"A Fully Focused Business"

An update on Dollar Tree (DLTR)

From “Dollar Tree: The First Inning” (March 2025):

“Dollar Tree’s Q4 FY24 results, FY25 guidance, and the Family Dollar sale were all directionally aligned with my long-term investment thesis. After many years of dedicating outsized resources, financial and otherwise, to Family Dollar, management will now be 100% focused on improvements at the namesake banner. In FY26 and beyond, I expect double digit annualized EPS growth; at the current price [~$73 per share], I think it is safe to conclude that Mr. Market isn’t quite on the same page… Last week was an important one for the Dollar Tree investment thesis. I expect more like it down the road.”

There were a few encouraging signals in Dollar Tree’s Q2 FY25 results.

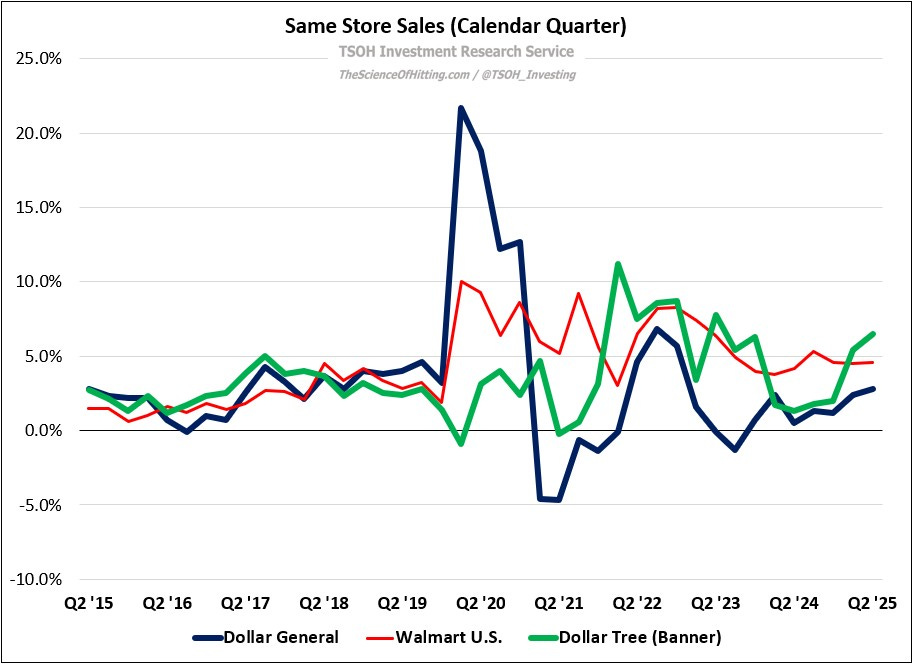

For one, the company reported strong net revenue (+12.3%) and same store sales (SSS) growth (+6.5%), with the latter attributable to a roughly equal contribution from traffic and ticket. By category, the quarter included a strong showing in Consumables (+6.7%) and Discretionary (+6.1%), reflecting Dollar Tree’s broad value appeal once shoppers are inside the store (it was their best Discretionary comp in two and a half years). As a result of a solid 1H FY25, management also raised the company’s full year SSS and revenue guidance. This is further evidence that Dollar Tree’s strategic changes are enhancing the product offering - and customers are responding accordingly.