TSOH Investment Research Service

Welcome to TSOH Investment Research Service.

My name is Alex Morris, and I’m a former buyside equities analyst. In early 2021, after a decade in the finance industry, I launched the TSOH Investment Research service, with the goal of offering complete transparency around my investment philosophy, research process, portfolio decision-making, and outcomes (returns). The portfolio disclosed to TSOH subscribers includes all of my investable assets.

What To Expect:

Paid subscribers receive:

Six write-ups per month (every Monday and every other Thursday)

Research reports on new ideas, including my investment decision

Periodic updates on current holdings / watch list (typically quarterly)

Prior disclosure of all portfolio changes, with a clear explanation for both sides of the transaction (what I’m buying, what I’m selling, and why)

Complete access to all previous investment research, including deep dives on companies like ABNB, NFLX, RBLX, COST, NKE, TKO, FEVR, and more

Quarterly portfolio updates, which detail every position and its current weighting, along with trailing portfolio returns. (Historic returns for my portfolio were made available at the launch of the service; I consider all subsequent updates to be the intellectual property of TSOH subscribers.)

About Me:

CFA Charterholder with an MBA and undergraduate Finance degree

10 years as a buyside equities analyst (2011 - 2021); the TSOH Investment Research Service has been my sole professional endeavor since April 2021

600+ paid subscribers

Start Here:

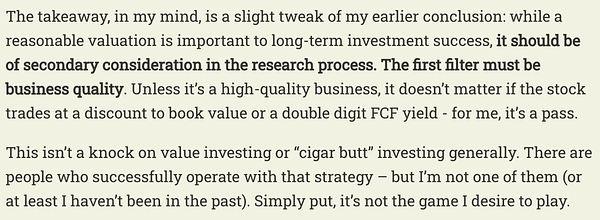

This is an overview of my approach to investing.

After a near-death experience in 2020, Airbnb emerged from the pandemic with a renewed appreciation for focus and operational excellence (“a crucible moment for the company”). In this deep dive, I discussed Airbnb’s history, its competitive position, the economics / valuation, and my investment decision.

Netflix: “This Is When It All Matters”

This article highlights my thought process during a period where a business and its stock price are facing intense pressure. It should give you some insight into how I think and act during difficult situations - specifically, while being 100% transparency with TSOH subscribers and staying focused on the long-term.

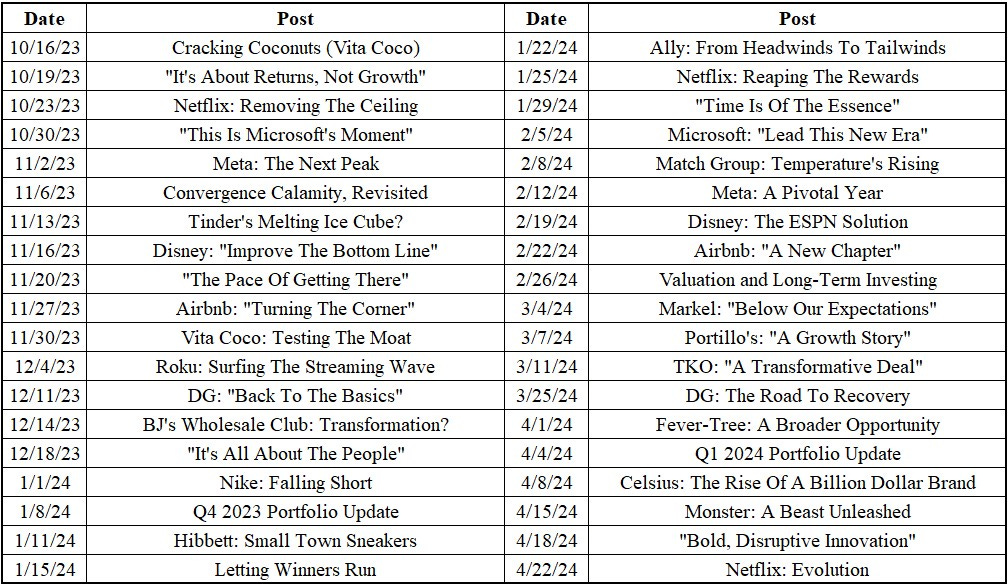

To give you a sense for the companies and industries that I tend focus on, here’s a list of the research that was sent to TSOH subscribers over the past six months.

Feedback From TSOH Subscribers:

Thank you for considering the TSOH Investment Research Service. If you have any questions, please let me know (thescienceofhitting@gmail.com).

- Alex Morris (@TSOH_Investing)