Academy: Retail Turnaround?

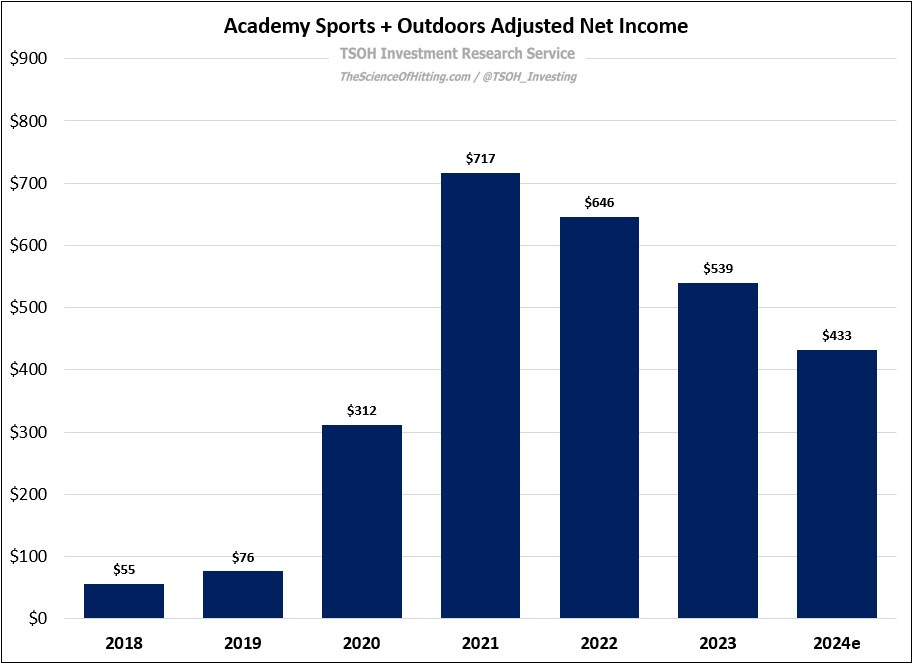

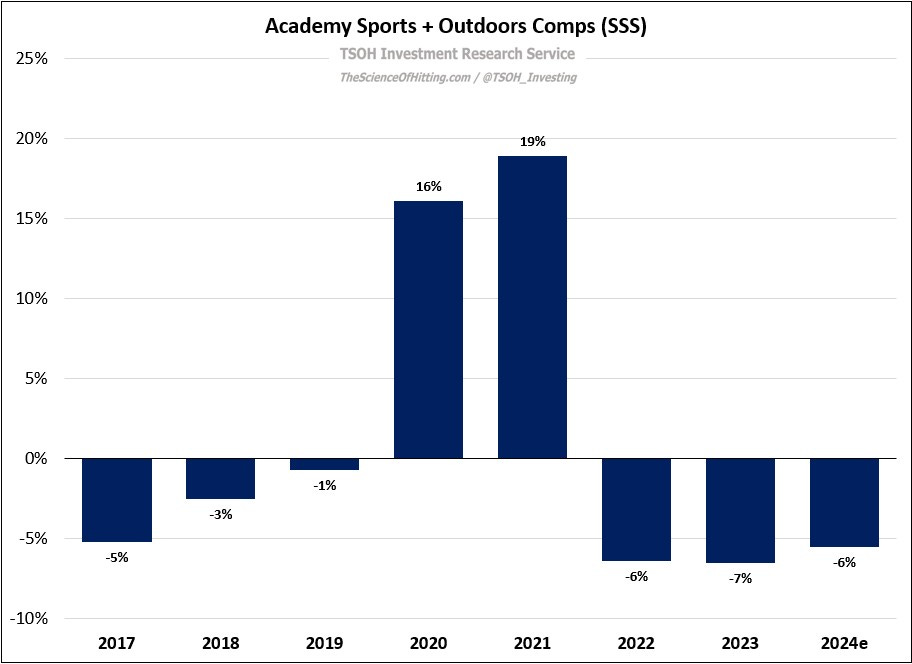

In October 2020, nearly a decade after being acquired by KKR, Academy Sports + Outdoors (ASO) went public. It seemed an ideal time to act: after reporting negative comps in each of the preceding three years, 2020 and 2021 comps increased by +16.1% and +18.9%, respectively. This resulted in average unit volumes (AUV’s) climbing by about 40% in two years, to $26.2 million in 2021, along with nearly 40% incremental operating profit margins (FY19 - FY21). As a result, they generated more than $700 million in FY21 adjusted net income – nearly 10x higher than what ASO earned in 2019.

The market quickly realized that the IPO price of ~$13 per share - a market cap of ~$1.1 billion - was now far too low: on the one year anniversary of the IPO, the stock had already tripled, to ~$40 per share; as of yesterday’s close, it had risen another ~50%, to $59 per share (a market cap of ~$4.2 billion).

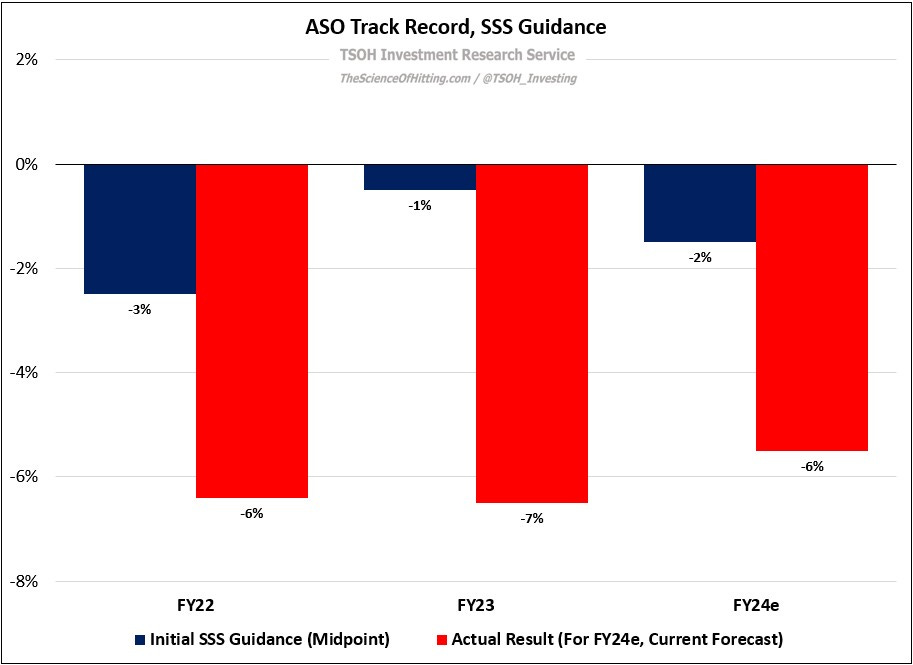

But at ~10x FY24e EPS, compared to ~17x FY24e for DKS, it’s clear Mr. Market still has some questions about the sustainability of Academy’s current economics, a view supported by three consecutive years of mid-single digit comp declines. (Management expects FY24 comps of -6% to -5%, below the initial guide of -4% to +1%. This has become a recurring outcome: they were also overly optimistic on their initial comp guidance in FY22 and FY23.)