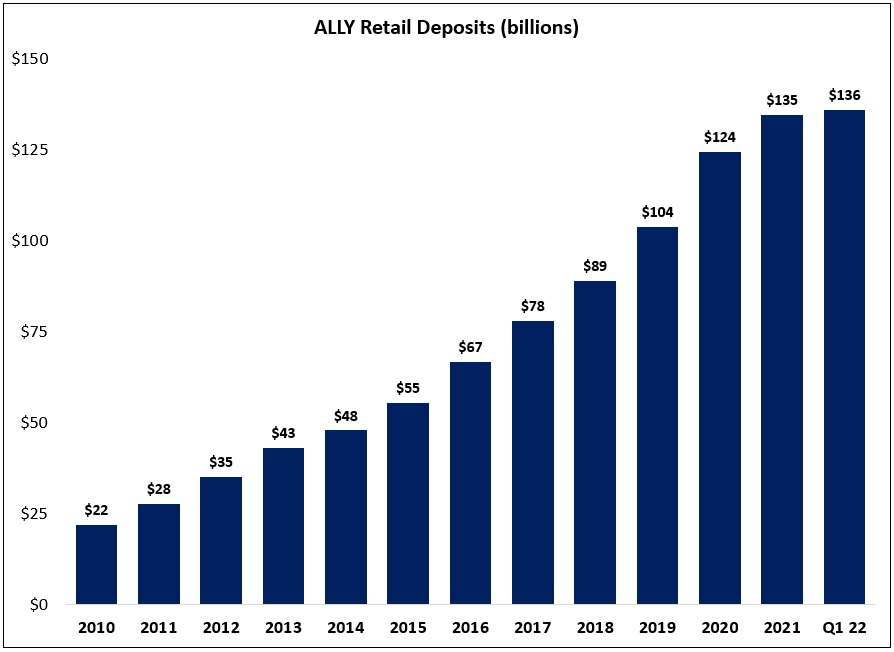

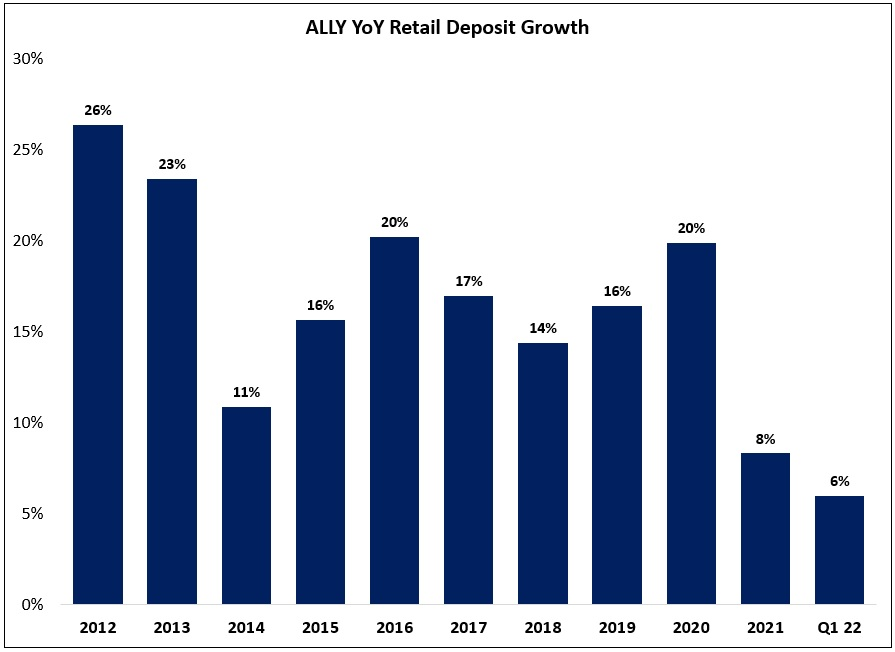

A key component of the thesis, as outlined in the deep dive, is continued growth in Ally’s retail deposit base. At the end of Q1, retail deposits totaled $136 billion (up ~2x over the past five years), with 2.5 million retail customers across the franchise (the customer count has increased every quarter for the past 13 years, with ~70% of new customers from millennial or younger generations). However, as shown below, the pace of deposit growth in Q1 (+6% YoY) was well below the results we’ve come to expect from the franchise. While there are some short-term considerations that deserve our attention (timing of tax payment outflows), I will reiterate that outsized long-term retail deposit growth is a key pillar of my investment thesis. (“The ability to offer a superior product in the form of competitive deposit rates, lower fees, and a better overall user experience, is key to Ally’s continued share gains in the U.S. retail deposit market; a more efficient model (cost structure) is fundamental to being able to deliver on this promise over the long run.”)

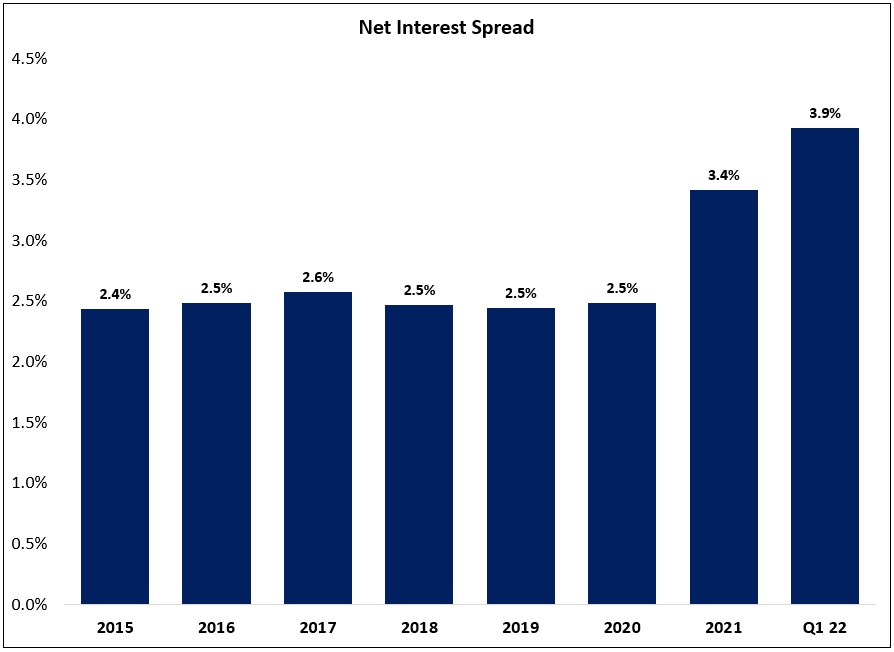

Primarily as a result of the funding shift towards retail deposits, Ally has been able to more cost effectively finance its business: in Q1, the cost of funding sources was less than 1%, compared to an average earning assets yield of ~4.9%; as a result, the net interest spread was ~3.9% in Q1, up ~140 basis points from the average in 2016 – 2020. (CFO Jen LaClair: “We've been able to structurally lower our cost of funds. This is a permanent change… We have a NIM expansion story that's unique across the industry.”)