"A Rare Opportunity"

Thoughts on the Netflix / Warner Bros. deal

Note: Access all prior Netflix (NFLX) research on the TSOH website

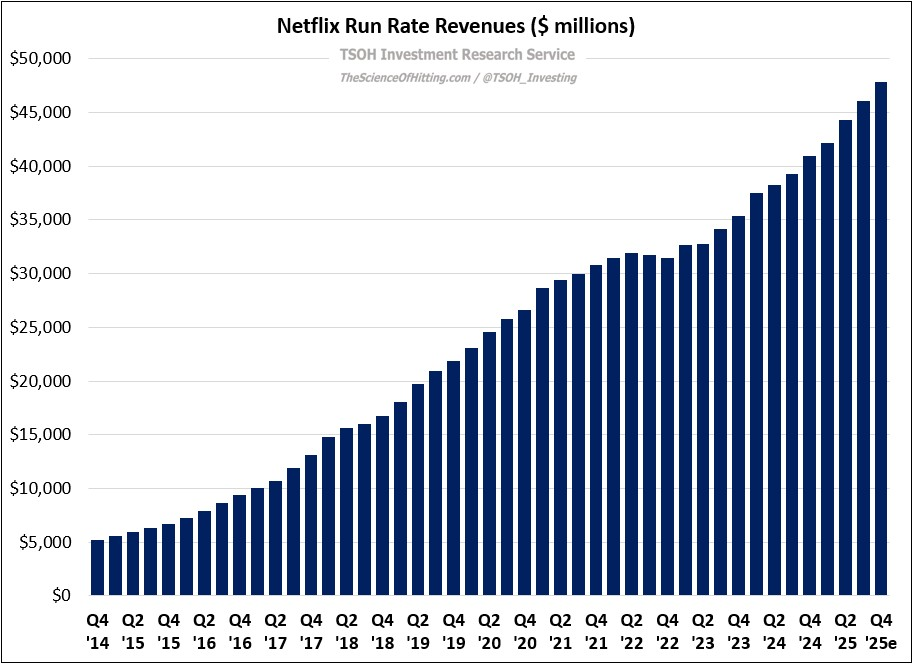

On December 5th, Netflix announced a deal to acquire Warner Bros (the Studios & Streaming / S&S business of WBD) for ~$82.7 billion. The logic of the deal, in terms of the acquired content / IP, is self-evident. Given Netflix’s unrivaled global scale in DTC video streaming, a position that supports a business with run rate revenues of ~$48 billion, I agree with co-CEO Ted Sarandos – “These assets are more valuable in our business model, and our business model is more valuable with these assets”. By virtue of Netflix’s scale, they can maximize content value to a degree others cannot replicate.

But where I think the logic of this transaction is less clear is in terms of the businesses acquired and the price to be paid (a number likely going higher).