"A Better Long-Term Home"

Last Saturday was a holiday for value investors: the annual release of Warren Buffett’s letter to the shareholders of Berkshire Hathaway. This year, the letter included a section titled “Thanks”, where Buffett spoke about the positive impact that teaching, writing, and building a family of long-term “partners” at Berkshire Hathaway has had on his life, both as an investor and as an individual. Reading that section led me to reflect on the countless number of people around the world who have been fortunate enough to learn from (and for shareholders, to profit alongside) two of the best to ever play our game.

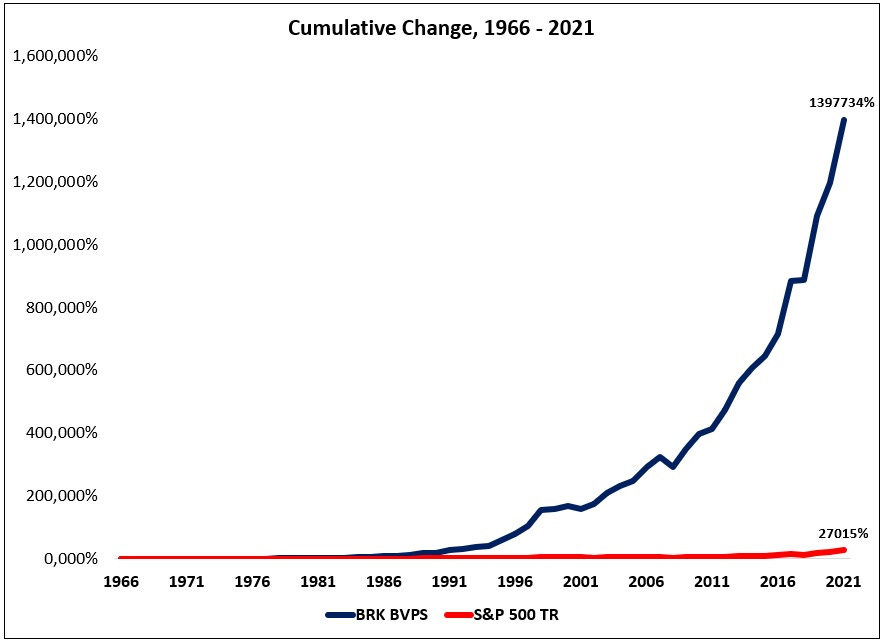

For more than five decades, Buffett and Munger have been responsible for “managing a portion of your savings” – which they’ve done at the highest level while refusing compensation that was commensurate with what their profession deemed appropriate. To be clear, this doesn’t absolve them of underwhelming results (like we’ve seen at GEICO in the past few years), nor is it a reason to own the stock. Instead, it’s a timely reminder of the immense value that Buffett and Munger have provided to the investment community, and to the shareholders of Berkshire Hathaway, for more than 50 years.

Insurance Operations

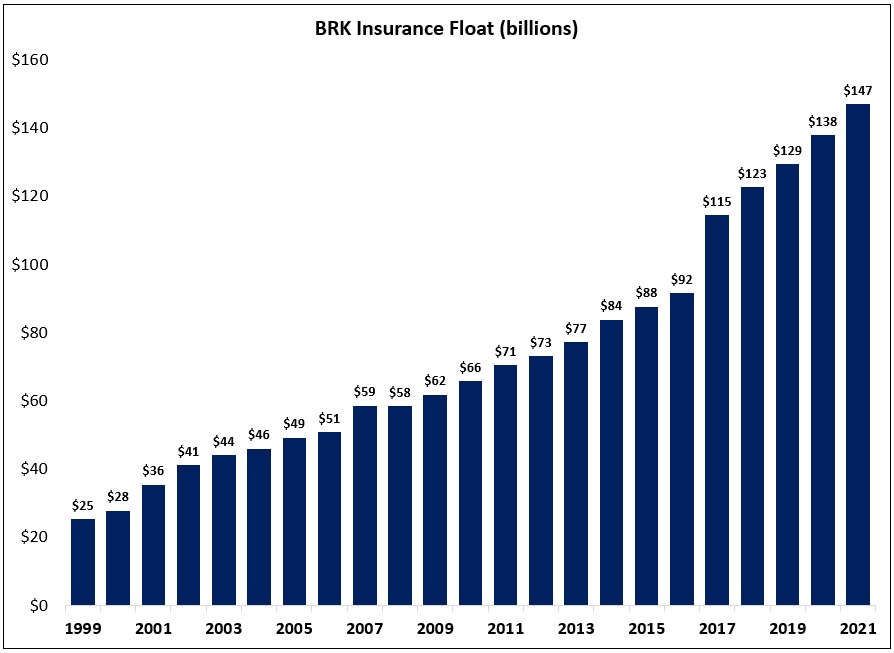

In the 2011 shareholder letter, Buffett wrote the following: “It’s unlikely that our float will grow much – if at all – from its current level. That’s mainly because we already have an outsized amount relative to our premium volume. Were there to be a decline in float, I will add, it would almost certainly be very gradual and therefore impose no unusual demand for funds on us.”

Thankfully, this prediction was off base. At the end of 2021, Berkshire’s insurance float totaled $147 billion – more than 100% higher than a decade ago. (“So far, this float has cost us less than nothing. Though we have experienced a number of years when insurance losses combined with operating expenses exceeded premiums, overall we have earned a modest 55-year profit from the underwriting activities that generated our float.”)